|

THE

WALL STREET JOURNAL.

Markets

The Hottest Metric in Finance: ROIC

General Motors placated activist investors with help of return on

invested capital

|

NO CREDIT |

By

David Benoit

Updated May 3, 2016 3:45 p.m.

ET

Last year,

General Motors Co. fended off a

group of activist investors with the help of an esoteric financial

metric to which it had previously paid little heed.

The century-old auto

maker began publicly touting the statistic, known as return on

invested capital, or ROIC. It tied compensation to a 20% target and

said that above a $20 billion cushion, cash it couldn’t earn that

return on would be handed back to shareholders.

The steps placated the

activists.

GM’s move underscores

that, as much as a financial metric can be, ROIC is all the rage.

The popularity of the

figure is also more evidence of the influence activists have come to

wield in boardrooms. For ROIC lovers, which also include traditional

stock pickers, the measure is the best way to distill what activists

view as the most critical skill of management: how they allocate

capital.

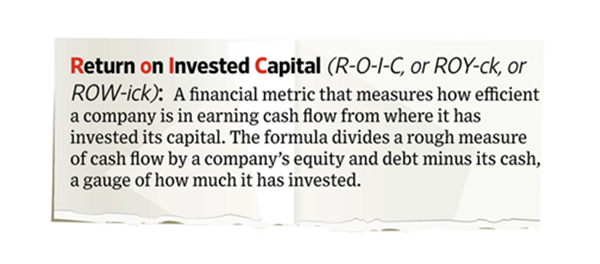

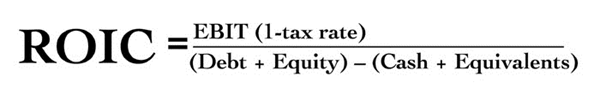

The typical ROIC equation

divides a company’s operating income, adjusted for its tax rate, by

total debt plus shareholder equity minus cash. It aims to show how

much new cash is generated from capital investments.

For example, at GM, over

the four quarters ended in March, adjusted operating earnings were

$11.4 billion, up from $8.1 billion a year earlier. The denominator

shrank as GM reduced, partly via buybacks, its equity, even though

debt went up. ROIC rose to 28.5% from 19.5%, showing it was earning

more with less.

“ROIC provides the

clearest picture of how we are managing our capital and our business,”

said GM Chief Financial Officer Chuck Stevens. “It’s really starting

to become part of the DNA of our decisions.”

ROIC isn’t perfect. There

are other efficiency metrics, such as return on equity, that are

better for certain industries. Some said ROIC is untrustworthy and not

everyone agrees on how to calculate it. (There is also disagreement

over how to pronounce it: Some say each letter aloud. Some pronounce

it as “ROW-ick” and others “ROY-ck.”)

GM isn’t the only auto

company focused on ROIC: Fiat Chrysler Automobiles NV Chief Executive

Sergio Marchionne has publicly called for consolidation to help the

whole industry improve its ROIC, even giving a presentation he titled

“Confessions of a Capital Junkie” last year.

New York University

finance professor Aswath Damodaran said ROIC is a lazy shortcut for

executives, because companies should have visibility into the cash

flowing from projects on a more granular basis.

“I could write a paper on

perverse ways you could destroy your company by raising your ROIC,” he

said.

Still, in 2015, 672 U.S.

companies cited the metric, up 42% from five years earlier, according

to an analysis of securities filings. Surveying global investors,

Rivel Research Group found recently that more investors care about

ROIC than any other financial metric, including per-share earnings

growth.

There is evidence ROIC

correlates to higher, less volatile shareholder returns, said Frank

Zhao of the Quantamental Research group at S&P Global Market

Intelligence. Investing in companies with the highest ROIC relative to

their peers in the S&P 500, adjusting for size and reallocating each

month, earned a 10.5% annual return from 2003 through the first

quarter. The S&P 500 returned 9.6% in the same period.

At

Goldman Sachs Group Inc.,

the co-heads of activist-defense banking,

Steven Barg and Avinash Mehrotra, now bring clients pages of data

showing quantitative metrics investors care about. Near the top of the

list is ROIC compared with a company’s cost of capital. If a company

scores poorly in that equation, it is a red flag.

“It becomes a disease, and

the symptoms show up elsewhere,” Mr. Barg said.

At iRobot Inc., which

makes the Roomba vacuum cleaner, activist investor Red Mountain

Capital Partners LLC is fighting for board seats. It argues the

Bedford, Mass., company has failed to earn its cost of capital and

questions the returns on projects like “remote presence,” which are

robots for video chats.

The company rejects the

activist’s ROIC calculation and said exploring new robots is necessary

for growth. Meanwhile, the company questions Red Mountain’s own

investment prowess, according to one person familiar with the fight.

Concerns about investor withdrawals led Red Mountain to restructure

its fund last year, which will no longer make new investments,

according to a letter it sent to its investors.

People familiar with Red

Mountain said the fund change was meant to establish permanent capital

so it couldn’t be forced to sell before driving value at iRobot and

other holdings. It aims to raise new funds later, one person said.

The focus on ROIC helps

explain why activists push decisions sometimes labeled short term.

Activists said they aren’t

inherently opposed to investment projects, but that companies have to

justify spending. If a plant or a new line of business falls short on

expected returns, companies should find a different project or give

the cash back to shareholders, they said.

“We want to make sure they

are making the right decisions,” said Clifton S. Robbins, the founder

of activist fund Blue Harbour Group LP who counts ROIC as one of the

most important metrics he watches.

When Mr. Robbins’s Blue Harbour took a

stake in Progressive

Waste Solutions Ltd.

in 2013, he had concerns a rush of deals

at the garbage collector hadn’t yielded good returns. In part at the

fund’s urging, Progressive Waste slowed its deal making and

concentrated on operations with a low ROIC, Mr. Robbins said. This

year, Progressive Waste agreed to combine with

Waste Connections Inc.

Blue Harbour sold out at a roughly 50%

gain.

A new report from S&P said

there is no direct link showing activists actually improve ROIC once

they take a stake, though stocks with a high one and activist

investors outperform.

At GM, the board in 2014

tied long-term bonuses to the new ROIC target and disclosed it the

next year. Just then, the activist group argued the company wasn’t

transparent enough about its investing process and was holding too

much cash.

GM now uses ROIC in

decision making throughout the organization, said Mr. Stevens.

Early last year, the auto

maker announced it would idle a plant in Russia, backing away from a

market that had been expected to generate significant growth. Mr.

Stevens said GM decided it would struggle to earn sufficient returns

on $1 billion it needed to invest to comply with new regulations. GM

can’t be everywhere, he said.

“These are the types of

decisions I would say we didn’t make in the past,” Mr. Stevens said.

—Kate Linebaugh

contributed to this article.

Write to

David Benoit at

david.benoit@wsj.com

|