Guiding Our Way to Quarterly Behavior?

Promoting Long-Term Thinking and Greater Transparency

Posted by Sarah Williamson, FCLTGlobal, on

Monday, October 8, 2018

By now, most business-watchers have seen the

president’s

tweet asking the Securities and Exchange Commission (SEC) to study the

requirement that US public companies release earnings quarterly. With this

message, President Trump has focused attention on the short-term mentality that

too often characterizes American business.

The tweet,

which followed his discussion with Pepsi CEO Indra Nooyi about how to

better orient corporations towards a more long-term view, has provoked

a flurry of discussion on how corporations can take a longer-term

approach to business and investment decisions, and in doing so, fuel

growth and innovation in their communities.

And rightly so. An

analysis

of publicly-listed US companies by the McKinsey Global Institute showed that

companies operating with a long-term approach consistently outperform their

peers on a wide range of metrics, including revenue growth, profitability,

shareholder return and job creation.

Furthermore, a

C-suite survey FCLTGlobal released with McKinsey and Company in 2016 is

telling: 55% of CFOs admitted that they would delay NPV-positive projects in

order to hit quarterly earnings targets. Clearly, too many capital allocation

decisions are made without a full appreciation of the long-term

implications—notwithstanding a few oft-cited exceptions such as Amazon. Most

Americans invest their retirement savings in these companies, and they depend

upon their success over several decades to enable them to retire with sufficient

savings or pay for their children’s education.

While the detrimental

effect of short-term behavior is real, shifting to semi-annual reporting in the

US raises legitimate fears of a lack of transparency with companies only

disclosing significant developments in their business twice a year.

There are four

solutions that the SEC could explore to encourage long-term behavior while

maintaining the disclosure that is critical to well-functioning markets:

-

Make it very clear that quarterly guidance is

neither required nor desirable

-

Encourage companies to report progress towards

their annual results rather than quarterly results per se

-

Encourage companies to provide long-term strategic

roadmaps, recognizing that the future may not unfold as expected

-

Study pairing any relaxation of the quarterly

reporting requirement with a strengthening of other disclosure rules to ensure

transparency in markets.

Quarterly guidance is neither required nor desired

It is critical to

distinguish quarterly guidance—forecasts issued by companies of future

earnings metrics—from quarterly reporting, the retrospective look at

how a company performed over the prior three months.

There is a common

belief that quarterly guidance is advantageous to companies and investors—and it

may have been in the pre-internet world of limited data and primarily retail

shareholders—but today it is a relic. Many market participants even believe that

quarterly guidance is required, which it is not, confusing the SEC’s

encouragement of forward-looking information as promoting short term guidance.

The SEC could more clearly underscore the distinction between quarterly guidance

and quarterly reporting.

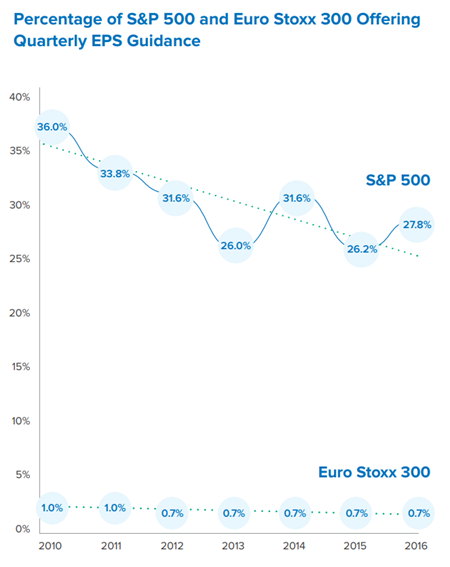

Guidance is already

falling out of favor with American companies and is virtually non-existent in

Europe. In 2016, for example, only 27% of the S&P 500 and 0.7% of Euro Stoxx 300

offered quarterly EPS guidance (see figure 1).

Figure 1: Source:

Moving Beyond Quarterly Guidance: A Relic of the Past. FCLTGlobal, 2017.

Furthermore, there is

overwhelming evidence that investors (as opposed to the media or other analysts)

don’t like quarterly guidance either. According to a Rivel study, only seven

percent investors are interested in guidance metrics for periods of less than a

year. Similarly, an Edelman survey of institutional investors revealed that 68%

agreed that providing long-term guidance positively impacts their trust in

companies they are invested in or considering investing in.

My organization,

FCLTGlobal, has also been vocal in its opposition to this practice. In

addition to underscoring investors’ desire to move away from the practice, our

research demonstrates that quarterly guidance has no impact on a company’s

valuation and in fact increases, rather than decreases, share price volatility,

particularly around reporting season.

Subsequent analysis from Bloomberg reinforces this: their analysis shows

that for 7 out of 9 quarters between 2016 and 2018, companies who issued

quarterly guidance (the guiders) experienced higher earnings surprise than

non-guiders, while the differences between the two for the remaining quarters

were immaterial.

FCLTGlobal’s position

has been reinforced several times since our 2017 research was released,

including in a

powerfully-worded op-ed by Warren Buffet and Jamie Dimon, as well as by the

National Investor Relations Institute and the National Association of Corporate

Directors, both of which publicly support companies’ efforts to focus on the

long-term growth of their business and the economy as a whole.

An SEC statement

clarifying that quarterly guidance is neither required nor desirable could serve

as the nudge American companies need to begin aligning their focus with

long-term objectives. While it is unlikely that the SEC would ban the practice

of quarterly guidance given its historical approach of enabling voluntary

disclosure, it could nevertheless call attention to the problem, including by

asking companies who do issue quarterly guidance to disclose the extent to which

such practice creates a risk factor, whether the board and audit committee have

discussed with management the pros and cons of providing such quarterly guidance

and why the company believes providing quarterly guidance, as opposed to

longer-term frameworks for value creation, is in the best interests of the

company and its shareholders.

Reporting progress

towards annual results rather than quarterly results

Another step the SEC

could take is to encourage companies to report their financial progress towards

annual results rather than quarter-by-quarter. Companies would report first

quarter results, then half-year results, then nine months results and then

finally results for the year without analyzing each quarter individually.

While anyone can do the

math and compare quarter over quarter, we have learned from the behavioral

economists how important framing is. Framing quarterly work as progress towards

a longer-term goal is costless and could serve as another nudge for long-term

thinking. When discussing quarterly results, companies would situate them within

the broader context of the company’s strategy, longer-term objectives and a

year’s worth of progress.

Providing long-term strategic roadmaps

We and others have been

encouraging companies to develop clear long-term strategic roadmaps in place of

quarterly guidance. Such strategic roadmaps can focus shareholders on a

company’s longer-term plans and provide them with the opportunity to evaluate

both the strategy and the management team’s execution of that strategy.

Companies also have more flexibility in deciding the right metrics to use when

conveying long-term strategic roadmaps. In a recent Financial Times column,

Harvard Professor Larry Summers bolsters the case for providing long-term

guidance by stating, “Wise corporate leaders should give a sense of their

long-term vision on at least an annual basis. Investors who insist on such

information are only being reasonable.”

The most common concern

we hear about providing such strategic roadmaps is a legal one: that companies

will be open to criticism if those plans do not come to fruition or if they need

to pivot as market conditions change.

To assuage this

concern, the SEC could provide clear direction to companies and investors alike

about the parameters for providing long-term strategic roadmaps and any

resulting liability, confirming that safe harbors for forward-looking statements

and other protective measures will apply to such long-term outlooks. Having

long-term oriented dialogues between companies and their shareholders supports

the allocation of resources to productive long-term uses.

Strengthening intra-period disclosures

There are many examples

of countries that do not require quarterly reporting. These countries have often

paired less regular financial statement reporting with stringent continuous

reporting of significant changes to a company’s business. This continuous

reporting framework offsets the concern that less frequent financial reporting

will lead to either very significant, discontinuous disclosures every six months

or the opportunity for insider trading.

It would certainly be

appropriate for the SEC to study the issue of quarterly reporting as the

president suggested. It can do so by examining the requirements in other

countries, such as the UK and Australia, for continuous disclosure, and looking

into whether today’s Form 8-K framework in the US for “current” reporting of

specified material events should be broadened to enable less frequent reporting

of full financial statements. Reporting is essential to maintaining transparency

for all shareholders, and mechanisms such as making on-going disclosure

requirements more robust could be appropriate.

The UK’s recent

experience in changing reporting frequency is also worth noting. It now requires

only half-yearly reporting, reversing a 2007 decision to implement quarterly

reporting. Both domestic and foreign investors encouraged the shift, and there

are a number of major institutional investors who continue to encourage the UK

companies that report quarterly to stop the practice.

Research from the CFA Institute indicated that for the periods studied and

using their methodology, the frequency of financial reporting had no material

impact on the levels of corporate investment, so relaxing quarterly reporting

requirements is not a panacea for short-term thinking. However, their research

also showed no impairment of analysts’ ability to forecast corporate

performance, assuaging some concerns about the impact of reductions in the

frequency of reporting.

Summary

We commend any attempt

by the White House, the SEC, and American business to combat short-term

pressures in our capital markets. While considering various reporting standards

is certainly a legitimate exercise, the evidence for addressing quarterly

guidance is much stronger than for addressing quarterly reporting and merits

close review.

By encouraging the

elimination of quarterly guidance, the reporting of progress towards annual

results, and the issuing of long-term strategic roadmaps, the SEC could have a

very significant impact on short-termism even within the current regulatory

framework.

|

Harvard Law School Forum

on Corporate Governance and Financial Regulation

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2018 The President and

Fellows of Harvard College. |