|

Equity Valuation

Hedge funds face ‘game over’ for buyout

strategy

Ruling in Dell case casts doubt

on popular tactic of seeking higher post-deal prices

|

Earlier this month,

the Delaware Supreme Court threw out an award stemming from the

2013 acquisition of Dell © Reuters

|

Sujeet Indap

december 28,

2017

A recent court ruling involving the

$24bn buyout of Dell could mean “game over” for hedge funds that have

profited from asking US judges to boost the prices of takeovers after

they have closed.

Hedge funds such as Merion Capital and

Magnetar have raised a total of more than $1bn from investors in

recent years to fund lawsuits in which they challenge the fairness of

the price paid to acquire public companies. These “appraisal” cases

seek to profit by convincing judges in Delaware, where most US

companies are incorporated, to give them a higher payout.

The funds initially scored a series of

high-profile wins, pushing up the buyout prices paid to dissenting

shareholders in deals involving Dell, Dole Foods and Cox Radio among

others.

But earlier this month, the Delaware

Supreme Court threw out an award stemming from the 2013 acquisition of

Dell, and ruled that the deal price should prevail when a sale process

is demonstrated to have been competitive.

That ruling and similar ones in recent

months are forcing appraisal-focused hedge funds to revisit their

approach. One long-time investor in this area told the Financial Times

that the Dell reversal means “game over” for the strategy. He said

that the initial Dell victory in 2016, among others, had made it too

easy to raise money for the strategy and that many funding sources

would now pull the plug.

However, other investors predicted the

strategy would survive as long as hedge funds became more selective

about picking their targets.

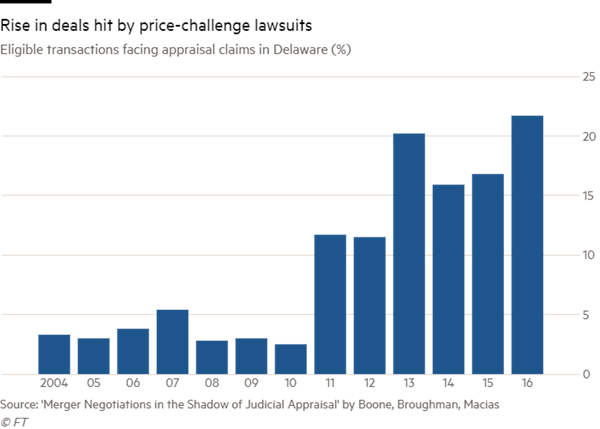

Up to now, the strategy has proved very

popular and lucrative. In 2016, one out of five eligible deals faced

a hedge fund lawsuit seeking a higher “fair value” price, up from less

than one in 20 a decade earlier.

While the hedge funds tended to win only

small awards in most of their cases — in the Dell matter, Silver Lake

and Michael Dell owed hedge funds led by Magnetar Capital roughly $20m

— in some appraisal cases, judges have granted awards in excess of

twice the deal price.

One recent study pegged the annualised returns of appraisal funds

at 33 per cent.

Such success also spawned bigger bets,

notably Merion Capital — created by shareholder attorney Andrew

Barroway — took a $600m stake in the grocer Safeway during the buyout

by rival Albertsons. The investment represented about 10 per cent of

the total deal price.

People familiar with that matter said

that Blackstone’s hedge fund unit had invested $200m in Merion’s $1bn+

fund.

Companies targeted by the appraisal

hedge funds pejoratively labelled their strategy “appraisal

arbitrage”. They pointed out that Merion and some of the others

typically acquired their shares in target companies after a

transaction had been announced with an express plan to challenge the

price in court.

The prevalence of the strategy also

spooked some potential buyers. By early 2016, bankers and lawyers were

noting that merger contracts were increasingly including “appraisal

out” clauses that gave purchasers the option to escape a deal if too

many shareholders challenged the price.

But the tide started to turn this year.

Judges in both the Delaware Court of Chancery and the Supreme Court

ruled against the appraisal funds in several cases, finding that the

merger price or even a lower price constituted fair value in the

acquisitions of such companies as Clearwire, Petsmart and DFC Global.

Now the Dell ruling has given buyers

very clear guidance on how to avoid being second guessed on the deal

price in the future, company advisers say.

In that case, Delaware vice-chancellor

Travis Laster had used his own models to determine that Dell’s fair

value per share was $17.62 rather than the $13.75 that Silver Lake

Partners and Michael Dell had paid. He ordered the buyers to

pay the difference.

But Delaware high court said earlier

this month that Mr Laster had inappropriately dismissed the extensive

sales process that Dell had undertaken.

“The recent Dell and DFC decisions

indicate that it will be difficult for hedge funds to do better than

market price where a deal had a strong sale process,” says Adam Gold,

an attorney at Ross Aronstam & Moritz, a Delaware law firm that

represents companies.

Appraisal investors and lawyers who work

with them agree that the ground has shifted. Some of them complain

that the Delaware judges have now become too deferential to companies

and too willing to accept deal purchase prices.

“If Delaware wants to gut appraisal to

be the most corporate-friendly jurisdiction in the world, that will

have consequences which include fewer shareholder protections and

lower valuations”, says Geoffrey Stern, who won an appraisal award

connected to DFC Global, only to have it overturned by the Supreme

Court.

But other investors who follow this

strategy say they believe it can still survive.

Matthew Giffuni, a longtime appraisal

investor at Quadre Investments, says the cases that have made it to

court tend to be the weaker ones because companies are quick to settle

the most compelling cases of undervaluation.

“Dissenters with strong facts have

gotten companies to settle for favourable outcomes prior to trial but

the public does not know the details,” he says. “Appraisal is not

going away. There will always be deals unfair to

shareholders.”

COMMENTS

|

LRosenthal |

December 29, 2017 |

The reporter left out

something very important that the court cited in their ruling. That

is, the presumption that markets are efficient should be taken as a

given. The importance of this is cited several times in the decision.

Unfortunately, the Delaware Court needs to catch up with the finance

profession. Indeed, the Nobel (pardon the incorrect use of words)

committee in economics has come to realize that there is no monolithic

view on efficient markets. As is well known, in 2013, there were two

awards - one to the most ardent believer in efficient markets (Fama)

and the other to someone who believes that efficient markets must be

leavened with the understanding that human behavior plays an important

role in markets (Shiller). In 2017, the most ardent proponent of the

role of human behavior in economics and finance (Thaler) with its

impact on markets as well gets a Nobel in economics. (It should be

noted that even Thaler is not an absolutist and does not say markets

are completely inefficient. He thinks that human behavior must be

understood as having an important important role in economics and

finance.

This writer thinks that the

Delaware Court can improve its decision making with regard to

appraisal if it better understands that an absolutist view of

efficient markets is no longer accepted as an explanation of how

markets operate. For the record, this writer is a long time finance

professor who teaches EMH as part of undergrad and grad investment

finance courses.

Copyright The Financial Times Limited 2017.

|