How to

find value amid a boom in U.S. housing stocks

Published: Dec 14, 2017 8:42 a.m.

ET

Shares of home

builders have run ahead of a strong stock market

|

Bloomberg

Contractors raise framed walls in San Jose, Calif. |

No

doubt you’ve seen or heard reports about a housing shortage in the

U.S. While this can make it difficult to buy a home, it can make you

plenty of money as an investor, as long as the trend continues.

Let’s take a broad look at dozens of housing-related stocks to find

value.

First, the big picture. This chart shows a very healthy market for

sellers of new homes in the past five years, after the housing-market

collapse and the 2008 financial crisis:

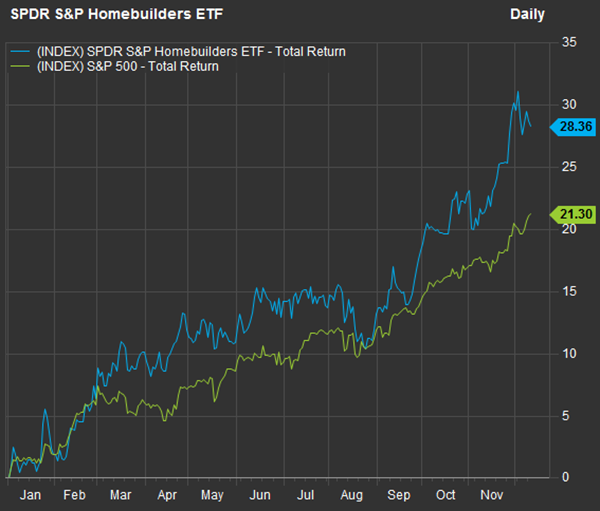

Here’s how the SPDR S&P Homebuilders ETF

XHB has performed this year through Dec. 12 against the S&P 500

Index

SPX:

|

FactSet

|

The

ETF tracks the S&P Homebuilders Select Industry Index, which includes

37 S&P 500 companies that build homes or provide related products or

services.

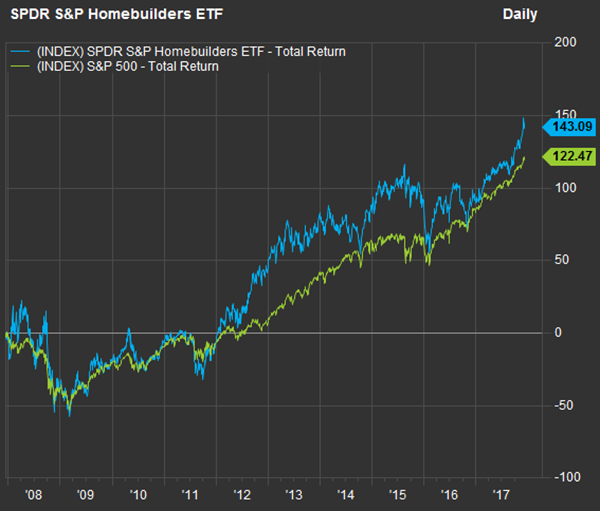

Here’s a 10-year chart comparing the total return of the ETF with the

S&P 500, through Dec. 12:

|

FactSet

|

Of

course, in December 2007, the housing-market collapse had already

started and the forward-looking stock market had already sent shares

of home builders and related companies plunging.

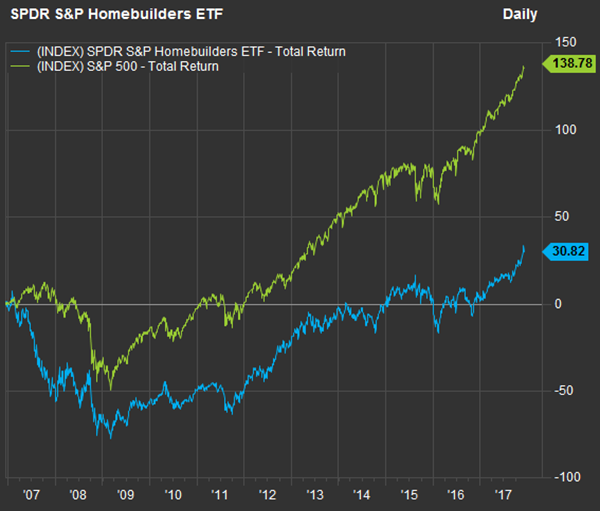

Looking instead at an 11-year chart, the story changes to show a

cyclical industry that can still perform very well over long periods:

|

FactSet

|

Other factors influence the housing market, of course, both nationally

and regionally. There’s no sign of a slowdown for the U.S. economy,

but

the Federal Reserve is slowly and steadily raising short-term rates.

Mortgage loan rates are still very low, but nobody knows how the

tax-reform legislation that may be passed and signed into law by

President Trump as early as next week might affect the housing market.

If

you believe in the long-term strength of U.S. housing and are looking

for a broad long-term investment, you might simply go with the SPDR

S&P Homebuilders ETF and its 36 holdings. Another option is the

iShares U.S. Home Construction ETF

ITB which tracks the Dow Jones U.S. Select Home Construction Index

and has 47 stock holdings. Even so, it is much more heavily

concentrated in stocks of the largest home builders.

The

iShares ETF’s five largest holdings are all home builders, and they

make up 45% of the fund. The fund has returned 54% through Dec. 12.

The SPDR ETF’s top five holdings are four home builders and Home Depot

(No. 5) that together comprise 25% of the fund. That fund has returned

28%, and the S&P 500 has returned 21% this year.

A short-term look at the components of XHB

We

focused our screens on the SPDR S&P Homebuilders ETF. Here are its

components, ranked by how much their sales for the past 12 reported

months (through Dec. 12) increased from the year-earlier 12-month

period:

|

Company

|

Ticker

|

Industry

|

Change in

sales per share - past 12 months from year-earlier 12-month period

|

Gross margin -

past 12 months

|

Gross margin -

year-earlier 12-month period

|

Total return -

2017 through Dec. 12

|

|

LGI Homes Inc. |

LGIH |

Homebuilding |

29% |

26.25% |

26.24% |

146% |

|

Installed

Building Products Inc. |

IBP |

Building Products |

29% |

27.01% |

27.81% |

69% |

|

PulteGroup Inc. |

PHM |

Homebuilding |

28% |

22.55% |

21.56% |

86% |

|

William Lyon

Homes Class A |

WLH |

Homebuilding |

24% |

17.28% |

17.99% |

48% |

|

Century

Communities Inc. |

CCS |

Homebuilding |

20% |

18.39% |

20.13% |

40% |

|

iRobot Corp. |

IRBT |

Electronics/

Appliances |

19% |

50.20% |

47.39% |

20% |

|

M.D.C. Holdings

Inc. |

MDC |

Homebuilding |

17% |

16.69% |

16.53% |

35% |

|

Toll Brothers

Inc. |

TOL |

Homebuilding |

17% |

21.60% |

19.84% |

53% |

|

Lowe’s Cos. |

LOW |

Home Improvement

chains |

16% |

32.16% |

32.26% |

22% |

|

Lennar Corp.

Class B |

LEN.B |

Homebuilding |

16% |

21.44% |

22.09% |

46% |

|

Lennar Corp.

Class A |

LEN |

Homebuilding |

16% |

21.44% |

22.09% |

46% |

|

D.R. Horton Inc. |

DHI |

Homebuilding |

15% |

21.63% |

21.84% |

85% |

|

Taylor Morrison

Home Corp. Class A |

TMHC |

Homebuilding |

14% |

18.70% |

19.39% |

21% |

|

Owens Corning |

OC |

Construction

Materials |

14% |

24.78% |

24.75% |

70% |

|

A.O. Smith Corp. |

AOS |

Building Products |

13% |

41.10% |

41.58% |

30% |

|

M/I Homes Inc. |

MHO |

Homebuilding |

12% |

20.96% |

22.47% |

36% |

|

Lennox

International Inc. |

LII |

Building Products |

11% |

29.33% |

29.23% |

36% |

|

Home Depot Inc. |

HD |

Home Improvement

Chains |

11% |

32.28% |

32.32% |

39% |

|

CalAtlantic Group

Inc. |

CAA |

Homebuilding |

11% |

21.24% |

22.04% |

62% |

|

TopBuild Corp. |

BLD |

Building Products |

10% |

24.02% |

23.17% |

83% |

|

NVR Inc. |

NVR |

Homebuilding |

10% |

19.47% |

19.43% |

102% |

|

Cavco Industries

Inc. |

CVCO |

Homebuilding |

10% |

22.39% |

22.20% |

40% |

|

Bed Bath & Beyond

Inc. |

BBBY |

Specialty Stores |

9% |

37.02% |

37.83% |

-42% |

|

Fortune Brands

Home & Security Inc. |

FBHS |

Building Products |

8% |

36.17% |

35.29% |

27% |

|

Allegion PLC |

ALLE |

Building Products |

7% |

43.85% |

43.93% |

29% |

|

Masco Corp. |

MAS |

Building Products |

7% |

34.11% |

32.96% |

35% |

|

Whirlpool Corp. |

WHR |

Electronics/

Appliances |

6% |

16.48% |

17.82% |

-6% |

|

Mohawk Industries

Inc. |

MHK |

Home Furnishings |

6% |

31.93% |

31.75% |

38% |

|

Williams-Sonoma

Inc. |

WSM |

Specialty Stores |

6% |

36.73% |

36.73% |

8% |

|

Leggett & Platt

Inc. |

LEG |

Home Furnishings |

4% |

22.20% |

24.14% |

-3% |

|

Helen of Troy

Ltd. |

HELE |

Electronics/

Appliances |

4% |

43.90% |

42.73% |

8% |

|

Aaron’s Inc. |

AAN |

Finance/ Rental/

Leasing |

3% |

47.03% |

47.45% |

13% |

|

Tempur Sealy

International Inc. |

TPX |

Home Furnishings |

2% |

41.72% |

41.72% |

-11% |

|

Johnson Controls

International PLC |

JCI |

Misc. Commercial

Services |

2% |

30.85% |

25.01% |

-5% |

|

Tri Pointe Group

Inc. |

TPH |

Homebuilding |

1% |

21.48% |

23.60% |

52% |

|

USG Corp. |

USG |

Construction

Materials |

-15% |

20.86% |

23.13% |

28% |

|

Source: FactSet |

You

can click the tickers for more information on each company, including

news, price ratios, financials and filings.

We

are showing sales per share, rather than raw revenue, because the

per-share figures incorporate any dilution from the issuance of new

shares for any reason (including to pay for acquisitions) as well as

any decline in the share count brought about by stock buybacks.

A

company’s gross profit margin is sales, less the cost of goods or

services sold, divided by sales. It is a measure of profitability for

the core business and reflects pricing power. A declining margin might

mean that a company has been forced to offer more discounts to defend

its market share or to increase sales.

Here’s the list again, in the same order, with summaries of the

opinions of sell-side analysts polled by FactSet:

|

Company

|

Ticker

|

Share ‘buy’

ratings

|

Share neutral

ratings

|

Share ‘sell’

ratings

|

Closing price

- Dec. 12

|

Consensus

price target |

implied

12-month upside potential

|

|

LGI Homes Inc. |

LGIH |

33% |

67% |

0% |

$70.73 |

$65.60 |

-7% |

|

Installed

Building Products Inc. |

IBP |

75% |

25% |

0% |

$69.80 |

$73.86 |

6% |

|

PulteGroup Inc. |

PHM |

36% |

59% |

5% |

$33.69 |

$30.97 |

-8% |

|

William Lyon

Homes Class A |

WLH |

40% |

60% |

0% |

$28.25 |

$30.88 |

8% |

|

Century

Communities Inc. |

CCS |

100% |

0% |

0% |

$29.50 |

$33.80 |

15% |

|

iRobot Corp. |

IRBT |

22% |

67% |

11% |

$70.40 |

$72.60 |

3% |

|

M.D.C. Holdings

Inc. |

MDC |

0% |

64% |

36% |

$31.17 |

$28.39 |

-9% |

|

Toll Brothers

Inc. |

TOL |

48% |

48% |

4% |

$47.09 |

$48.86 |

4% |

|

Lowe’s Cos. |

LOW |

53% |

44% |

3% |

$84.99 |

$88.10 |

4% |

|

Lennar Corp.

Class B |

LEN.B |

52% |

48% |

0% |

$49.29 |

$61.54 |

25% |

|

Lennar Corp.

Class A |

LEN |

52% |

48% |

0% |

$61.43 |

$61.54 |

0% |

|

D.R. Horton Inc. |

DHI |

52% |

48% |

0% |

$50.00 |

$49.05 |

-2% |

|

Taylor Morrison

Home Corp. Class A |

TMHC |

8% |

92% |

0% |

$23.35 |

$24.75 |

6% |

|

Owens Corning |

OC |

64% |

36% |

0% |

$86.98 |

$90.35 |

4% |

|

A.O. Smith Corp. |

AOS |

43% |

57% |

0% |

$61.06 |

$64.29 |

5% |

|

M/I Homes Inc. |

MHO |

100% |

0% |

0% |

$34.26 |

$36.50 |

7% |

|

Lennox

International Inc. |

LII |

24% |

76% |

0% |

$206.68 |

$193.33 |

-6% |

|

Home Depot Inc. |

HD |

71% |

29% |

0% |

$181.80 |

$188.09 |

3% |

|

CalAtlantic Group

Inc. |

CAA |

7% |

93% |

0% |

$54.75 |

$49.05 |

-10% |

|

TopBuild Corp. |

BLD |

71% |

29% |

0% |

$65.24 |

$73.14 |

12% |

|

NVR Inc. |

NVR |

11% |

78% |

11% |

$3,368.97 |

$3,231.00 |

-4% |

|

Cavco Industries

Inc. |

CVCO |

100% |

0% |

0% |

$140.00 |

$164.00 |

17% |

|

Bed Bath & Beyond

Inc. |

BBBY |

4% |

71% |

25% |

$23.18 |

$22.83 |

-1% |

|

Fortune Brands

Home & Security Inc. |

FBHS |

50% |

50% |

0% |

$67.23 |

$71.21 |

6% |

|

Allegion PLC |

ALLE |

55% |

45% |

0% |

$82.15 |

$89.78 |

9% |

|

Masco Corp. |

MAS |

68% |

32% |

0% |

$42.19 |

$44.63 |

6% |

|

Whirlpool Corp. |

WHR |

36% |

64% |

0% |

$166.51 |

$187.13 |

12% |

|

Mohawk Industries

Inc. |

MHK |

78% |

22% |

0% |

$275.34 |

$294.84 |

7% |

|

Williams-Sonoma

Inc. |

WSM |

14% |

64% |

22% |

$50.90 |

$49.57 |

-3% |

|

Leggett & Platt

Inc. |

LEG |

44% |

56% |

0% |

$46.33 |

$54.86 |

18% |

|

Helen of Troy

Ltd. |

HELE |

60% |

20% |

20% |

$90.90 |

$104.25 |

15% |

|

Aaron’s Inc. |

AAN |

82% |

18% |

0% |

$36.02 |

$47.14 |

31% |

|

Tempur Sealy

International Inc. |

TPX |

36% |

55% |

9% |

$61.00 |

$66.14 |

8% |

|

Johnson Controls

International PLC |

JCI |

37% |

58% |

5% |

$38.25 |

$44.29 |

16% |

|

Tri Pointe Group

Inc. |

TPH |

58% |

42% |

0% |

$17.42 |

$17.95 |

3% |

|

USG Corp. |

USG |

10% |

76% |

14% |

$36.92 |

$33.71 |

-9% |

|

Source: FactSet |

While there are majority “buy” or equivalent ratings for 18 out of the

ETF’s 36 components, the analysts’ price targets for most of them

aren’t particularly aggressive.

A longer-term look

The

first table showed sales per share and gross margin. It’s good if both

are going up, of course, but these figures don’t incorporate other

expenses or other problems companies face.

There’s a new tool that you can use to make useful comparisons of

companies to their industry competitors. It’s called return on

corporate capital (ROCC) and was recently developed by the Shareholder

Forum to help individual investors screen companies for quality.

The

calculation is similar to return on invested capital (ROIC), but there

are some differences. There’s no strict definition for ROIC. ROCC is

calculated the same way for every company that’s publicly traded in

the U.S., using annual data filed with the Securities and Exchange

Commission: Net income plus interest expense and income taxes, divided

by the ending balance of total assets less current liabilities other

than interest-bearing debt.

The

idea is to measure how good a company’s management is at investing the

money it raises or borrows. Each company’s ROCC is compared to its

industry competitors, based on the company’s Standard Industrial

Classification (SIC), which also comes from SEC filings. In other

words, the subject company’s numbers are excluded from those of its

industry SIC group when the comparison is made. The comparisons are

available here for free.

ROCC

comparisons are most meaningful within industries. Banks, for example,

tend to have lower ROCC than many other industries because it is their

business to leverage capital by gathering deposits and borrowing

money.

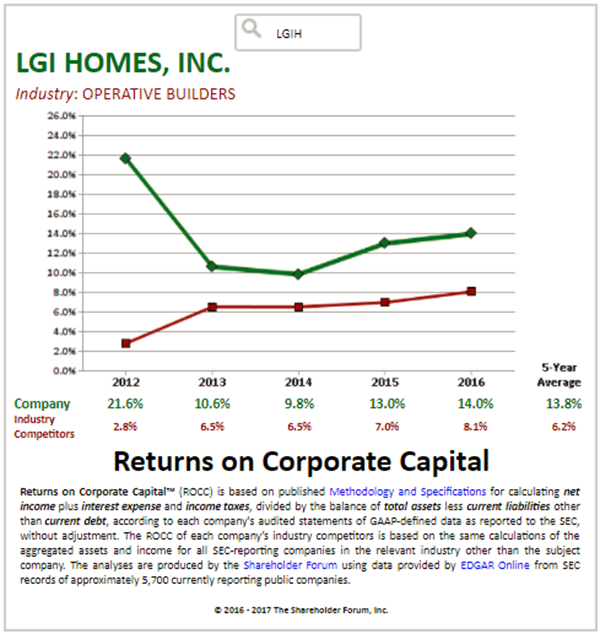

Here’s a sample comparison of LGI Homes Inc.

LGIH to its SIC industry group:

|

The Shareholder Forum

|

You

can see that the company’s average ROCC for five years has been well

above that of its industry competitors, and that the numbers have been

sloping upward over the past two years.

Here

are the components of the SPDR S&P Homebuilders ETF again, in the same

order, with average ROCC comparisons to their industry groups.

|

Company

|

Ticker

|

Five-year

average ROCC

|

Five-year

average ROCC for SIC group

|

SIC group

|

|

LGI Homes Inc. |

LGIH |

13.8% |

6.2% |

Operative

Builders |

|

Installed

Building Products Inc. |

IBP |

11.8% |

7.4% |

General Building

Contractors - Residential Buildings |

|

PulteGroup Inc. |

PHM |

7.0% |

6.1% |

Operative

Builders |

|

William Lyon

Homes Class A |

WLH |

4.4% |

6.3% |

Operative

Builders |

|

Century

Communities Inc. |

CCS |

6.8% |

7.1% |

Operative

Builders |

|

iRobot Corp. |

IRBT |

12.5% |

10.4% |

Household

Appliances |

|

M.D.C. Holdings

Inc. |

MDC |

4.6% |

6.3% |

Operative

Builders |

|

Toll Brothers

Inc. |

TOL |

4.7% |

6.4% |

Operative

Builders |

|

Lowe’s Cos. |

LOW |

15.5% |

29.2% |

Retail - Lumber

and Other Materials Dealers |

|

Lennar Corp.

Class B |

LEN.B |

7.0% |

9.1% |

General Building

Contractors - Residential Buildings |

|

Lennar Corp.

Class A |

LEN |

7.0% |

9.1% |

General Building

Contractors - Residential Buildings |

|

D.R. Horton Inc. |

DHI |

11.1% |

5.2% |

Operative

Builders |

|

Taylor Morrison

Home Corp. Class A |

TMHC |

0.3% |

6.6% |

Operative

Builders |

|

Owens Corning |

OC |

6.1% |

0.7% |

Abrasive Asbestos

and Misc. Nonmetallic Mineral Products |

|

A.O. Smith Corp. |

AOS |

16.9% |

9.5% |

Household

Appliances |

|

M/I Homes Inc. |

MHO |

6.0% |

6.2% |

Operative

Builders |

|

Lennox

International Inc. |

LII |

27.1% |

18.9% |

Air Conditioning

and Warm Air Heating Equipment and Commercial and Industrial

Refrigeration Equipment |

|

Home Depot Inc. |

HD |

31.0% |

14.6% |

Retail - Lumber

and Other Materials Dealers |

|

CalAtlantic Group

Inc. |

CAA |

6.1% |

6.2% |

Operative

Builders |

|

TopBuild Corp. |

BLD |

6.1% |

3.1% |

Construction

Special Trade Contractors |

|

NVR Inc. |

NVR |

19.9% |

5.6% |

Operative

builders |

|

Cavco Industries

Inc. |

CVCO |

8.3% |

N/A |

Mobile Homes |

|

Bed Bath & Beyond

Inc. |

BBBY |

32.8% |

19.0% |

Retail - Home

Furniture, Furnishing and Equipment Stores |

|

Fortune Brands

Home & Security Inc. |

FBHS |

10.0% |

6.7% |

General Building

Contractors - Residential Buildings |

|

Allegion PLC |

ALLE |

17.9% |

-34.4% |

Detective, Guard

and Armored Car Services |

|

Masco Corp. |

MAS |

15.4% |

4.8% |

Millwood, Veneer,

Plywood and Structural Wood Members |

|

Whirlpool Corp. |

WHR |

9.5% |

14.5% |

Household

Appliances |

|

Mohawk Industries

Inc. |

MHK |

9.7% |

N/A |

Carpets and Rugs |

|

Williams-Sonoma

Inc. |

WSM |

30.4% |

26.5% |

Retail - Home

Furniture, Furnishing and Equipment Stores |

|

Leggett & Platt

Inc. |

LEG |

15.8% |

14.6% |

Household

Furniture |

|

Helen of Troy

Ltd. |

HELE |

10.3% |

N/A |

Electric

Housewares and Fans |

|

Aaron’s Inc. |

AAN |

13.8% |

7.2% |

Services -

Equipment Rental and Leasing |

|

Tempur Sealy

International Inc. |

TPX |

15.2% |

15.1% |

Household

Furniture |

|

Johnson Controls

International PLC |

JCI |

11.4% |

8.4% |

Misc. Business

Services |

|

Tri Pointe Group

Inc. |

TPH |

11.4% |

6.3% |

Operative

Builders |

|

USG Corp. |

USG |

9.5% |

5.8% |

Concrete, Gypsum

and Plaster Products |

|

Source: The

Shareholder Forum |

If

fewer than five years of data is available for a company, the average

ROCC used for the comparisons in the table is for the number of full

years of data available. If there is no average ROCC number available

for a company’s competitors, it means there are fewer than four other

publicly traded companies within that SIC group.

You

can review more detailed ROCC data for each company

here.

|

|

Philip

van Doorn |

|

Philip van Doorn covers various investment and industry topics.

He has previously worked as a senior analyst at TheStreet.com.

He also has experience in community banking and as a credit

analyst at the Federal Home Loan Bank of New York. |

|

Copyright ©2017 MarketWatch, Inc. |