COMMENTARY • SALESFORCE

Activists should sail away from their doomed attack on Benioff’s

Salesforce

BY JEFFREY

SONNENFELD AND STEVEN

TIAN

March

1, 2023 at 10:02 AM EST

|

Salesforce co-founder and CEO Marc Benioff has announced layoffs and a

renewed focus on profitability.

FABRICE COFFRINI—AFP/GETTY IMAGES

|

Over the past six weeks, activist investors have piled on tech giant Salesforce due

to a failed 12-month succession that resulted in the return of founder Marc

Benioff to assume full command amid a drop in stock price. The firms include:

Third Point, Elliott Investment Management, Starboard Value, Value Act, and

Inclusive Capital. However, as The Wall Street Journal concluded,

“It’s not yet clear what all the investors, and particularly Elliott, may want.”

Just last month, Disney

CEO Bob Iger modeled a master class on

how CEOs can turn back activist threats through strategic engagement. Instead of

retreating under the onslaught of Nelson

Peltz’s deceptive attacks, Iger

beat back Trian by simply pointing to genuine facts:

presenting a compelling restructuring and cost-cutting plan while refusing to

concede to false narratives and refuting

the false charge that Disney

overpaid for Fox entertainment.

Our research revealed Peltz’s

own faltering performance, which had been missed by the business press.

No wonder Peltz

was forced to end his

proxy fight before it really began.

A similar story is now playing out at Salesforce. The

facts clearly show that founder and longtime CEO Marc Benioff has created more

long-term shareholder value than

any of the activist funds targeting him–and his strategic pivots to re-orient

Salesforce appear to be taking the wind right out of the activists’ sails.

At this rate, like Peltz last month, these activists are quickly approaching the

point where they have to acknowledge that their sails are set against the tidal

force that is a leaner, profit-focused Salesforce 2.0, which enjoys broad

support from shareholders, suppliers, customers, and Wall Street.

Instead, the activists should learn something from Benioff on shareholder value

creation and not vice versa. When we crunched the numbers, we found that all

four of the major activist funds currently targeting Salesforce–Elliott

Management, Third Point, Starboard Value, and ValueAct–have dramatically

underperformed all the major stock indices, including the S&P 500, the Dow Jones

Industrial Average, and the Nasdaq-100, over the last 3, 5, 7, and 10 years. Our

original, carefully sourced research study found

that through the end of 2022:

-

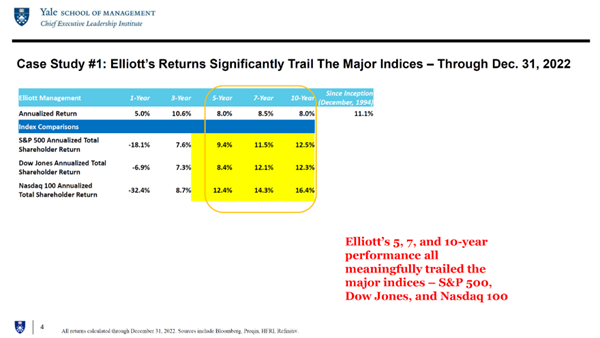

Elliott Management’s annualized returns trailed the S&P 500, Dow Jones, and Nasdaq 100

on an annualized 5-year basis (8.0% vs. 9.4%, 8.4%, and 12.4% respectively);

7-year basis (8.5% vs. 11.5%, 12.1%, and 14.3% respectively); and 10-year

basis (8.0% vs. 12.5%, 12.3%, and 16.4% respectively).

-

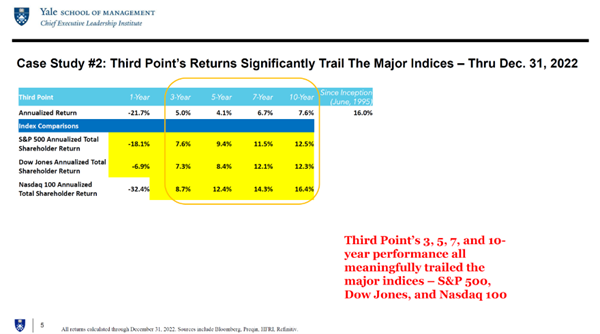

Third Point’s annualized returns trailed the S&P 500, Dow Jones, and Nasdaq

100 on an annualized 3-year basis (5.0% vs. 7.6%, 7.3%, and 8.7%

respectively); 5-year basis (4.1% vs 9.4%, 8.4%, and 12.4% respectively);

7-year basis (6.7% vs. 11.5%, 12.1%, and 14.3% respectively); and 10-year

basis (7.6% vs 12.5%, 12.3%, and 16.4% respectively).

-

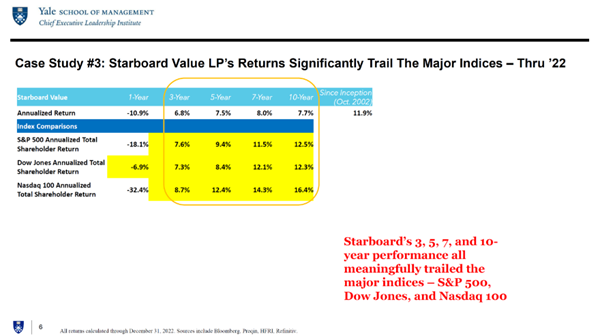

Starboard Value’s annualized returns trailed the S&P 500, Dow Jones, and

Nasdaq 100 on an annualized 3-year basis (6.8% vs. 7.6%, 7.3%, and 8.7%

respectively); 5-year basis (7.5% vs. 9.4%, 8.4%, and 12.4% respectively);

7-year basis (8.0% vs. 11.5%, 12.1%, and 14.3% respectively) and 10-year

basis (7.7% vs 12.5%, 12.3%, and 16.4% respectively).

-

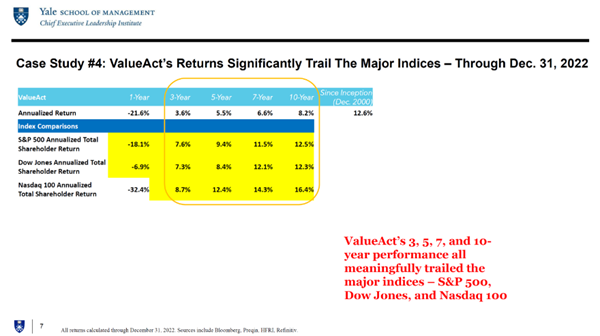

ValueAct’s annualized returns trailed the S&P 500, Dow Jones, and Nasdaq 100

on an annualized 3-year basis (3.6% vs. 7.6%, 7.3%, and 8.7% respectively);

5-year basis (5.5% vs. 9.4%, 8.4%, and 12.4% respectively); 7-year basis

(6.6% vs. 11.5%, 12.1%, and 14.3% respectively); and 10-year basis (8.2% vs

12.5%, 12.3%, and 16.4% respectively).

Even more remarkably, these same activists all underperformed nothing other than

Salesforce stock when investment performance is calculated through the end of

2021(around the time of Salesforce’s appointment of a co-CEO who has now left

the company), no matter how one slices and dices it–across 1-year, 3-year,

5-year, 7-year, and 10-year annualized returns. As

our study found:

-

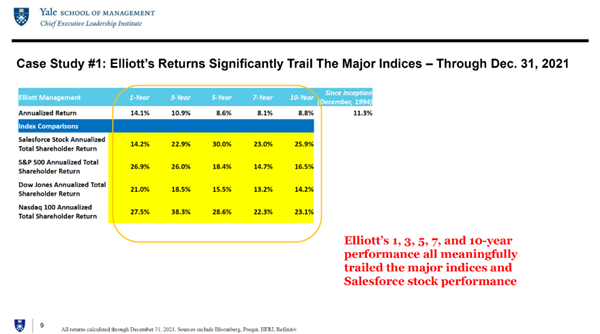

Elliott Management’s annualized returns trailed Salesforce stock, S&P 500,

Dow Jones, and Nasdaq 100 on an annualized 1-year basis (14.1% vs. 14.2%,

26.9%, 21.0%, and 27.5%, respectively); 3-year basis (10.9% vs. 22.9%,

26.0%, 18.5%, and 38.3%, respectively); 5-year basis (8.6% vs. 30.0%, 18.4%,

15.5%, and 28.6%, respectively); 7-year basis (8.1% vs. 23.0%, 14.7%, 13.2%,

and 22.3%, respectively); and 10-year basis (8.8% vs. 25.9%, 16.5%, 14.2%,

and 23.1%, respectively).

-

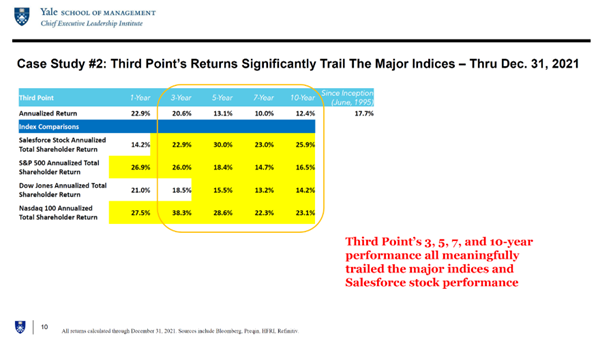

Third Point’s annualized returns trailed Salesforce stock, S&P 500, Dow

Jones, and Nasdaq 100 on an annualized 3-year basis (20.6% vs. 22.9%, 26.0%,

28.5%, and 38.3% respectively); 5-year basis (13.1% vs. 30.0%, 18.4%, 15.5%,

and 28.6% respectively); 7-year basis (10.0% vs. 23.0%, 14.7%, 13.2%, and

22.3% respectively); and 10-year basis (12.4% vs. 25.9%, 16.5%, 14.2%, and

23.1% respectively).

-

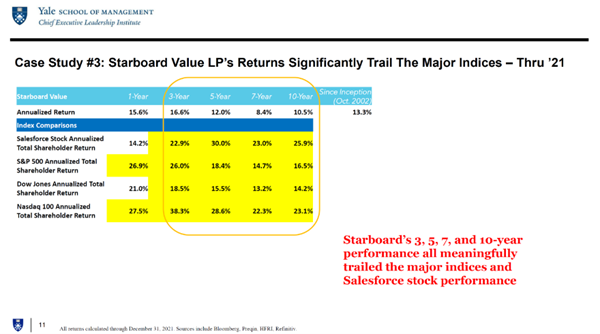

Starboard Value’s annualized returns trailed Salesforce stock, S&P 500, Dow

Jones, and Nasdaq 100 on an annualized 3-year basis (16.6% vs. 22.9%, 26.0%,

18.5%, and 38.3%, respectively); 5-year basis (12.0% vs. 30.0%, 18.4%,

15.5%, and 28.6%, respectively); 7-year basis (8.4% vs. 23.0%, 14.7%, 13.2%,

and 22.3%, respectively); and 10-year basis (10.5% vs 25.9%, 16.5%, 14.2%,

and 23.1%, respectively).

-

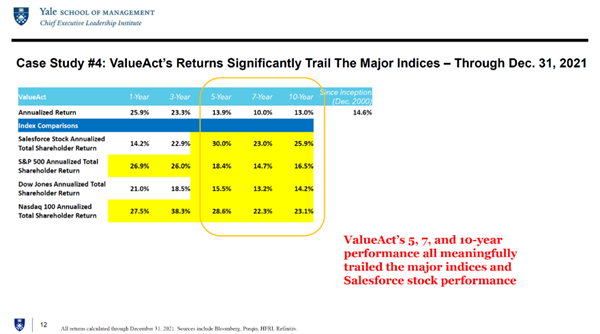

ValueAct’s annualized returns trailed Salesforce stock, S&P 500, Dow Jones,

and Nasdaq 100 on an annualized 5-year basis (13.9% vs. 30.0%, 18.4%, 15.5%,

and 28.6%, respectively); 7-year basis (10.0% vs. 23.0%, 14.7%, 13.2%, and

22.3%, respectively); and 10-year basis (13.0% vs. 25.9%, 16.5%, 14.2%, and

23.1% respectively).

Of the other activists in Salesforce, Jeff Ubben’s Inclusive Capital is a new

activist fund that does not yet have a track record. Presidential candidate

Vivek Ramaswamy’s Strive Capital is irrelevant, with a ridiculously puny stake

equivalent to less than .00001% of Salesforce shares–not enough to buy half a

space in the company parking lot. Ramaswamy doesn’t seem to have an argument

other than vague accusations of “wokeism.” If the threshold is now so low for

launching activist campaigns, then perhaps the authors of this essay, who have

modest .000001% Salesforce stakes combined, should consider joining the ranks of

activist investors themselves, as should millions of retail investors!

The dramatic underperformance of these activist funds is even more important

given the strong endorsements Benioff has received from key stakeholders,

including savvy Wall Street analysts, as he lays out a detailed plan focused on

driving profitability and improving margins. Just this week, Goldman

Sachs gave Salesforce a strong “buy” recommendation with

a fresh price target of $310.

“We believe Salesforce is at an inflection point that can vault it into the

upper echelons of highly valued tech companies. We believe Salesforce remains

poised to be one of the most strategic application software companies in the $1

trillion+ TAM cloud industry and is on a path

to $50 billion of revenue growth….we

think revenues and margins have the potential to double in the next 5 years,

potentially quadrupling earnings in steady state. To that end, we remain bullish

on the company’s ability to drive continued y/y operating margin expansion

beyond FY23,” Goldman

Sachs concluded.

“The narrative at Salesforce over recent quarters has shifted from top-line

growth to profitability and efficiency…..we believe Salesforce has significant

margin expansion potential ahead, and we believe Salesforce can become a 30%+

plus operating margin business over the next three years and drive

better-than-expected free cash flow growth at a CAGR of 25%,” analysts

at William Blair wrote,

echoing similarly enthusiastic fresh “buy” recommendations from Morgan

Stanley, Bank

of America, Wells

Fargo,

and Evercore.

Salesforce’s customers are also enthusiastic, with 92% deriving revenue from

Salesforce’s vaunted sales cloud and reporting high satisfaction ratings in

a survey by Guggenheim.

Just last year, Benioff

was selected by his CEO peers as Chief Executive’s CEO of the Year.

If precedent is

any guide, Elliott’s vaunted tech activist Jesse Cohn knows when a company’s

leadership has deftly taken the wind out of the activists’ sails. This is

clearly the case. When all is said and done, perhaps Benioff should offer

lessons on value

creation to

activist investors.

Jeffrey Sonnenfeld is the Lester Crown Professor in Management Practice and

Senior Associate Dean at Yale School of Management. Steven

Tian is the director of research at the Yale Chief Executive Leadership

Institute.

The opinions expressed in Fortune.com commentary pieces are solely the views of

their authors and do not necessarily reflect the opinions and beliefs of Fortune.

© 2023 Fortune Media IP

Limited. |