Business Day

Hedge Fund Titan’s

Surefire Bet Turns Into a $4 Billion Loss

By

GRETCHEN

MORGENSON

and

GERALDINE FABRIKANT MARCH

19, 2017

|

William A. Ackman in 2015. Last

week, he and his investors in funds run by Pershing Square

Capital Management swallowed a $4 billion loss on Valeant

Pharmaceuticals International.

Axel Dupeux/Redux Pictures |

A little over two years ago, William A.

Ackman, one of Wall Street’s brashest and most self-assured hedge fund

managers, was on top of the world. A billionaire before he hit 50, he

was generating double-digit gains for his investors and raking in

hundreds of millions in fees for his firm and himself.

Hailed as a master investor, he clinched

his highflier status in the fall of 2014 by paying $90 million with

some friends to buy the penthouse at One57, a 13,500-square-foot aerie

in Midtown Manhattan overlooking Central Park. He didn’t plan to live

there — it was an investment property — but until he sold it, the

apartment would make a good party space, he told

The New York Times.

If

Mr. Ackman were a stock, that might have been his peak.

Today, things are very different for him. His company’s performance is way down,

he is in the midst of an expensive divorce, and on March 13, he and investors in

funds run by Pershing Square Capital Management swallowed a $4 billion loss on

Valeant Pharmaceuticals International, a beleaguered drug company.

As

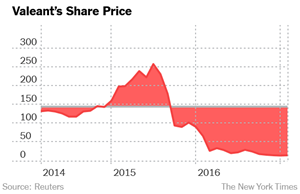

bad bets go, it was one for the record books. Valeant was a big Pershing Square

holding. In May 2015, Mr. Ackman said Valeant’s acquisition strategy made it “a

very early-stage Berkshire,” referring to Berkshire Hathaway, Warren E.

Buffett’s investment vehicle. But only a few months later, Mr. Ackman and his

investors began riding Valeant’s shares all the way from $262 to $11, driven

both by rival investors who had bet against Valeant’s shares and former fans who

dumped the stock as bad news emerged.

As

much as Mr. Ackman and investors in his $11 billion firm would like to close the

book on Valeant, they cannot do so quite yet. That’s because of a Valeant-related

lawsuit in a federal court in California contending that he and his firm

violated securities laws in 2014. According to the plaintiffs, Pershing Square

secretly acquired a stake in the pharmaceutical giant Allergan based on

nonpublic information from Valeant that it intended to mount a takeover bid.

This

is not just any lawsuit. Damages in the case may be $2 billion, as noted by the

judge who certified the litigation as a class action Wednesday. Mr. Ackman’s

lawyers, who in court hearings have put potential damages at less than $1

billion, are vigorously contesting the case and contend there is no liability.

Defendants in the matter, which has not received a lot of publicity recently,

are Mr. Ackman, his funds, Valeant and J. Michael Pearson, the company’s former

chief executive.

The

case is entering a crucial stage. Court documents indicate that Mr. Ackman and

Mr. Pearson have either been deposed by lawyers for the plaintiffs or will be

questioned under oath soon. The documents also show that Mr. Ackman must set

aside 12 hours to answer questions.

Mr.

Pearson was the architect of Valeant’s business model, in which the company

acquired drugmakers and jacked up prices on their products. Mr. Ackman, 50, is

one of the country’s best-known activist investors — taking large positions in

companies and trying to use that weight to influence their direction and

decision-making. Initially, Mr. Ackman praised Mr. Pearson’s strategy of

acquiring rivals rather than developing drugs internally.

Mr.

Ackman declined to comment on the mistakes he made in Valeant or the lessons he

gleaned from the loss.

In a

statement, Pershing Square noted that the firm “has generated billions of

dollars of profits for its investors and double the stock market returns since

the inception of the firm inclusive of our large loss on Valeant.”

“Unfortunately,” it continued, “we cannot guarantee that every one of our

investments will be successful. We regret the loss which occurred due to Valeant

board and management decisions made prior to our active engagement with the

company. Over the past year, as members of the new board of directors, we have

taken important steps to stabilize the company, including replacing prior

management, which positions the company for a better and more profitable

future.”

Due Diligence Falters

The

stock market is a humbling place, where even astute investors make many

mistakes. Mr. Ackman is by no means the only money manager to have erred in

assessing a company’s prospects.

|

The post at the New York Stock

Exchange where Valeant is traded. Mr. Ackman and his investors

rode Valeant’s shares all the way from $262 to $11.

Brendan Mcdermid/Reuters |

But as loosely regulated hedge funds

have grown both in number and in power recently, a cult of personality

has arisen. Unlike mutual funds, which employ ranks of portfolio

managers, hedge funds like Pershing Square are dominated by the people

who run them. Investors in Mr. Ackman’s firm are essentially placing a

bet on him, his acumen and his discipline.

Some

investment managers — Mr. Ackman’s peers and rivals — say that his Valeant wager

raises questions about his investment style. His failure to limit his losses on

the trade and his unusual public comments as a Valeant director, in which he

cheered the company’s management and strategies even as its business was

collapsing, are viewed as troubling.

D.

Ellen Shuman is the veteran manager of Edgehill Endowment Partners, which

oversees $650 million in nonprofit money. She evaluates money managers for her

clients and said she had avoided investing in Pershing Square.

Why?

“It is all about Bill Ackman,” she said in a recent telephone interview. “It is

not about his investors or the companies in which he is investing.”

As

confident a money manager as ever walked Wall Street, Mr. Ackman has

acknowledged that his investment in Valeant represented a breakdown in his

firm’s due diligence — the research it does about the companies it backs. That

concession came last spring when he was called to testify before a Senate

committee on Valeant’s drug pricing practices.

In an

email to The New York Times, Pershing Square said, “Valeant is an anomaly in an

outstanding record over nearly 14 years.”

But

while his funds notched an exceptional 40 percent gain in 2014 — much of it

attributable to the Allergan trade that has drawn the lawsuit — Mr. Ackman’s

funds lost 13.5 percent last year and 20.5 percent in 2015. Through March 15,

Pershing Square is flat.

Other

hedge funds have turned in poor performances as well in recent years. And it is

not clear whether or to what extent Mr. Ackman’s investors have reacted to his

firm’s losses by fleeing. Pershing Square declined to disclose redemption

figures.

As is

typical with hedge funds, Pershing Square has rules governing client

redemptions. In many cases, clients can withdraw only 12.5 percent every quarter

over two years; this prevents a run on the operation amid a mass of redemptions.

And several years ago, Mr. Ackman astutely raised permanent capital with a stock

offering in Europe, another cushion against a run on the firm.

Still, his Valeant flop naturally brings to mind some of his previous

high-profile mistakes. These include investments in the retailers Target and J.

C. Penney, where he installed a chief executive who quickly crashed. And his

protracted $1 billion crusade against

Herbalife, a maker of health supplements,

has lost money for his investors.

Finally, there’s his previous hedge fund, Gotham Partners, which ran into

trouble when clients redeemed and its

illiquid investments could not be sold quickly. He wound down that firm in 2003,

and founded Pershing Square later that year.

$4 Billion Loss

One

reason so many on Wall Street have been riveted by Mr. Ackman’s wrong-way

Valeant bet is that it seems to confirm an age-old investing truth: Karma has

everyone’s address.

For

example, Mr. Ackman’s $4 billion loss in Valeant more than wiped out the $2.2

billion he made in 2014 on Allergan.

Valeant’s Rise, and Fall

A timeline of Pershing’s relationship with

Valeant.

Feb. 25, 2014

Valeant, overseen by J.

Michael Pearson, quietly strikes an agreement with Pershing allowing the

fund company to take a nearly 10 percent stake in Allergan, the

pharmaceutical giant and producer of Botox, to support Valeant’s takeover

of the company.

Oct. 21, 2015

Citron Research, a

favorite of short sellers who bet against stocks, publishes a report

asking if Valeant is the pharmaceutical industry’s Enron.

Read more »

|

|

Mr.

Ackman had never invested in the pharmaceutical industry when he put over $3

billion into Allergan. Pershing had avoided such companies, Mr. Ackman told

investors in April 2014, because they don’t generate predictable cash flows.

Pershing preferred companies like Burger King and Kraft, whose strong brands

protected them from competitors.

After

generating a quick $2.2 billion profit in Allergan, Mr. Ackman continued his new

interest in pharma. In March 2015, Pershing began putting about $4 billion into

Valeant.

Initially, Mr. Ackman swooned over the company. At an investing conference in

May 2015, he said, “We spent a year working with Valeant trying to take over

Allergan, and one of the frustrations we had, as we got to see Valeant trading

at $110 a share, was that we couldn’t buy the stock.”

He

added: “But the moment we could, we bought it. You could say we’re late to the

party.”

Mr.

Ackman was more correct than he knew about coming late to his big Valeant

purchase. His average cost was $190 per share.

At

first, the investment scored. On July 23, 2015, Valeant reported blowout

financial results; by early August, the stock had topped $262 a share.

Although few suspected it, that was the zenith for Valeant. By September the

stock had fallen to around $160.

In

October came a

report from Citron Research, by the

short-seller Andrew Left. Its headline: “Valeant — Could This Be the

Pharmaceutical Enron?” The report delved into Valeant’s association with a

shadowy specialty pharmacy operation known as Philidor. Valeant shares skidded

to $110 on the news.

On

Oct. 30, Mr. Ackman battled back with a four-hour conference call defending

Valeant. The company was sound, he said, and although its stock would recover

slowly, he expected it to hit $400 within three years.

Investors weren’t convinced; the stock closed down 16 percent that day.

“We

held the call to respond to a large number of investor questions we received,”

Pershing Square said in an email last week to The Times. “We presented our point

of view and analysis based on the facts that we had at the time. We continued to

hold the stock at that time because we believed there continued to be

substantial upside on our investment.”

From

then on, Valeant was essentially in free fall. In late December 2015, Mr.

Pearson took a medical leave. In March 2016, Mr. Ackman joined Valeant’s board

and the company announced it would replace Mr. Pearson. Hauled before

congressional hearings about escalating drug prices in April, Mr. Ackman

apologized for Valeant’s mistakes, vowing to use his position on the board to

change the company.

As

Valeant’s business flagged, investors began focusing on its $30 billion debt,

taken on to acquire companies. Clearly the company was going to have to sell

assets to pay it down, but as analysts noted, Valeant had typically overpaid for

acquisitions; selling those units might not generate gains.

Mr.

Ackman continued to defend Valeant publicly, an unusual stance for a corporate

director. In May 2016, after Charlie Munger, Berkshire Hathaway’s vice chairman,

criticized Valeant’s business model and called the company “a sewer,” Mr. Ackman

took to

CNBC. And in July of that year, he told an

interviewer that Valeant’s phone was ringing off the hook because so many

companies wanted to buy the assets it was selling.

By

this time, the stock had drifted down into the $20s. The company’s business was

faltering, and it was under investigation by regulators and the Justice

Department, inquiries that had come about before Mr. Ackman joined the board and

are continuing. For 2016, Valeant reported a $2.4 billion loss.

|

From left, J. Michael Pearson and

Howard Schiller of Valeant with Mr. Ackman in 2016 before

testifying at a congressional hearing.

Drew Angerer for The New York Times |

Last Monday, Mr. Ackman had had enough.

Pershing dumped its Valeant stake at roughly $11 a share.

Insider Trading Accusations

As

this calamity played out, Mr. Ackman was also fighting the Allergan lawsuit in

California. The plaintiffs were investors who had missed out on gains in

Allergan stock in 2014 because they had sold shares without knowing about

Valeant’s impending bid, while Pershing Square, which did know about it, was

buying Allergan shares. They contended that Valeant and Pershing Square violated

securities laws, which prohibit fraudulent, deceptive or manipulative actions in

connection with a tender offer.

It

would have been very costly for Valeant to finance a takeover of Allergan;

instead it struck an agreement on Feb. 25, 2014, allowing Pershing Square to

take a nearly 10 percent stake in Allergan to support Valeant’s takeover

efforts.

If

the bid succeeded, wonderful. But if another offer topped it, Valeant would

receive 15 percent of any profits generated by Pershing Square when it sold its

Allergan stock to the acquirer.

Pershing set up an entity called PS Fund 1 and began buying. By April 21, it

held a 9.7 percent stake in Allergan worth $3.2 billion, court documents show.

But the arrangement between Pershing Square and Valeant was not disclosed until

the following day, when Valeant

said it intended to acquire Allergan.

Discussing the arrangement, Mr. Pearson

said, “Having Bill out there in the public”

was a plus. “He doesn’t give up.”

Allergan rejected Valeant’s offer and was

acquired by Actavis P.L.C., a Dublin-based

pharmaceutical company, the next November. Tendering its shares, Pershing Square

made a $2.6 billion profit; it gave $400 million of that to Valeant.

Critics of the arrangement cried foul, contending that Pershing had profited

from its knowledge of Valeant’s impending bid, essentially front-running the

deal, or trading on nonpublic information. And a month later, investors filed

suit against Valeant and Pershing Square.

Mr.

Ackman and his lawyers have contended that Pershing Square did not violate any

insider-trading laws. Still, the case continues to advance under Judge David O.

Carter of the Federal Court for the Central District of California.

Lawyers for Mr. Ackman have argued in court that a January

order from the Securities and Exchange

Commission fining Allergan $15 million for disclosure failures during the

Valeant bid supports their case. Because the agency looked hard at the

transaction and did not cite violations by Pershing and Valeant in its order,

the transaction passed muster, the lawyers contended.

But

Judge Carter expressed skepticism. According to the transcript of a Feb. 13

hearing, he questioned why he should accept the S.E.C. order as a finding of

fact in the Allergan case. Although he said he would consider the order, he told

the lawyers, “Don’t hang your hat on it.”

Of

course, cases like the one Mr. Ackman faces often settle for far less than the

amount of estimated damages, and Pershing remains a very wealthy fund, with $11

billion in assets. Asked if any of its clients had expressed concern about the

case, Pershing declined to comment.

Still, Mr. Ackman recently persuaded Valeant to agree to pay 60 percent of any

settlement that might arise in the case.

Struggling Valeant, however, does not have a big cash cushion to contribute

toward a money-losing legal case. And the settlement deal, described in a

regulatory filing on Feb. 13, expires in November. It is unclear what will

happen after that.

A

Valeant spokesman provided a statement saying, “We are pleased to have

entered into this agreement to resolve issues that could have affected our joint

defense of the Allergan litigation and enhance our ability to defend against the

plaintiffs’ allegations as we continue to work without distraction on nurturing

and growing our mutual business interests.”

Wall

Street will definitely be watching as Mr. Ackman tries to recover from the

Valeant investment. For now, the normally loquacious money manager has gone

quiet.

A version of this article appears in print on March 20, 2017, on Page

A1 of the New York edition with the headline: A Top Investor Is

Tripped Up by a Bold Bet.