|

With Apple Campaign,

Activist Jana Partners Polishes Its Brand

The activist fund has traditionally focused its energy on share price

improvement and M&A. Now it has a social impact fund with a different

kind of campaign at the iPhone giant.

By

Ronald Orol

Jan 12,

2018 9:19 AM EST

Activist fund Jana Partners and a giant California public pension fund

launched a new kind of activist campaign over the weekend, joining

forces to urge Apple Inc. (AAPL)

to take action to curb smartphone addiction among children.

The campaign, which sets up a special impact fund for the campaign,

represented an unusual shift for the activist investment firm headed

by Barry Rosenstein, who typically targets corporations with efforts

seeking to improve their share price through operational changes or

M&A.

Jana and its partner, the California State Teachers' Retirement System, issued a

letter Saturday full of statistics and data about child overuse of iPhones and

their impact on sleep, depression, and risk of suicide. The effort should be

lauded. But is there a bigger picture beyond protecting children? Yes. The

investment will almost certainly help Rosenstein as he seeks capital allocations

from public pension funds for his traditional activist fund and its more

aggressive, less friendly agitations. For example, the campaign is likely to

help Jana maintain a strong relationship with CalSTRS, its partner in the Apple

effort.

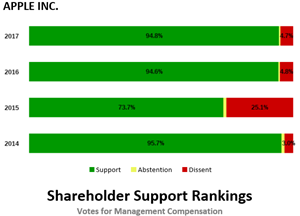

Also, it could help Jana Partners gain support for its campaigns in the form of

the votes of big institutional investors, whether they have the fund's back in

behind-the-scenes negotiations or public boardroom battles.

The campaign fits squarely within the category of environmental, social and

governance activism, or ESG, an investing category that sizeable public pension

funds such as CalSTRS as well as the primary index funds, including Vanguard

Group, State Street, and BlackRock, are concentrating on heavily.

Shane Goodwin, chief of the Columbia Law School shareholder activism research

project, suggests that the new Apple campaign indicates that Jana Partners is

motivated in part by seeking to get on the good side of index funds, who are

often the largest investors at corporations targeted by activists. "These index

funds are very focused on ESG for the 2018 proxy season," Goodwin said. "You

[activist] need the top three index funds if you are going to win your campaign.

Is Barry [Rosenstein] trying to rebrand himself as constructivist in the

boardroom?"

Gary Lutin, the founder of the Shareholder Forum, suggests that the Jana-CalSTRS

partnership and Apple effort is a very constructive development because it

demonstrates that a professionally managed activist hedge fund is focusing on

something that supports the foundations of fair business practices. "It is good

positioning both for Jana Partners' specialized purpose fund, and it is good for

their public image, anything they are doing," Lutin said.

The effort has already developed a lot of buzz, with news articles and TV

interviews on the subject, in large part because Rosenstein and Jana Partners

were included in the effort. Will other activists and pension funds join forces

with similar social campaigns in the future? Expect it, experts say.

Andrew Freedman, a partner at Olshan Frome Wolosky LLP in New York, argues that

the partnership goes a long way towards building goodwill between Jana and the

ESG-focused institutional investor community at the same time that it also

generates good PR and visibility for Jana. "It could also spearhead a trend

among the top tier activist investors to seek to wield their influence more

holistically on other fronts and issues at public companies," Freedman said.

Columbia's Goodwin agreed that the kind of collaboration exhibited by Jana

Partners and CalSTRS would be followed by other funds, though he said he didn't

know if other investors will employ similarly formal arrangements. "You are

going to see many others do this," Goodwin said. "Some of the well-known

activist funds have been privately doing things in the philanthropic arena in

part to get a halo effect around their name."

Even so, don't expect Rosenstein to launch a director-election proxy contest if

Apple doesn't respond

to the Jana Partners-CalSTRS demands. In fact, observers argue that one of the

reasons Rosenstein targeted Apple for the campaign is because there is a great

likelihood that the iPad and iPhone maker will respond in some way he can say

was a win for his campaign.

Columbia's Goodwin argued that Apple seeks to be a good corporate citizen, so

the smartphone maker makes for an easy target. "It's an easy win," Goodwin said.

"Going after some other corporations would require a bigger fight."

Next on the agenda? A pension fund-hedge fund partnership targeting Coca Cola's

impact on childhood obesity? Only time will tell.

© 1996-2018 TheStreet,

Inc. |