Weighing the Virtual-Only Shareholder Meeting

The perils

of ditching face-to-face gatherings

By Eve Tahmincioglu

Duke Energy will hold its annual shareholder meeting virtually on May 4,

abandoning its long-standing in-person gathering.

"The live webcast will greatly increase our shareholders' access to the

meeting, making it easy and inexpensive for them to participate," said

Steve Young, Duke Energy executive vice president and chief financial

officer, in a statement announcing the move last month.

The virtual-only meeting decision, however, didn’t make all shareholders

happy with many voicing their concerns.

“It’s a deflection,” said Jim Warren, executive director of NC WARN, a

Durham nonprofit and Duke shareholder that has been highly critical of the

electric utility’s practices, according to

a recent story in the

Charlotte Observer.

Duke Energy and a growing number of corporations are moving to the

virtual-only shareholder model in order to reach more shareholders and to

save money. And some believe its time may have come.

“The annual general meeting, in my humble view, is an exercise in ritual,”

says Michael Useem, management professor and director for the Center for

Leadership and Change Management at Wharton School, University of

Pennsylvania . “The number of people, the faction of investors that come

to these is just tiny.”

Regarding concerns by some shareholders that executives and board members

are just trying to dodge angry investors and tough questions, he says,

“there may be something hidden, but so little genuine content comes out

of in-person meeting, it’s not clear to me what will be kept from the

clear light of day.”

That may be the thinking among a growing number of companies.

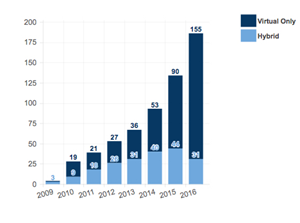

According to research from Broadbridge 155 public companies opted for

virtual-only meetings last year, a steady increase that began in 2010.

“Although our technology service was provided in just 3% of shareholder

meetings last year, the technology has become more accepted and adoption

is on the rise,” says Cathy Conlon, Vice President of Corporate Issuer

Product and Strategy at Broadridge. “Greater numbers of companies and

shareholders welcome the greater conveniences, cost savings, and enhanced

communications features of virtual shareholder meetings.”

Even though there’s been a precipitous increase, the majority of

corporations still opt for the in-person and hybrid models. “It’s not a

tsunami,” explains Ron Schneider, Director of Corporate Governance at

Donnelley Financial Solutions.

He adds there’s a growing movement to derail the growth.

Indeed, earlier this month, New York City Comptroller Scott M. Stringer

sent a letter to more than a dozen S&P 500 companies denouncing the rapid

rise of the virtual-only meeting, saying he would “recommend that the New

York City Pension Funds adopt a policy to vote against directors at

companies that continue to hold ‘virtual-only’ meetings.”

So what should companies do? “Like almost anything there’s unintended

consequences,” says Schneider. “It’s not a one size fits all.”

Companies are well aware that there will be some investors who’ll object

to doing away with face-to-face meetings and that it could bring negative

media attention, he says.

Schneider offers some things to keep in mind before going virtual:

-

Consider the financial cost

benefit. You could downgrade your in-person meeting, offering less food

or giveaways, for example; or hold it at a company facility, saving the

cost of renting a space.

-

Think about your ownership

base. If you’re a target of known activists, or if there’s a shareholder

proposal and they want to come to the meeting and share the proposal,

understand there will be some negative pushback from those investors,

publicized through social media. You may get dinged on the vote.

-

Context matters. If

performance is fine and there are no controversies brewing that might be

one environment to consider bypassing an in-person meeting.

-

If the perception is that a

company is trying to muzzle or limit the ability of investors at the

meeting to make their views heard, management has to consider whether

that perception is worth it.

| © 2017

Directors & Boards. All rights reserved. |

|