|

Editor’s Note:

Ali Saribas is

a Partner, and Andrew

Brady is a Director at SquareWell Partners. This post

is based on their SquareWell survey. |

SquareWell Partners (“SquareWell”) conducted a survey of over 30

institutional investors collectively responsible for more than $35

trillion in AUM from North America, Europe, and Asia. The survey

engaged both Stewardship Team professionals and Portfolio Managers

from investors of a range of sizes, employing both active and passive

strategies, ensuring a balance of perspectives.

Survey questions were organized around three key themes: (1) Views on

Activism, (2) Evaluation Criteria, and (3) Engagement Dynamics.

The full survey can be downloaded from our website:

https://squarewell-partners.com/insights/

(1) Views on Activism

Investors overwhelmingly agreed that activism is a valuable market

force; roughly three-quarters of responses appreciate the role of

activists in catalysing change and driving accountability. More than

half of respondents also credited activists with bringing fresh

perspectives and promoting transparency and engagement from the target

company.

Despite this widespread appreciation for the outcomes of activism,

two-thirds of respondents remain cautious that activists can overlook

complexities by having a narrow focus. Half of investors surveyed

cited short-termism as a primary concern.

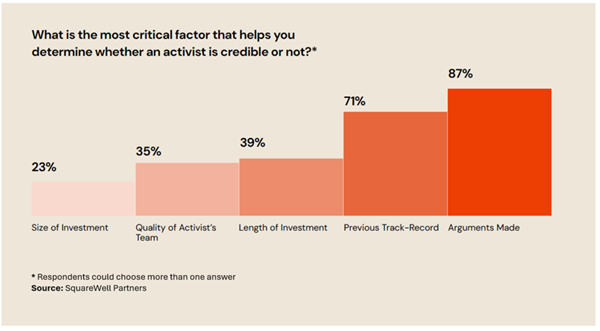

As shown in the graph, main contributors to an activist’s credibility

are intrinsically linked to these factors. Given the prominence of

investor concern that activists have a narrow and short-term focus,

the central element to credibility is the quality of the arguments

made. Similarly, given investors appreciate activists most for

catalysing change and bringing accountability, an activists track

record elsewhere matters. Features like length of investment and

holding size, are seen to be less relevant.

Graph 1

(2) Evaluation Criteria

In making the case for change, respondents ranked Return Metrics (TSR,

ROIC, ROE..) and Profitability Ratios (Operating Margin, Net Profit

Margin…) as the most appropriate for evaluating company performance.

Poor governance was seen as a trigger for activism by a large majority

of respondents (84%), reflecting the 71% of investors that confirmed

they were most comfortable supporting board-related activism (i.e.

affecting governance or management change).

The other types of activism – M&A, Balance Sheet and Operational –

were significantly less supported, indicating that while these issues

may be strong underlying rationale, investors prefer

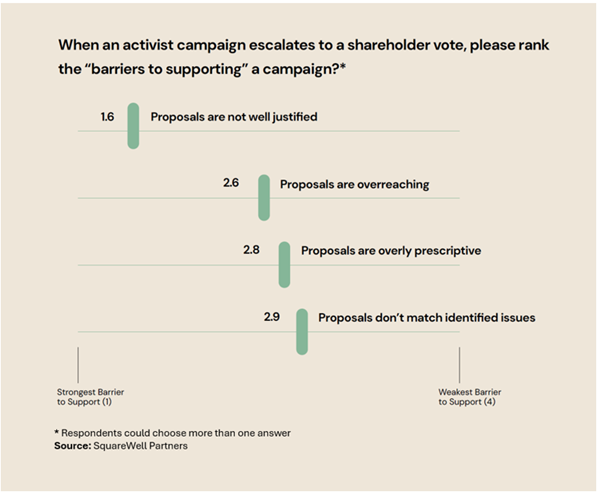

governance-related demands. As shown in the graph, when these demands

are taken to a shareholder vote, investors consider the proposal’s

justification to be the first hurdle, followed by assessments of

overreach, prescriptiveness, and proposals matching issues identified.

Graph 2

(3) Engagement Dynamics

Reflective of the content of activism campaigns, Fund Managers play a

leading role in final voting decisions – with the support of

Stewardship Teams. Only 16% of respondents indicated that the final

voting decision is taken by the Stewardship Team alone.

Investors reported that they primarily engage with campaigns through

letters and press releases, followed by direct engagement and fight

decks. Dedicated websites and webinars ranked lower, potentially

reflective of the limited use of webpages for content delivery, and

the preference of investors for direct engagement versus group

webinars.

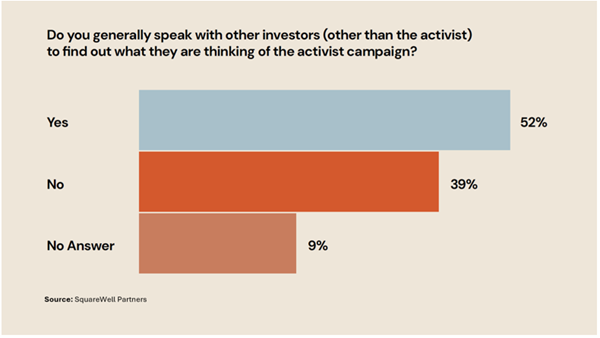

Nearly half of investors said they were open to engaging before a

campaign is public, and as shown below, just over half responded that

they actively engage with other investors (other than the activist) to

discuss a campaign. This openness to engage offers activists an

opportunity to gain traction with large holders and heightens the

responsibility on companies to maintain strong relationships

throughout the shareholder base.

Graph 3

Concluding Remarks

Responses from the survey indicate that companies are at risk if they

rest on their laurels when it comes to investor relations. At a time

where long-term institutional investors are increasingly more willing

to engage with activists, and amongst each other, companies must

have confidence in the alignment of the shareholder base with the

equity story being told.

This increases the importance of peacetime engagement activities,

recognising these as the first line of defence to an activist

situation, should one arise. Companies must ensure engagements are

impactful by asking the following questions:

-

Do we understand our investors (including their investment

strategies, the decision makers, and the inputs of third-party

research)?

-

Do we understand what investor

sensitivities exist, and for which constituencies?

-

Are we involving the right people? Should

board members be part of the engagement to better instil trust in

elected representatives?

-

Are our engagements leading to valuable

investor feedback and actionable items?

A thoughtful approach to these questions not only strengthens

shareholder relations but also enhances a company’s ability to

anticipate and address concerns before they escalate. For companies

aiming to build trust in the capital markets, prevention is better

than remedy.

|

Harvard Law School Forum on

Corporate Governance

All copyright and trademarks in

content on this site are owned by their respective owners. Other

content © 2025 The President and Fellows of Harvard College.

Privacy

Policy |