Are Top Investors

Listening to Proxy Advisors on Pay?

Posted by Seth Duppstadt, Proxy Insight,

on Thursday, February 2, 2017

|

Editor’s Note: Seth Duppstadt is Senior Vice

President at Proxy Insight. This post is based on a Proxy Insight

publication authored by Mr. Duppstadt. |

Large

investors are not following the recommendations on executive compensation set

out by Proxy Voting Advisers (“PVA”), a study by data company Proxy Insight has

found.

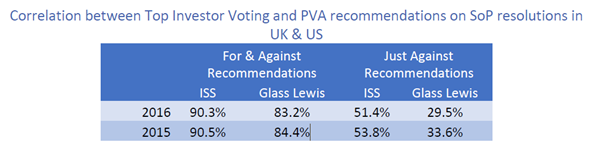

Proxy Insight analyzed voting on Advisory

Say on Pay (“SoP”) resolutions in the US and UK in 2015 and 2016 for

10 of the largest institutional investors and compared each vote to

the recommendations from ISS and Glass Lewis. While voting by top

investors correlated with ISS 90% of the time and Glass Lewis 83% of

the time for all SoP resolutions, the link is drastically reduced for

votes where ISS and/or Glass Lewis recommend against a SoP proposal.

In

aggregate, the 10 investors matched ISS on only 51.4% of recommendations to vote

against management on SoP in 2016, and 29.5% of Glass Lewis’. In each case, the

level of opposition was sharply reduced compared to the year before.

The

picture is even more noteworthy when both ISS and Glass Lewis recommended

voting Against management. Since 2015, the top investors only voted Against

61.8% of SoP resolutions where both ISS and Glass Lewis recommended against.

Commenting on the analysis, Proxy Insight Managing Director, Nick Dawson

remarked: “Not only does the data provide a more realistic measure of the

influence of Proxy Advisors, which is often overblown, but it also suggests

increasing reluctance from investors to oppose management on the perennial issue

of compensation.”

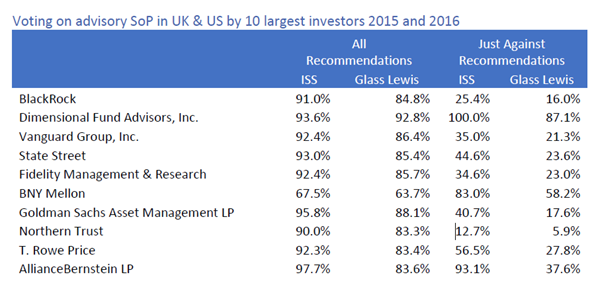

The

breakdown for the 10 investors is as follows:

|

Harvard Law School Forum

on Corporate Governance and Financial Regulation

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2017 The President and

Fellows of Harvard College. |