THE

WALL STREET JOURNAL.

Business |

Management |

Management & Careers

CEOs Should Focus on Long Term, Study Says

Authors contend that switching from short-term gains to a long

view improves profits and sales

|

RA long-term management view is exemplified by Indra Nooyi,

PepsiCo’s CEO.

PHOTO: JEMAL COUNTESS/GETTY IMAGES |

By

JOHN SIMONS

Dec. 27, 2016 9:00 a.m. ET

Should corporate leaders

focus on short-term gains or take the long view?

Adherents of long-term

management will find potent ammunition in a new study from a pair of

management researchers who conclude that myopic leaders are hampering

businesses by failing to invest in innovation and risky projects.

What’s more, they say that

switching to a long-term outlook can improve a company’s operating performance

by several measures—return on assets, operating profits, and sales growth—within

two years.

Simply put, an increased long-term

orientation fosters innovation and enhances market value, argue authors Caroline

Flammer of Boston University’s Questrom School of Business and Pratima Bansal of

the University of Western Ontario’s Ivey Business School. Their paper, “Does a

Long-Term Orientation Create Value?,” is slated to publish in a coming issue of

the Strategic Management Journal.

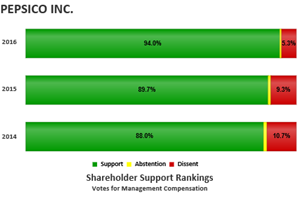

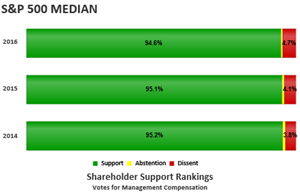

To determine whether executives

with a long view logged better performance, researchers identified 808

shareholder proposals on long-term executive compensation between 1997 and 2012,

and examined the measures that passed by a small margin of votes.

The executive compensation

proposals included awards of restricted stock, restricted stock options, and

long-term incentive plans. The researchers measured the effects of approved

proposals during the year of passage, one year later, and then three years after

passage.

The authors set out to study

companies whose leaders had made a clear break with short-termism. So they

zeroed in on chief executives who may not have seen the changes coming in the

form of narrowly passed long-term incentive proposals.

The compensation adjustments led

chief executives to pursue longer-term strategies. Following the passage of

long-term incentives, the researchers found that companies boosted their efforts

to innovate and pursue riskier forward-looking projects. More specifically,

businesses increased their research and development spending, which led to

surges in the number of patents they garnered.

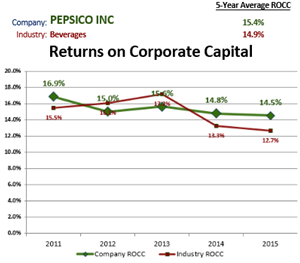

The long-term view is exemplified

by

PepsiCo Inc. CEO

Indra Nooyi.

Ms. Nooyi identified health and

wellness as one of the company’s biggest growth opportunities when

she became chief executive in 2006.

She has boosted R&D spending and

vowed to turn the maker of sugary soft drinks into a company where sales growth

of healthy products outpaces the rest of the portfolio by 2025.

Ms. Flammer warns that the

research findings may not hold true for small public companies and firms that

have passive shareholders. There is a hidden gem in the research for short-term

adherents, too.

Ms. Flammer and Ms. Bansal found

that companies whose boards narrowly approved long-term executive incentive

proposals saw their share prices jump 1.14% on the day the measures passed,

compared with companies where shareholder proposals were narrowly rejected.

Write to

John Simons at

John.Simons@wsj.com