The Changing Face of Shareholder

Activism

Posted by Paula Loop, Catherine Bromilow,

and Leah Malone, PricewaterhouseCoopers LLP, on Thursday, February 1,

2018

|

Editor’s Note: Paula

Loop is Leader, Catherine Bromilow is Partner, and Leah Malone is

Director of the Governance Insight Center

at PricewaterhouseCoopers LLP. This post is based on a PwC

publication by Ms. Loop, Ms. Bromilow, and Ms. Malone. Related

research from the Program on Corporate Governance includes Dancing

with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and

Thomas Keusch (discussed on the Forum here);

Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on

Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed

on the Forum here);

and

The Long-Term Effects of Hedge Fund Activism by

Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum

here). |

Activism is about driving

change. Shareholders turn to it when they think management isn’t maximizing a

company’s potential. Activism can include anything from a full-blown proxy

contest that seeks to replace the entire board, to shareholder proposals asking

for policy changes or disclosure on some issue. In other cases, shareholders

want to meet with a company’s executives or directors to discuss their concerns

and urge action. The form activism takes often depends on the type of investor

and what they want.

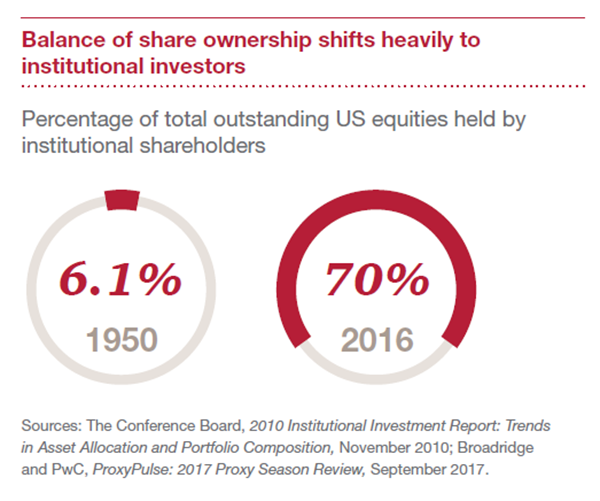

Institutional

investors and hedge funds typically have the most impact. Individual

investors may submit lots of shareholder proposals, but they usually

lack the backing to drive real change.

To prepare for—and possibly to even avoid—shareholder activism,

companies and their directors need to understand today’s landscape. Who are the

activists? What are they are trying to achieve? When are activists more likely

to approach a company? What tactics do they use? We break down the answers by

the two main types of investors. Read on.

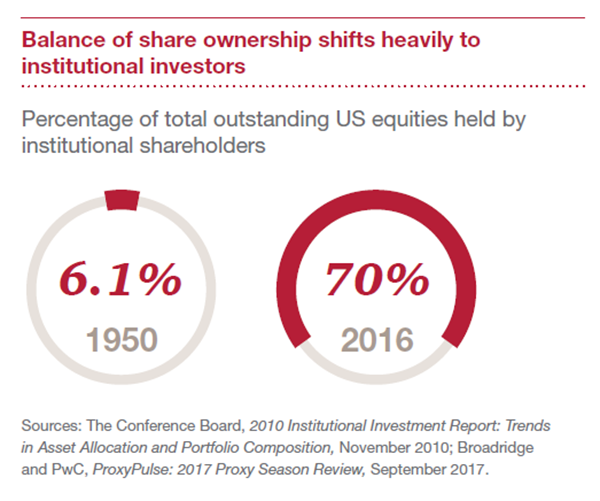

Institutional investors

These include pension funds, asset managers, mutual funds and

insurance companies.

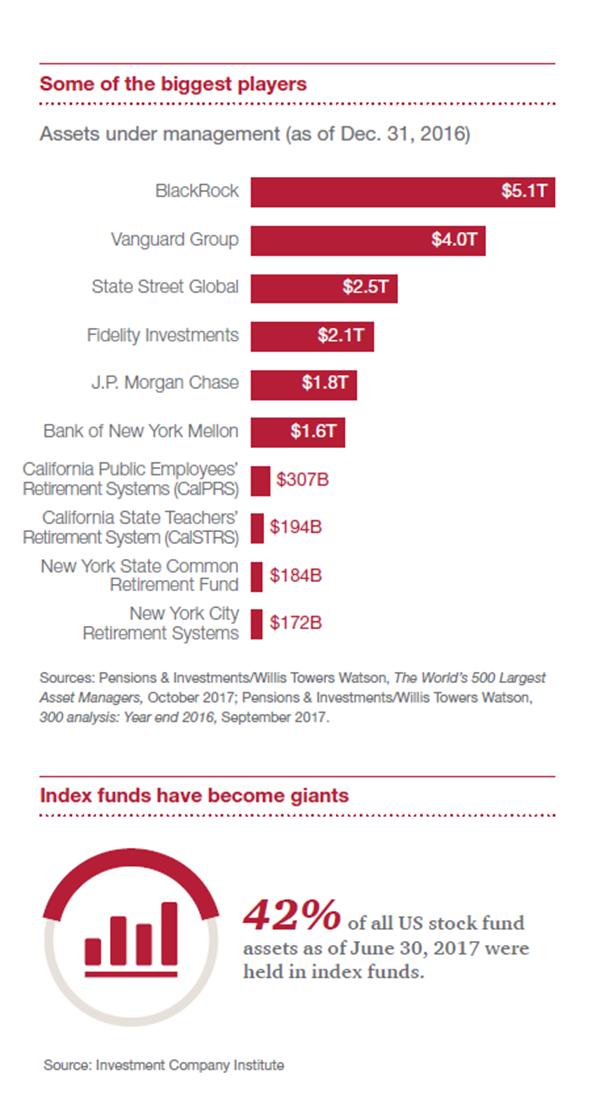

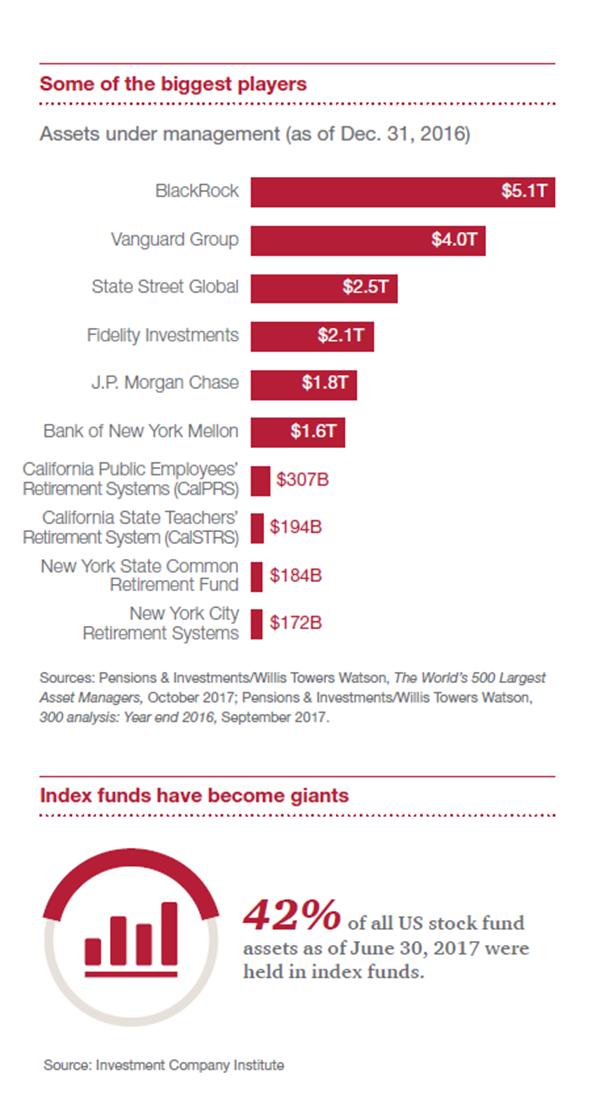

Institutional investors are normally long-term shareholders. Many

hold their shares in index funds, which are popular for their low fees.

Institutions that provide index funds can’t just sell a position if they think a

stock is underperforming, or if they believe the company’s governance practices

hinder it’s long- term value. And so they turn to activism. Through activism,

they can bring attention to their concerns and drive the change that they

believe will create long-term value—including through changes in corporate

governance practices. Institutional investors such as Vanguard are vocal about

their belief that companies with strong corporate governance practices can

deliver better value in the long run.

Shareholder engagement

When institutional investors have concerns, they often start by

engaging one-on-one with the company. In prior years, engagement was mostly

between the portfolio manager and the company’s investor relations team or

members of management, and focused largely on company performance. Today,

investors’ corporate governance teams are often driving the meetings—sometimes

alone and sometimes in combination with portfolio managers.

At times shareholders ask to meet with directors. They may have

identified issues in the company’s executive compensation plans, its governance

policies or practices, or its strategic plan. Other times, shareholders are

looking to lay the foundation of an open dialogue with the directors. So when

issues do arise in the future, they have an existing relationship upon which to

build.

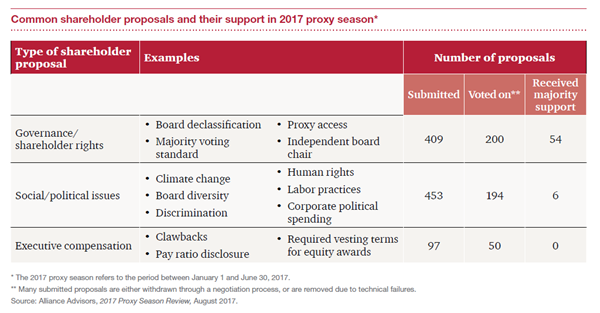

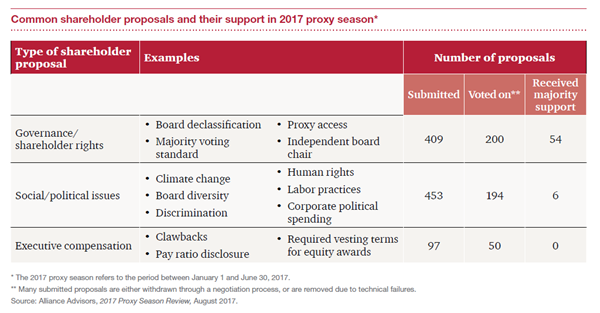

Shareholder proposals

In some cases, institutional investors submit—or indicate they

plan to submit—a proposal if direct engagement with the company and its

directors doesn’t produce changes. Other investors view a shareholder proposal

as a way to begin the conversation with a company.

These proposals often focus on governance practices or policies,

executive compensation, or the company’s behavior as a corporate citizen.

Proponents watch how the major institutional investors are voting on issues, and

have a sense of which shareholders may be likely to support their proposal going

in. Investors also often reach out to other shareholders to encourage support

for their measure. By the time a company even receives a shareholder proposal,

its sponsor may already have a sense of whether it will pass.

Proxy access: a highly

successful campaign

Proxy access

allows certain shareholders to include their director nominees in the company’s

proxy statement

Institutional investors have been pushing for proxy access for

years through shareholder proposals. In the 2012-2014 proxy seasons, these

proposals got limited support. But in the fall of 2014, the New York City

Pension Fund helped proxy access to take hold through its Boardroom

Accountability Project. It targeted more than 70 major public companies with a

coordinated, highly public effort. Most proposals passed, and companies started

to implement proxy access bylaws. Efforts have continued since then, and by

mid-2017, 60% of the S&P 500 had proxy access bylaws in place.

Why does this matter now? The New York City Pension Fund has

launched version 2.0 of its Boardroom Accountability Project for 2018. This

time, they are taking on board diversity and renewal, calling on companies to

disclose the race, gender and skills of their directors in a standard matrix

format.

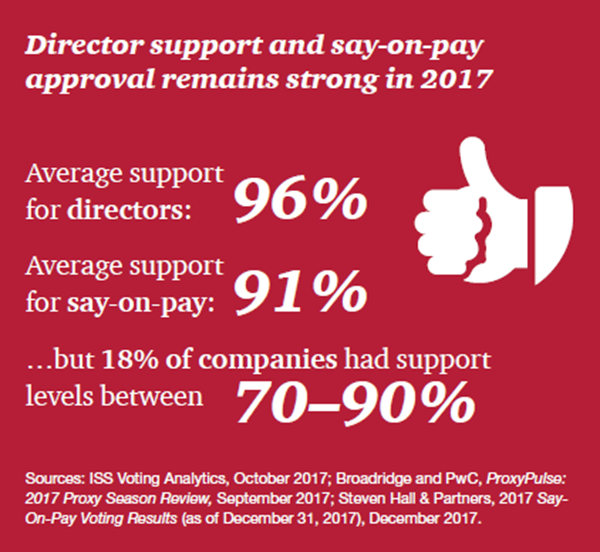

“Vote no” campaigns

“Vote no” campaigns urge shareholders to withhold their votes

from director candidates or to vote against a company’s say on pay.

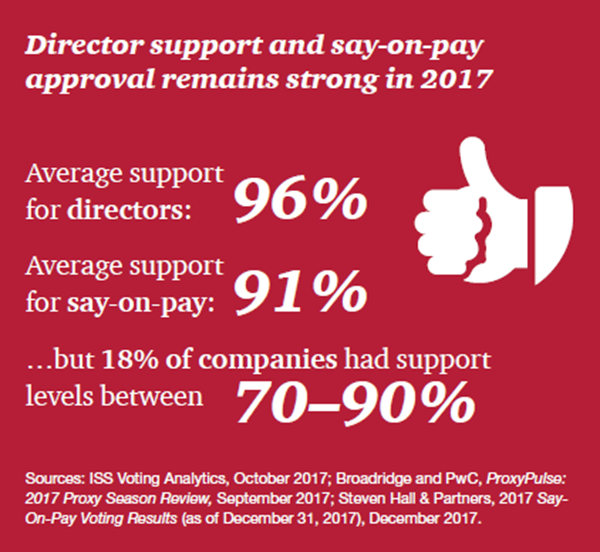

The vote doesn’t actually have to fail for a vote no campaign to

be a success. Overall shareholder support both for directors and for say on pay

is typically above 90%. So if support levels fall to the 60s or 70s, it sends a

stark message about shareholder dissatisfaction. It also generates media

scrutiny, and can affect a director’s reputation. Directors often serve on

multiple boards, and low support levels at one company can affect how that

director is viewed at his or her other companies as well.

A vote no campaign can send a strong signal about shifting

shareholder priorities. Just as proxy season was beginning in 2017, State Street

Global Advisors (SSGA) used the tactic to shine a spotlight on gender diversity.

They announced they would start voting against nomination and governance

committee chairs at companies that didn’t have any women directors and weren’t

making efforts to add them. Indeed, SSGA voted against directors at over 400

companies in 2017, sending a clear signal.

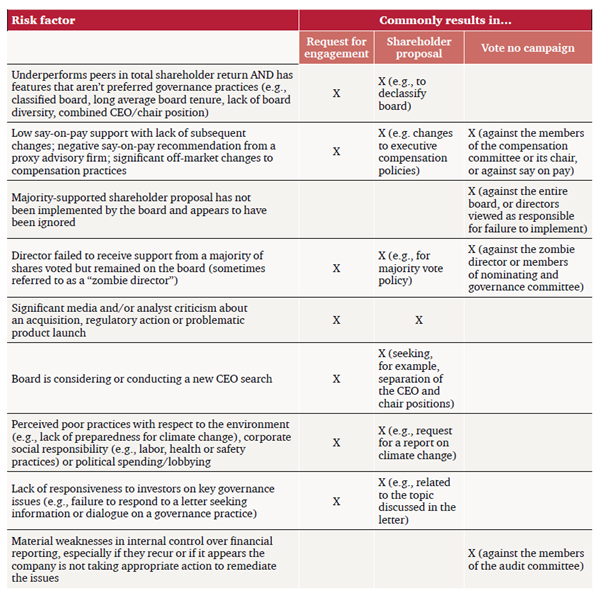

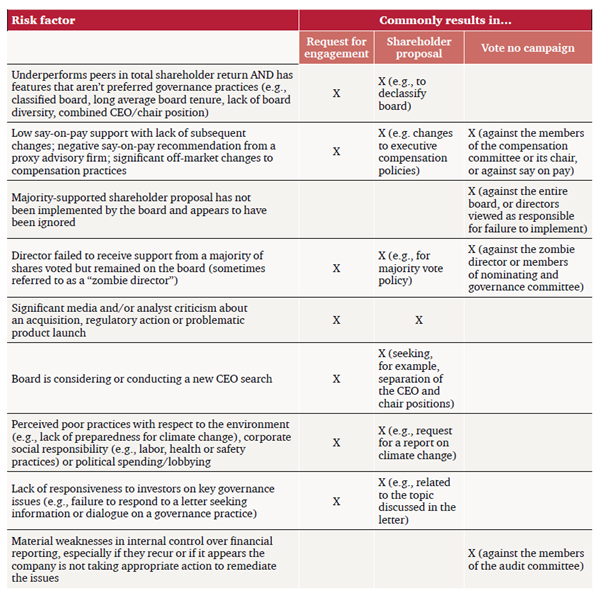

Risk factors

Different types of shareholder concerns lead to different

approaches. Although these methods can seem like escalation tactics, different

investors simply prefer to start in different places and may adopt more than one

approach on a given issue.

Preparing for and responding to

institutional investor activism

-

Start a pattern of regular director engagement.

Before the company

receives a shareholder proposal or is targeted by a vote no campaign, start

getting directors involved in discussions with major investors. Some investors

view a shareholder proposal as a way to begin a conversation with the board.

But if the lines of communication are already open, shareholders may not feel

they need to resort to a shareholder proposal or other means.

-

Respond directly to the investor.

If you have received a

shareholder proposal or been targeted for a vote no campaign, reach out to the

investor. Discuss their specific concerns. When dealing with a shareholder

proposal, the company and the shareholder may be able to agree on some action

at the company in exchange for withdrawal of the proposal. Shareholders don’t

always insist on immediate action. They know change can take time, and often

they are satisfied if the company demonstrates that it has a plan in place to

address the issue. Communication might not put an end to a vote no campaign,

but understanding the shareholder’s perspective will help the company respond.

-

Reach out to other shareholders.

A shareholder proposal or a

vote no campaign can be an opportunity to discuss the issue with other

shareholders. Take the chance to articulate the company’s view about why its

current course is in the best long-term interests of the company and all of

its investors. And consider disclosing the breadth of the company’s

shareholder engagement efforts in the proxy statement to give yourself credit

for your outreach. For more on shareholder engagement, take a look at our

paper

Director-shareholder engagement: getting it right.

Blurring the lines—The future of

institutional investor activism

Some institutional investors are moving beyond their traditional

tactics. With many committed to long-term passive investments in a broad

portfolio of companies, they are looking hard for ways to find untapped value at

those companies—by encouraging governance changes, and otherwise. And so today,

some are engaging in what has traditionally been thought of as hedge fund

activism. Long-term institutional investors who previously never would have

considered themselves “activists” are getting into the fray. Some are

approaching hedge funds with a specific target in mind, backed by their own

research, to suggest teaming up. Others are turning into “occasional activists”

in their own right, without a hedge fund partner.

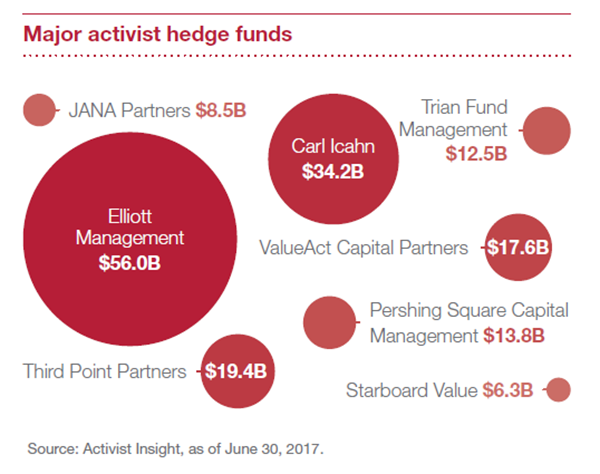

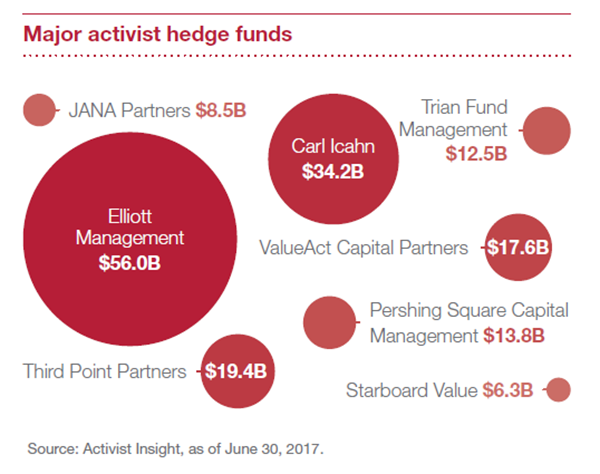

Hedge funds

Hedge funds attract big dollars from investors looking for

above-average returns. So they are always looking for untapped value. Hedge fund

activists often see that untapped value in the way a company is run, or the

strategy it pursues. They see ineffective management, a stale board, or a

company missing out on new opportunities. They see the potential for a new

capital allocation strategy or changes in operations that will increase share

value. And when their efforts to engage with executives or directors about these

ideas fail, they often try to elect different directors.

Hedge fund activism today

Hedge fund activists used to focus mostly on capital allocation

issues, such as dividends and share buybacks. Many then began looking for

company combinations and break-ups—mergers, carveouts and spin-offs. Now, there

is a greater focus on operational activism, which has more of a long-term focus.

Activists join the board (or appoint independent directors), replace

members of management and help execute a new strategy. While many hedge funds

had been thought of as being too focused on short-term gains, the longer-term

operational activism has helped to shift that perception.

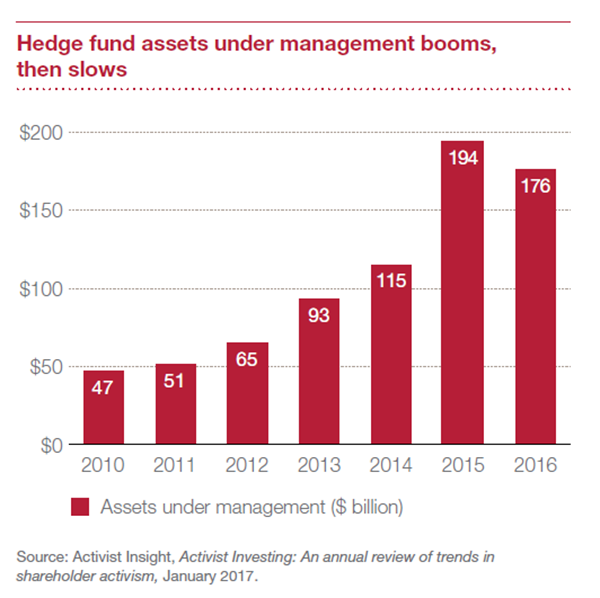

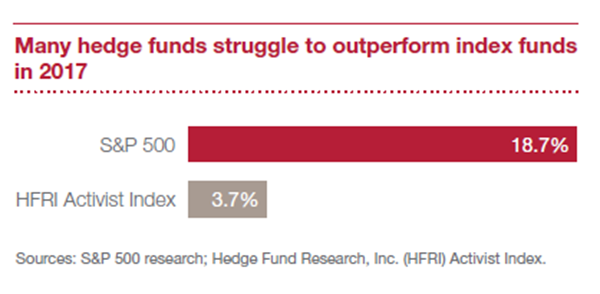

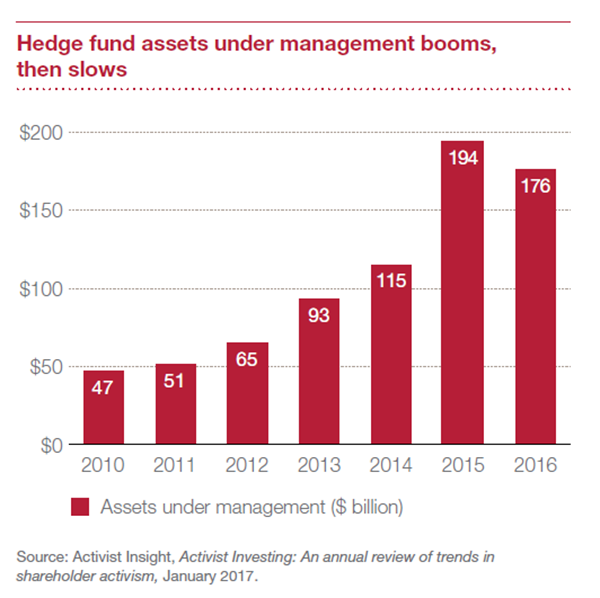

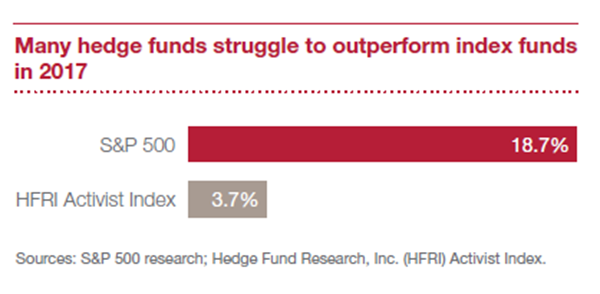

While a few hedge funds made significant profits for their

investors in 2017, most have failed to outperform the S&P 500. For many

investors, these returns don’t justify the high related fees, and so some large

institutional investors such as the California Public Employees’ Retirement

System (CalPERS) have pulled their investments out of hedge funds entirely. In

2016, hedge funds actually closed at the fastest rate since the 2008 financial

crisis.

With competition for investments growing tighter, hedge funds are

under greater pressure to post returns, which may be driving up activism even

more.

Activism tactics

Some activists follow a standard playbook. Many first spend time

talking to the company, highlighting areas for improvement and value creation.

If they can’t negotiate a consensus around specific changes, they may move on to

a proxy contest or a public media campaign.

Again, not all hedge funds follow this trajectory. Some move

first to a media campaign or some other way of making a major splash. Whatever

approach, hedge funds may also have spent time talking with some of the

company’s key shareholders to gauge their level of support for the campaign.

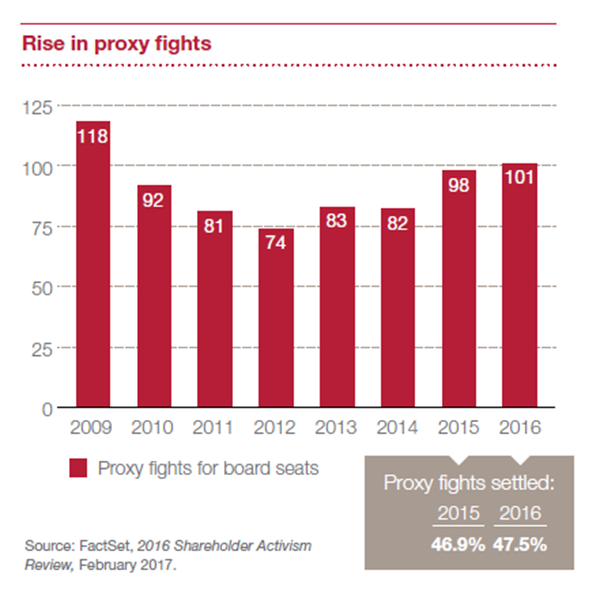

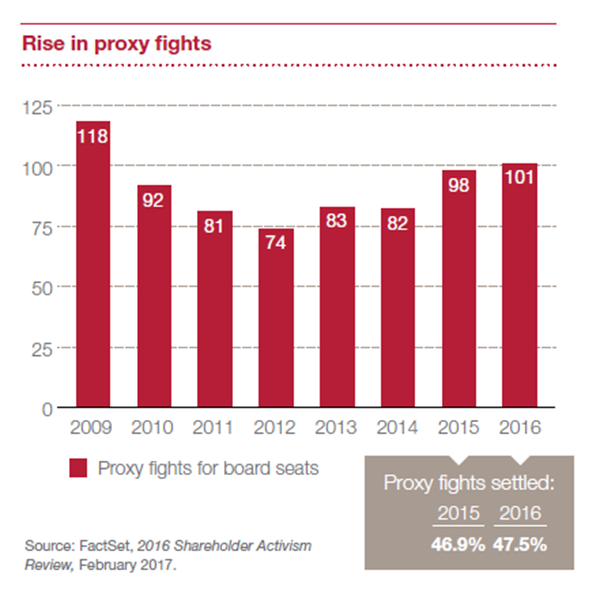

The number of proxy fights in 2016 reached its highest level

since 2009, and companies are more willing to settle with activists than ever

before. Proxy fights are long, expensive and draining for a company. There is

greater recognition that the directors nominated by activists can sometimes add

real value to the boardroom. So for many companies, it’s just not worth the cost

and distraction of a proxy fight.

Settlements have now become so common, in fact, that some

institutional investors are concerned that companies are settling too easily.

Before rushing to settle, they urge companies to at least reach out to their

significant shareholders to solicit their views. Sometimes these investors might

agree with the activist—and sometimes they might want the company to hold their

ground against the activist.

Risk factors

Hedge fund activists use proprietary processes to identify their

targets. But most targeted companies have some or many of these characteristics:

-

Low market value relative to book value

-

Disappointing company performance compared to peers

-

Profitable with sound operating cash flows and return on assets

-

Excessive cash on hand

-

For multi-business companies: one or more significantly underperforming

business lines or business lines with markedly different growth potential

-

Board composition does not meet today’s preferred governance practices (e.g.,

instead has long average board tenure, lack of board renewal, lack of

diversity, lack of industry experience)

Before hedge fund activist

campaigns occur

Companies can best anticipate, prepare for and respond to an

activist campaign if they put themselves in an activist’s shoes. Here are four

key steps:

-

Rethink the information.

Boards may get too much

granular information that doesn’t highlight underperforming assets. Reassess

the type of information the board receives and revamp it so it gives the full

picture.

-

Monitor shareholder positions and understand the activists.

Ensure

that the board is informed when an activist takes a significant position in

the company or in an industry competitor. And make sure the board hears about

broader activism trends that could affect the company in the future.

Understanding what these shareholders may seek (i.e., understanding their

“playbook”) will help the company assess its risk of becoming a target and

help it know what tactics to expect.

-

Evaluate and address your “risk factors.”

Look for the ways an

activist might criticize the company and its board. Examine company strategy

from an outside perspective, and then test whether it’s working. Ask to hear

from consultants, industry analysts or others from outside the company, to get

a better understanding of how the company is seen by investors and potential

activists and where its vulnerabilities are. Make sure they are giving their

“unvarnished view”—one that has not been white-washed by management or by an

unwillingness to give a frank evaluation.

If there are issues, take

proactive steps to address them. This can reduce the chance of being an activist

target and strengthen credibility with the company’s shareholders. Even if the

company chooses not make any changes, going through the critical process will

help company executives and directors reaffirm and articulate why they believe

the company is on the right course.

-

Launch an engagement plan.

Once a company identifies

areas that may attract activist attention, engaging with other shareholders

around these topics can help prepare for—and in some cases may help to

avoid—an activist campaign. Being transparent about the company’s

vulnerabilities and its strategic choices can help change a shareholder’s view

of the issue, and demonstrate that the board is fulfilling its oversight

responsibilities. Other times, the engagement should be more about listening.

We hear more and more about boards bringing portfolio managers or other

investors in to share their thoughts on the company and ways they could

improve—and possibly head off an activist.

Responding to a campaign

In responding to an activist, consider the advice that large

institutional investors have shared with us: good ideas can come from anyone.

Some circumstances may call for more defensive responses—such as litigation—to

an activist’s campaign. But in general, we believe the most effective response

plans have three components:

-

Objectively consider the activist’s ideas.

Activists usually do

extensive homework before they approach a company. Based on that research,

they develop specific proposals for unlocking value—at least in the short

term. And they have often discussed these ideas with other shareholders.

Assume the company’s institutional investors have already spent time

evaluating the activist’s suggestions. Investors will expect the company’s

executives and board to do the same—even when it’s uncomfortable. And it often

is. The changes activists propose are not easy and they are not

uncontroversial. If they were, the company would have already done them. More

often, they are recommending fundamentally restructuring the company or the

go-forward strategy. They might be looking for changes in the boardroom, which

may feel like a personal affront to the directors around the table. Or they

may be looking for a change in management, which will almost certainly feel

like an attack on the CEO. But none of these ideas should be dismissed out of

hand.

-

Look for ways to build consensus.

More companies than ever are

finding ways to work with activists. By doing so, they avoid the distraction

and high cost of a proxy contest. Companies might agree to change their

capital allocation, or even to add new directors to the board. Sometimes a

brush with an activist gives a company a welcome opportunity to refresh its

board.

Activists are also motivated to

reach agreement. Proxy contests are expensive— for both sides. If given the

option, most activists would prefer to spend less time and money to achieve

their goals. Once they agree, the activist and the company enter into a

standstill agreement that sets the terms of their relationship going forward.

-

Tell the company’s story.

Now is the time to reach out

instead of hunkering down. As we’ve said, an activist will likely be engaging

with other shareholders, so it’s important these investors hear from

management and the board as well. Ideally, the company already has an

established relationship with those shareholders to build upon. If the company

doesn’t believe the activist’s proposed changes are in the best long-term

interests of the company and its owners, investors will want to know why—and

just as importantly, how the company reached this conclusion. Often we hear

that the suggestions activists make are ones that the company had already been

considering.

If the activist and company are

able to reach an agreement, investors will want to hear from executives and

directors about why the changes are good for the company. Being seen as

forward-thinking leaders, rather than victims of activism, can boost investor

confidence.

Hedge fund activism is rarely

“one and done”

When the annual meeting is over, and changes have been

implemented, or the hedge fund has moved its attention to another target, it may

feel like the storm is over. But the risk of additional activism doesn’t go

away. The way the company responded to the activism, and the perception of the

board’s independence and open-mindedness can make it a repeat target.

To get ahead of this, companies periodically refresh the four

steps described earlier in the “Before hedge fund activist campaigns occur”

section. By periodically assessing risk factors and engaging in a tailored and

focused shareholder engagement program, the company can enhance its resiliency

and strengthen its long-term relationship with investors.

Conclusion

As activism—by both institutional investors and hedge

funds—continues to be strong, many think the number of campaigns could be on the

upswing. These campaigns may also be more likely than ever to succeed. For

companies, listening to and understanding shareholder concerns may be more

important than ever.

|

Harvard Law School Forum

on Corporate Governance and Financial Regulation

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2018 The President and

Fellows of Harvard College. |