|

Editor’s Note:

Will Goodwin is the Co-founder & Head of US Sales at Tumelo. This

post is based on his opening statement at an SEC IAC panel.

|

In June 2025, I participated in a panel hosted by the U.S. Securities

and Exchange Commission’s Investor Advisory Committee to discuss the

growing momentum behind pass-through voting and what it means for

investor empowerment.

The conversation brought together experts from across the governance

ecosystem, including Vanguard, EQ Shareowner Services, the Society for

Corporate Governance, and a renowned academic from the University of

Pennsylvania. Each of us explored how the proxy voting system is

evolving, and why giving clients a direct say in corporate governance

is no longer a fringe idea, but a fiduciary necessity.

Why investor choice matters

More than 50% of U.S. households own pooled investment vehicles —

mutual funds, ETFs, or closed-end funds.(1) That’s around 74 million

households or approximately 130 million individual investors.

If we believe corporate governance plays a critical role in how

companies operate today, then we must also believe that clients should

have a say in how that governance is executed.

The current state of proxy voting

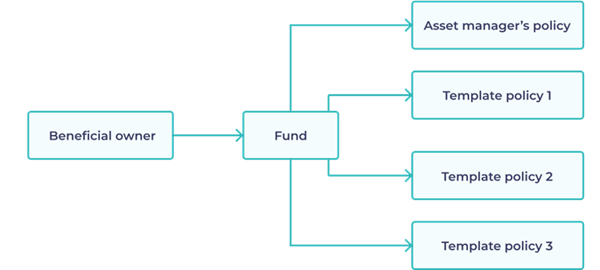

Traditional flow:

Today, the typical process looks like this:

-

A beneficial owner invests in a fund.

-

That fund votes on behalf of all its

clients.

-

The asset manager makes voting decisions

according to its own policy.

This creates significant issues:

What pass-through voting changes

Pass-through voting introduces choice at the point of proxy

decision-making.

We move from:

Client

➝

Fund

➝

Fund votes on behalf of client

To:

Client

➝

Fund

➝

Client chooses how their shares are voted

At Tumelo, as a technology provider, we’ve seen several implementation

models tailored to different types of clients:

-

Policy selection:

Clients choose from a menu of voting policies, including the fund

manager’s default.

Example: Vanguard’s approach.

-

Custom-policy creation:

Clients build their own proxy-voting policies based on personal or

organisational principles.

-

Proposal-by-proposal voting:

Typically used by institutional clients who want to vote on

specific ballot items they care most about.

The principle is straightforward: It’s the client’s money,

therefore it is the client’s choice.

Solving real problems for institutional clients

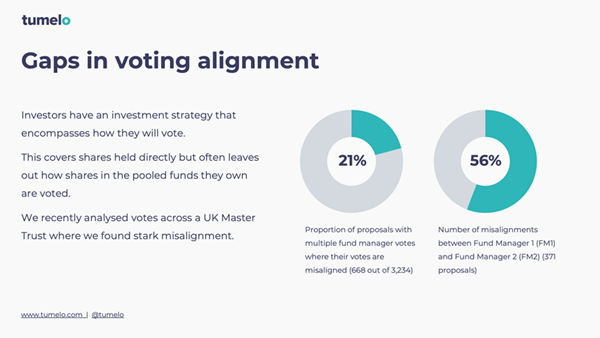

From an institutional perspective, we’ve observed significant

misalignment between an asset owner’s investment strategy and how its

votes are cast in the pooled funds they use.

To address this, Tumelo offers a reporting solution that allows

clients to compare:

This often reveals discrepancies, which dilutes the impact of the

client’s investment strategy.

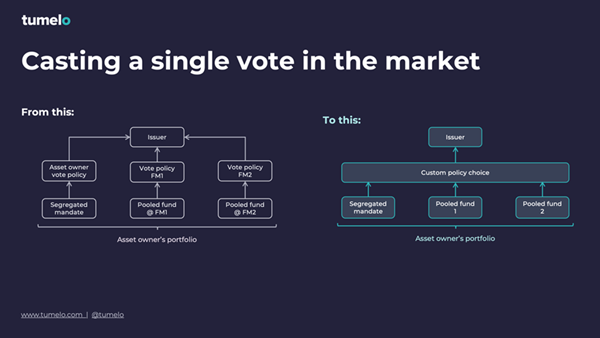

Enabling policy alignment across all assets

Pass-through voting solves this misalignment for asset owners.

Consider this simplified comparison:

-

Before: An

asset owner has a separate account (voted with their own policy)

and several pooled funds (voted by fund managers).

-

After: With

pass-through voting, the client’s preferred policy can apply to

all holdings —including pooled funds.

This alignment is essential. Without it, the client’s influence in

corporate governance is fragmented, undermining their ability to act

on their investment principles.

Customisation in practice

We’ve seen broad customisation among institutional and retail clients

that have adopted pass-through voting. Examples include:

-

Wealth managers seeking

alignment across pooled funds used in client portfolios.

-

Local Government Pension Schemes (LGPS) in

the UK such as LGPS Central, which votes over £12 billion under a

unified policy

-

Defined Benefit (DB) and Defined Contribution (DC) Corporate

Pension Schemes

which often take an issuer-focused approach,

selecting target companies based on size or strategic priority.

-

Retail investors making

a voting policy choice at the point of fund purchase.

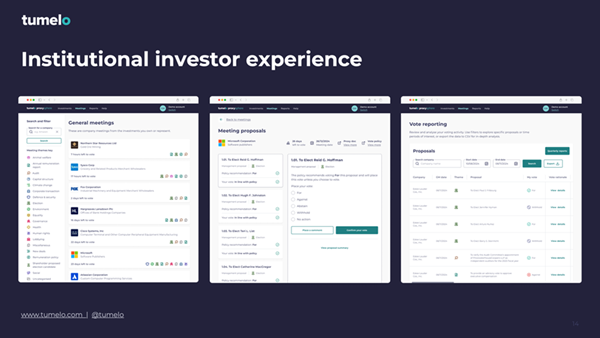

Technology-enabled experiences

For institutional investors:

Tumelo offers a stewardship platform that enables:

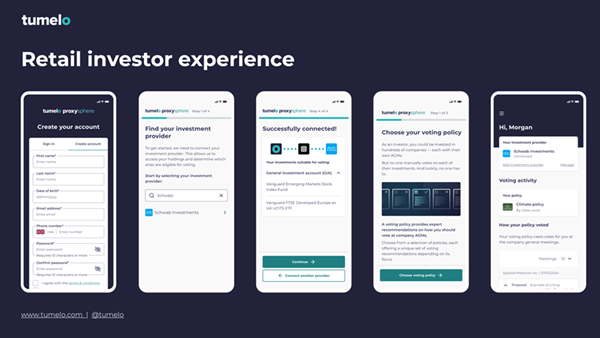

For retail investors:

The focus is on transparency and education. The experience includes:

-

Connecting brokerage accounts.

-

Viewing how shares are voted under the

selected policy.

-

Holding policy providers accountable for

how votes are actually cast.

Growth of pass-through voting

We’re seeing strong and accelerating demand across the market:

-

We support multiple fund managers.

-

Over £200 billion in client assets

currently vote through our platform.

-

An additional £30 billion is in

onboarding.

-

We’ve identified over £1 trillion in

institutional assets interested in adopting pass-through voting,

but unable to access it — often because their fund managers do not

yet support the functionality.

Importantly, demand is not limited to passive funds. Clients expect

voting alignment across both passive and active portfolios.

Looking ahead

We believe pass-through voting will become a standard feature across

all pooled investment vehicles. Why? Because clients want

customisation, they believe voting control strengthens their

investment strategy, and for many, it’s now considered table stakes.

We envision a future where investors buying a fund through a brokerage

platform are immediately offered the chance to choose how their shares

are voted all from within the same user interface.

References:

1 Investment

Company Institute. (2023, October). Ownership of mutual funds,

shareholder sentiment, and use of professional financial advisers,

2023 (ICI Research Perspective, Vol. 29, No. 10). https://www.ici.org/system/files/2023-10/per29-10.pdf

|

Harvard Law School Forum on

Corporate Governance

All copyright and trademarks in

content on this site are owned by their respective owners. Other

content © 2025 The President and Fellows of Harvard College.

Privacy

Policy |