Opinion:

Here’s a better way to screen for dividend stocks so you don’t get

burned

Published: Nov 28, 2017 4:06 a.m. ET

A dividend cut is an

income investor’s worst nightmare

|

Bloomberg News

Seagate Technology has reported plenty of free cash flow to

support a higher dividend payout. |

As

U.S. equity markets hit record highs, stocks with high dividend yields

remain popular, despite the Federal Reserve’s inclination to raise

official interest rates.

There are several ways to screen dividend-paying companies, and we’ll

share two of them here, while listing the 35 highest-yielding stocks

in the S&P 500 Index

SPX.

Dreading dividend

cuts

One

of the riskiest aspects of dividend stocks is the prospect of a

dividend cut. If investors expect the dividend to decline, the stock

price is almost certain to plunge, which will push the yield higher

until the cut is announced.

S&P

Dow Jones Indices maintains a list of roughly 50

S&P 500 Dividend Aristocrats,

which are companies included in that benchmark index that have

increased their regular dividend payments for at least 25 consecutive

years. However, many Dividend Aristocrat stocks have low yields.

Any

analysis of a company’s financial performance is backward looking, so

there can never be a guarantee that you won’t suffer a dividend cut.

However, we can present data that will provide comfort or at least

some warnings.

ROCC

Using data provided by FactSet, we looked at the 35 S&P 500

SPX stocks

with the highest dividend yields. We’re going to list them twice

(three times for real estate investment trusts).

First, we will show how the companies have performed against industry

competitors, as measured by their returns on corporate capital (ROCC).

ROCC

was recently developed by the Shareholder Forum. The calculation is

similar to return on invested capital (ROIC), but there are some

differences. Definitions of ROIC vary. ROCC is calculated the same way

for every company that’s publicly traded in the U.S., using annual

data filed with the Securities and Exchange Commission: Net income

plus interest expense and income taxes, divided by the ending balance

of total assets less total liabilities other than interest-bearing

debt.

The

idea is to measure how good a company’s management is at investing the

money it raises or borrows. Each company’s ROCC is compared to its

industry competitors, based on the company’s Standard Industrial

Classification (SIC), which also comes from SEC filings. Those

comparisons are available for free

here.

So a

company’s ROCC is not simply compared to the average ROCC for its SIC

group. Instead, a calculation is made for the aggregated assets and

income data for the entire SIC group, excluding for the subject

company. This means that the industry ROCCs for two companies in

the same group may be different.

ROCC

is most meaningful within industries. Banks, for example, tend to have

lower ROCC than many other industries because it is their business to

leverage capital by gathering deposits and borrowing money.

You

can get quite a bit of insight if you compare a company’s ROCC to its

industry competitors. For example, the five-year ROCC trend for Altria

Group Inc.

MO is

up, while the trend for its competitors in the cigarettes SIC group is

down:

|

The

Shareholder Forum |

If

the ROCC trend curve for a company you are interested in is heading

south, something may be very wrong, and you had better do additional

research to find out what is going on.

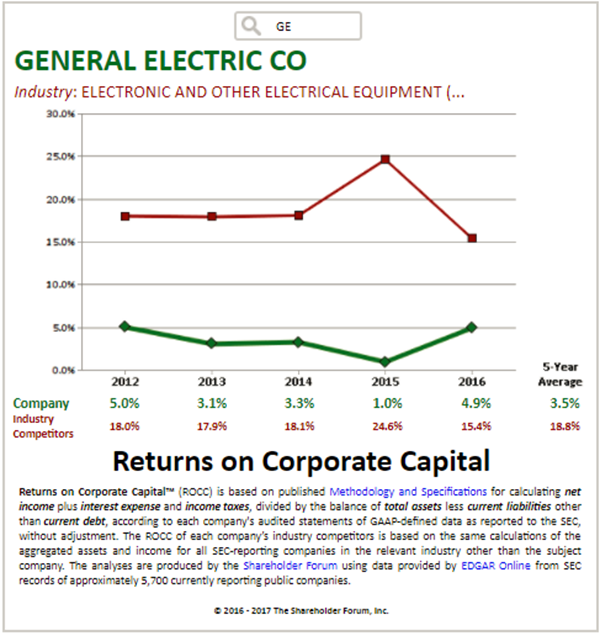

On

Nov. 13, General Electric Co.

GE said

it would cut its dividend in half.

That was not a surprise for investors, as company CEO John Flannery

had said the dividend policy was under review as part of an effort to

shore up cash.

Check out GE’s ROCC trend against that of its industry group:

|

The

Shareholder Forum |

The

ROCC indicated that GE’s management just wasn’t getting it done.

Here

are the 35 S&P 500 stocks with the highest yields, with five-year

average ROCC comparisons and indications of whether the companies have

cut their dividend payments at any time over the past five or 10

years:

|

Company

|

Ticker

|

Dividend

yield - Nov. 24

|

SIC group

|

Average ROCC

|

Average ROCC

for industry competitors

|

Dividend cut

over past five years?

|

Dividend cut

over past 10 years?

|

|

CenturyLink

Inc. |

CTL |

15.61% |

Telephone

Communications (No Radio Telephone) |

5.0% |

7.3% |

Yes |

Yes |

|

Macy’s Inc. |

M |

7.17% |

Retail -

Department Stores |

15.3% |

2.2% |

No |

Yes |

|

Seagate

Technology PLC |

STX |

6.25% |

Computer

Storage Devices |

27.8% |

9.9% |

No |

Yes |

|

Kimco Realty

Corp. |

KIM |

5.96% |

Real Estate

Investment Trusts |

7.3% |

3.9% |

No |

Yes |

|

Scana Corp. |

SCG |

5.85% |

Electric and

Other Services Combined |

7.4% |

5.0% |

No |

No |

|

Oneok Inc. |

OKE |

5.84% |

Natural Gas

Transmission and Distribution |

5.7% |

6.7% |

No |

No |

|

Iron Mountain

Inc. |

IRM |

5.67% |

Real Estate

Investment Trusts |

7.6% |

3.9% |

No |

No |

|

AT&T Inc. |

T |

5.63% |

Telephone

Communications (No Radio Telephone) |

7.4% |

6.3% |

No |

No |

|

HCP Inc. |

HCP |

5.51% |

Real Estate

Investment Trusts |

7.7% |

3.9% |

Yes |

Yes |

|

Navient Corp. |

NAVI |

5.19% |

Security

Brokers, Dealers & Floatation Companies |

1.1% |

1.1% |

No |

No |

|

Welltower Inc. |

HCN |

5.10% |

Real Estate

Investment Trusts |

4.1% |

4.0% |

No |

No |

|

Verizon

Communications Inc. |

VZ |

5.02% |

Telephone

Communications (No Radio Telephone) |

8.9% |

5.8% |

No |

No |

|

Helmerich &

Payne Inc. |

HP |

5.00% |

Drilling Oil

and Gas Wells |

12.6% |

1.5% |

No |

No |

|

L Brands Inc. |

LB |

4.96% |

Retail -

Women’s Clothing Stores |

33.4% |

11.1% |

No |

No |

|

Ford Motor Co. |

F |

4.96% |

Motor Vehicles

and Passenger Car Bodies |

4.8% |

0.6% |

No |

No |

|

Kohl’s Corp. |

KSS |

4.88% |

Retail -

Department Stores |

15.4% |

3.6% |

No |

No |

|

Ventas Inc. |

VTR |

4.79% |

Real Estate

Investment Trusts |

5.4% |

3.9% |

Yes |

Yes |

|

Macerich Co. |

MAC |

4.61% |

Real Estate

Investment Trusts |

7.6% |

3.9% |

No |

Yes |

|

Simon Property

Group Inc. |

SPG |

4.53% |

Real Estate

Investment Trusts |

8.1% |

3.9% |

No |

Yes |

|

Southern Co. |

SO |

4.51% |

Electric

Services |

6.0% |

4.8% |

No |

No |

|

Realty Income

Corp. |

O |

4.51% |

Real Estate

Investment Trusts |

4.5% |

4.0% |

No |

No |

|

Occidental

Petroleum Corp. |

OXY |

4.50% |

Crude Petroleum

& Natural Gas |

1.3% |

-5.8% |

No |

No |

|

AES Corp. |

AES |

4.49% |

Cogeneration

Services and Small Power Producers |

4.8% |

N/A |

No |

No |

|

Target Corp. |

TGT |

4.44% |

Retail -

Variety Stores |

12.8% |

18.4% |

No |

No |

|

PPL Corp. |

PPL |

4.35% |

Electric

Services |

7.1% |

4.8% |

No |

No |

|

Williams Cos. |

WMB |

4.28% |

Natural Gas

Transmission |

4.6% |

4.2% |

Yes |

Yes |

|

FirstEnergy

Corp. |

FE |

4.24% |

Electric

Services |

-1.2% |

5.2% |

Yes |

Yes |

|

Entergy Corp. |

ETR |

4.17% |

Electric

Services |

2.1% |

5.0% |

No |

No |

|

Philip Morris

International Inc. |

PM |

4.15% |

Cigarettes |

50.1% |

35.2% |

No |

No |

|

Host Hotels &

Resorts Inc. |

HST |

4.04% |

Real Estate

Investment Trusts |

6.6% |

3.9% |

No |

Yes |

|

Altria Group

Inc. |

MO |

4.03% |

Cigarettes |

36.2% |

48.3% |

No |

Yes |

|

Duke Energy

Corp. |

DUK |

4.01% |

Electric and

Other Services Combined |

4.3% |

5.2% |

No |

No |

|

International

Business Machines Corp. |

IBM |

3.95% |

Computer and

Office Equipment |

20.6% |

4.0% |

No |

No |

|

PG&E Corp. |

PCG |

3.92% |

Electric and

Other Services Combined |

3.7% |

5.2% |

No |

No |

|

Interpublic

Group of Cos. |

IPG |

3.84% |

Services -

Advertising Agencies |

14.3% |

13.0% |

No |

No |

|

Sources:

FactSet, Shareholder Forum |

Note: We’re indicating whether a company has cut its dividend over the

past five or 10 years. However, but this does not mean a company

didn’t initiate a regular dividend payout during either of

these periods.

CenturyLink

CTL is

the highest-yielding S&P 500 stock. A yield of 15.61% makes it very

clear that many investors expect the company to cut its dividend. The

company last cut its dividend on Feb. 13, 2013, when it announced

a 26% reduction in the regular payout on

the same day it unveiled a $2 billion buyback. That was

quite a smack in the face for investors who were relying on the

dividend income. The stock dropped 23% the following day.

During the company’s most recent earnings conference call with

analysts on Nov. 8, CenturyLink CEO Glen Post said: “We realize the

dividend is an attractive part of our shareholder return, and we are

confident we can continue to pay the dividend while investing in

growth and in our network and as we de-lever our balance sheet.”

A

dividend cut that happened many years ago may not indicate that a

company’s current payout is threatened. An example is Altria, which

cut its dividend in 2008 after Kraft and Philip Morris International

Inc. were spun off, so that shareholders of the former parent and

spun-off companies would initially receive the same aggregate payouts.

A

shorter-term approach: free cash flow yield

Leaving long-term performance aside, a company’s free cash flow yield

can indicate whether it can comfortably continue to pay its current

dividend or raise the dividend. Free cash flow is remaining cash flow

after planned capital expenditures. It is money that can be used to

raise the dividend, repurchase shares, expand through acquisitions,

reinvest in plants and equipment, or do other things to grow the

business organically.

We

can calculate a company’s free cash flow yield by dividing its free

cash flow per share over the past 12 months by the current share

price. If we then compare the free cash flow yield to the current

dividend yield, we can see if the company has “headroom” to increase

the dividend.

If

we look again at GE, we can see that as of the market close on Nov.

10, before the dividend cut was announced, the dividend yield was

4.69%. The company’s free cash flow yield over the previous 12 months

was minus 1.27%. Its free cash flow per share was negative

during three of the past four reported quarters.

If a

company’s 12-month free cash flow yield is lower than its dividend

yield, it does not necessarily mean a dividend cut is coming. The

company may have made an important acquisition using a lot of cash,

skewing the results for a year. Or there could be other good reasons

for a temporary reduction in cash flow. But you had better find out.

For

real estate investment trusts, a non-GAAP measure called funds from

operations (FFO) is typically used by investors to gauge

dividend-paying ability. FFO adds depreciation and amortization back

to earnings, while subtracting gains on property sales. In the next

table, we will show the same group of highest-yielding S&P 500 stocks

with free cash flow yields based on GAAP. This will be followed by an

FFO yield table for the REITs.

Here

are free cash flow yield comparisons for the 35 highest-yielding S&P

500 stocks:

|

Company

|

Ticker

|

Dividend

yield - Nov. 24

|

Free cash

flow yield - past 12 reported months |

‘Headroom’

|

|

CenturyLink

Inc. |

CTL |

15.61% |

6.16% |

-9.45% |

|

Macy’s Inc. |

M |

7.17% |

21.34% |

14.17% |

|

Seagate

Technology PLC |

STX |

6.25% |

9.72% |

3.47% |

|

Kimco Realty

Corp. (REIT) |

KIM |

5.96% |

3.93% |

-2.03% |

|

Scana Corp. |

SCG |

5.85% |

-2.61% |

N/A |

|

Oneok Inc. |

OKE |

5.84% |

5.05% |

-0.79% |

|

Iron Mountain

Inc. (REIT) |

IRM |

5.67% |

2.85% |

-2.82% |

|

AT&T Inc. |

T |

5.63% |

7.66% |

2.03% |

|

HCP Inc. (REIT) |

HCP |

5.51% |

6.11% |

0.60% |

|

Navient Corp. |

NAVI |

5.19% |

33.92% |

28.73% |

|

Welltower Inc.

(REIT) |

HCN |

5.10% |

3.00% |

-2.10% |

|

Verizon

Communications Inc. |

VZ |

5.02% |

2.79% |

-2.23% |

|

Helmerich &

Payne Inc. |

HP |

5.00% |

-0.67% |

N/A |

|

L Brands Inc. |

LB |

4.96% |

6.06% |

1.10% |

|

Ford Motor Co. |

F |

4.96% |

22.19% |

17.23% |

|

Kohl’s Corp. |

KSS |

4.88% |

13.53% |

8.65% |

|

Ventas Inc. (REIT) |

VTR |

4.79% |

6.02% |

1.23% |

|

Macerich Co. (REIT) |

MAC |

4.61% |

4.96% |

0.35% |

|

Simon Property

Group Inc. (REIT) |

SPG |

4.53% |

6.60% |

2.07% |

|

Southern Co. |

SO |

4.51% |

-3.30% |

N/A |

|

Realty Income

Corp. (REIT) |

O |

4.51% |

5.43% |

0.92% |

|

Occidental

Petroleum Corp. |

OXY |

4.50% |

2.25% |

-2.25% |

|

AES Corp. |

AES |

4.49% |

3.23% |

-1.26% |

|

Target Corp. |

TGT |

4.44% |

15.13% |

10.69% |

|

PPL Corp. |

PPL |

4.35% |

-2.34% |

N/A |

|

Williams Cos. |

WMB |

4.28% |

7.49% |

3.21% |

|

FirstEnergy

Corp. |

FE |

4.24% |

5.51% |

1.27% |

|

Entergy Corp. |

ETR |

4.17% |

-8.57% |

N/A |

|

Philip Morris

International Inc. |

PM |

4.15% |

4.18% |

0.03% |

|

Host Hotels &

Resorts Inc. (REIT) |

HST |

4.04% |

6.34% |

2.30% |

|

Altria Group

Inc. |

MO |

4.03% |

3.38% |

-0.65% |

|

Duke Energy

Corp. |

DUK |

4.01% |

-3.67% |

N/A |

|

International

Business Machines Corp. |

IBM |

3.95% |

8.05% |

4.10% |

|

PG&E Corp. |

PCG |

3.92% |

1.36% |

-2.56% |

|

Interpublic

Group of Cos. |

IPG |

3.84% |

2.88% |

-0.96% |

|

Sources:

FactSet, Shareholder Forum |

Note: For L Brands Inc.

LB free

cash flow figures for the quarter ended Oct. 28 are not yet available,

so the free cash flow yield calculation is for the four quarters ended

July 29.

Here

are the REITs with FFO yield comparisons, as explained above the

previous table:

|

Company

|

Ticker

|

Dividend

yield - Nov. 24

|

FFO yield -

past 12 reported months |

‘Headroom’

|

|

Kimco Realty

Corp. |

KIM |

5.96% |

8.24% |

2.28% |

|

Iron Mountain

Inc. |

IRM |

5.67% |

5.02% |

-0.65% |

|

HCP Inc. |

HCP |

5.51% |

7.66% |

2.15% |

|

Welltower Inc. |

HCN |

5.10% |

6.28% |

1.18% |

|

Ventas Inc. |

VTR |

4.79% |

6.43% |

1.64% |

|

Macerich Co. |

MAC |

4.61% |

6.19% |

1.58% |

|

Simon Property

Group Inc. |

SPG |

4.53% |

6.73% |

2.20% |

|

Realty Income

Corp. |

O |

4.51% |

5.32% |

0.81% |

|

Host Hotels &

Resorts Inc. |

HST |

4.04% |

8.43% |

4.39% |

|

Sources:

FactSet, Shareholder Forum |

No

screening method for stocks can be perfect. But long-term and

short-term information, combined with your own research and opinion

about a company’s products and business strategy, can help you pick

solid stocks for income.

|

|

Philip

van Doorn |

|

Philip van Doorn covers various investment and industry topics.

He has previously worked as a senior analyst at TheStreet.com.

He also has experience in community banking and as a credit

analyst at the Federal Home Loan Bank of New York. |

|

Copyright ©2017 MarketWatch, Inc. |