INTELLIGENT §

TRANSPARENT

§

GLOBAL

|

Shareholder adviser Glass Lewis joins political retreat

Liz Hoffman and

Rohan Goswami

Apr 29, 2025, 5:31am EDT

business

|

Elizabeth Frantz/Reuters

|

The Scoop

The Scoop

For years, two firms have dominated the business of telling investors

how to vote in corporate elections. One wants out.

Glass Lewis, the scrappier and smaller rival of Institutional

Shareholder Services (ISS), is discussing a dramatic shift to

essentially scrap its “house view” on ballot measures ranging from

takeover battles to complaints about gender balance, political

donations, and carbon emissions, according to people familiar with the

matter and an internal memo seen by Semafor. The move is partly in

response to heightened conservative backlash, they said.

Instead, Glass Lewis would help investors develop their own custom

voting policies, handle the paperwork and regulatory reporting, and

provide data and research. The changes would be phased in over a few

years, and the firm would likely continue to make explicit

recommendations in the meantime.

Glass Lewis has angered both corporate executives and conservative

politicians by supporting, among others, ballot measures for

McDonald’s to audit its racial diversity, Starbucks to produce an

independent report on its labor practices, and meatpacker Tyson to

disclose and defend its political contributions.

It also recommended that shareholders reject Jamie Dimon’s $53 million

bonus in 2022, which earned it the unending ire, recently

vented in an interview with Semafor, of the JPMorgan chief. (In a

perfectly timed juxtaposition, ISS on Monday recommended that

BlackRock shareholders vote down CEO Larry Fink’s $30 million-plus pay

package.)

Its pivot reflects a growing desire among players across the financial

industry to get out of the moralizing business and back into the

business of managing and making money. The most visible backpedaling

happened at investment giant BlackRock, which has retreated from its

late 2010s progressive push under a hail of political arrows.

“Speak softly and invest money,” Mark Wiedman, then a top BlackRock’s

executive told Semafor in 2023, about a year into the $11.6 trillion

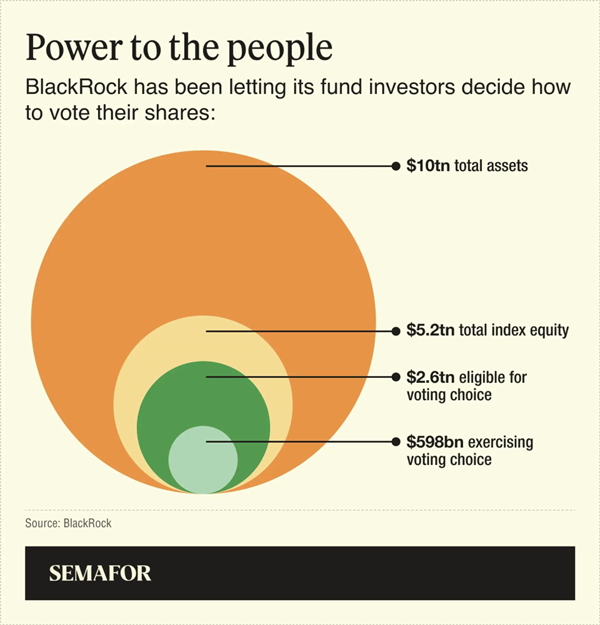

firm’s change of heart. BlackRock and Vanguard have both dialed

back their requirements that public company boards include women

and minority investors, and rolled out new options for investors to

vote their own shares, rather than adopt BlackRock’s house view.

Other gatekeepers, like Goldman Sachs, a

major IPO underwriter, and Nasdaq have scrapped similar requirements —

the latter after a court

order.

Glass Lewis’ own pivot comes a year into the tenure of its new CEO,

Bob Mann, and amid an investigation by House Republicans into it and

ISS. The two firms control an estimated 90% of the US

shareholder-advice market, which critics say has allowed them to push

an ideological agenda. Glass Lewis’ moves would go beyond those of

ISS, which said in

February that it would no longer consider the diversity of board

members when making its recommendations.

A congressional

hearing is set for Tuesday afternoon.

Liz’s view

Liz’s view

I’ve always found Republican claims of a vast left-wing conspiracy in

investing a little silly. BlackRock, Glass Lewis, Goldman Sachs, and

Nasdaq are commercial creatures, and they were responding to

commercial pressures in the late 2010s and early 2020s.

The political winds were blowing left, so they went left. BlackRock

was cajoled into joining a climate-change coalition by European and

Japanese pension funds that threatened to pull their money if it

didn’t. Not to say that Larry Fink didn’t believe in diversity, or see

a chance to burnish his own standing by fronting a social movement.

But as I wrote last summer, his

leftward shift seemed “like a CEO tweaking his company’s product

because some important customers stopped buying it.”

Now the customers want something else. Plus, designing and executing

custom voting policies for clients is more profitable for Glass Lewis

than having big ideas of its own, according to people familiar with

the privately held company’s finances. Making more money while getting

yelled at less is a good business model.

Rohan’s view

Rohan’s view

ESG handwringing aside, this will shake up the world of activist

investing, where dissident hedge funds and companies lobby Glass Lewis

hard to recommend their case to shareholders. Many institutional

investors automatically vote their shares however their chosen proxy

firm recommends, and every public missive and presentation from both

sides is aimed at swaying the proxy advisors’ internal judges.

At one of the few active proxy fights of this season – a battle

between activist Elliott Management and Phillips 66 – Elliott spent

the day in Washington on Monday speaking with ISS, according to people

familiar with the matter. Phillips is scheduled to meet with them

Tuesday, according to other people with knowledge of the event.

Glass Lewis’ decision changes the game for these investors. Where

there was once a duopoly, now ISS will have singular sway over huge

swathes of the shareholder base. ISS may be willing to bear the

political heat that comes with it.

Room for Disagreement

Room for Disagreement

Deeply researched recommendations from proxy advisory firms are

“essential,” Better Markets, the left-leaning Wall Street advocacy

group, wrote

this week. “Without these firms, investors would receive only

management’s perspective on the key issues a company faces, and all

too often management’s perspective favors management over the

long-term interests of the company and its shareholders.”

© 2025 SEMAFOR INC. |