Goldman analysts say these red flags could make activist

investors attack your company

BY

SHERYL ESTRADA

April 25, 2023 at 7:06 AM EDT

|

CAIAIMAGE/PAUL BRADBURY FOR GETTY IMAGES

|

Good morning,

What increases the likelihood of becoming a target of an activist

investor? A new analysis by Goldman Sachs provides some insight.

The analysts were trying to better understand how activist investors

seek to create value through fundamental changes in a company. The

report examines 2,142 shareholder activism campaigns launched since

2006 with a corporate valuation demand against Russell 3000 companies.

They identified four financial variables representing potential

sources of vulnerability that might prompt an activist attack: slower

trailing sales growth; lower trailing EV/sales multiple (lower

valuations); weaker trailing net margin; and trailing two-year

underperformance (lower excess returns).

Sales growth has been the most important variable in determining an

activist target, followed by EV/sales valuation, according to the

analysts. A probit model, which in most cases is used to predict

whether something will or won’t happen, was used to analyze the

performance and fundamental characteristics most associated with

companies targeted by activist investors.

As a result, the report identifies

116 stocks in the Russell 3000 index that could be

susceptible to an activist investor campaign. “These firms have a

market cap greater than $5 billion, at least one source of

vulnerability based on our model, and experienced at least 10 pp lower

realized sales growth relative to its sector median during the

trailing 12 months,” according to the report.

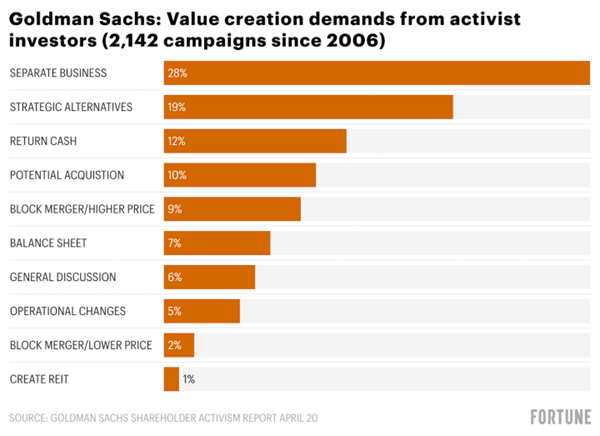

Another key finding: The top three most frequent demands of activist

investor campaigns since 2006 have been for companies to separate

their business (28%), review strategic alternatives (19%), and return

cash to shareholders (12%). Specific demands such as realizing net

asset value (NAV), creating a real estate investment trust (REIT), or

changing investment strategy are less common, along with operational

changes and a general discussion of strategy.

During 2022, investors launched 148 campaigns against 120 distinct

public U.S. companies, a roughly 20% year-over-year increase,

according to the report. Goldman analysts expect shareholder activism

to remain popular this year as investors adapt to regulatory changes

and the macroenvironment. In Q1 2023, activists launched 27 campaigns

against 26 companies.

In the first quarter, big companies like Walt Disney and Salesforce

were targeted by activists. Following Disney’s announcement of new

operating initiatives, Trian

Partners withdrew its Disney board nominations. After the

board elected a director from ValueAct, Elliott Management ended its campaign

against Salesforce.

Most recently, Ken Lui, leader of the “Spin Off HSBC Asia Concern

Group,” has hired Alliance Advisors to assist in identifying and

contacting HSBC Holdings PLC investors, Bloomberg

reports. Lu is lobbying in favor of a proposal to

restructure the lender’s business on May 5 at its annual general

meeting.

With 65% of Russell 3000 companies planning their annual meetings

during May, expect to hear more from these noisy investors.

Sheryl Estrada

sheryl.estrada@fortune.com

© 2023 Fortune Media IP

Limited.