|

THE

WALL STREET JOURNAL.

Markets |

Streetwise

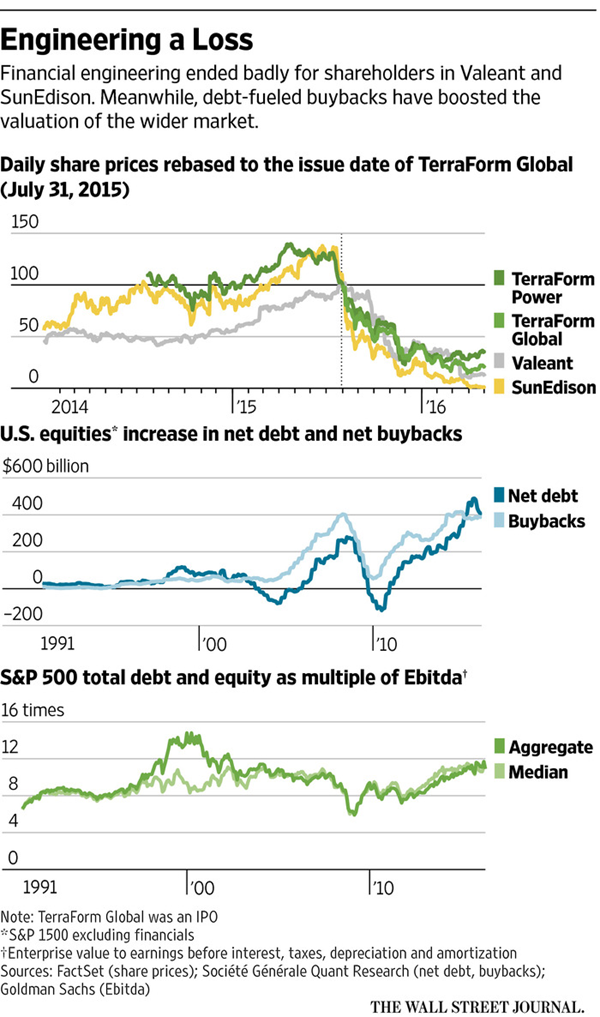

Financial Engineering Shows Its Downside

Is the stock market engaged in unsustainable financial engineering

in an effort to satisfy shareholders?

|

A solar facility built by SunEdison in

Pueblo, Colo. SunEdison was among companies relying on financial

engineering to satisfy shareholders. PHOTO: RICK WILKING/REUTERS |

Valeant, SunEdison…the S&P

500?

Financial engineering has built vast

financial edifices, but all too often there is little of substance

providing support. The latest Wall Street constructs to crumble are

familiar names,

Valeant Pharmaceuticals International

Inc.

and

SunEdison Inc.

Both relied on financial engineering to

satisfy shareholders desperate for two items scarce in today’s weak

economy: growth, offered by Valeant, and income, supplied by

SunEdison’s so-called yieldcos.

Shareholders who avoided

both will be congratulating themselves, or thanking their luck. But

they should also be asking themselves a bigger question: Is the entire

stock market engaged in unsustainable financial engineering in an

effort to satisfy shareholders? Put another way: We know the market is

engaged in large-scale financial engineering in the form of a huge

ramp-up of leverage. Is it sustainable?

Valeant and SunEdison show

financial engineering in a bad light. Valeant used access to cheap

finance, in the form of its own highly valued stock and bonds, to make

ever-bigger acquisitions. Aggressive accounting allowed it to goose

its profits so long as the deals went on.

Because the company looked

as though it was providing strong growth, investors marked up its

shares, allowing it to do the next deal, and so on. Until it stopped.

Investors have learned

once again the problem of “roll-up” companies where the growth is

driven by accounting and valuation multiples rather than economies of

scale. The virtuous circle of cheap financing for takeovers leading to

higher valuations leading to cheap financing works only as long as

they keep doing deals. Valeant’s market value is down $78 billion from

its peak, about the same in today’s money as the total lost by

shareholders of Enron.

SunEdison, a solar

company, used more-novel financial engineering. It created twin

yieldcos,

TerraForm Power Inc.

and

TerraForm Global Inc.,

to raise cash from investors for its

completed projects. By clever use of tax losses, shareholders were

promised a high and rising dividend without corporate taxes, while

SunEdison secured upfront cash and retained control of the projects.

Renewable-power companies

created a line of yieldcos, gaining high valuations from

income-starved investors, helped by those demanding environmentally

friendly homes for their money. Almost all have been badly hurt by

changes to state tax breaks for green projects and the cheapening of

fossil fuels.

The financial engineering

behind Valeant and SunEdison has a bad name, at least for now. But

yesterday’s financial engineering often becomes widely accepted. In

the case of the engineering behind today’s high stock-market

valuations, it goes further: Borrowing to buy back shares is widely

welcomed.

The biggest 1,500

nonfinancial companies in the U.S. increased their net debt by $409

billion in the year to the end of March, according to Société Générale,

using almost all—$388 billion—to buy their own shares, net of newly

issued stock. Companies have become far and away the biggest customer

for their own shares.

As corporate profitability

slows, the obvious worry is that this debt will lead shareholders to

disaster. Total corporate debt is close to the proportion of the

economy hit during the debt-fueled bubble that ended in the 2008

collapse of Lehman Brothers.

According to David Kostin,

a strategist at Goldman Sachs, the debt and equity of the median U.S.

nonfinancial company is worth 11 times operating cash flow, higher

than in 2007 and higher than at the peak of the dot-com bubble. (This

widely used measure is known as enterprise value to earnings before

interest, taxes, depreciation and amortization).

So not only do companies

have a lot of debt, but shareholders love it. What could possibly go

wrong?

The case for calm is that

when interest rates are low, it is only natural that companies will

take on more debt. One illustration: The interest cover for U.S.

junk-rated nonfinancials, or the number of times operating profit

covers interest costs, is the strongest since at least 1997, according

to the Office of Financial Research, a U.S. watchdog created by the

Dodd-Frank Act.

The case for concern is

that this borrowed money wasn’t invested into productive projects that

would boost earnings in the future and so pay off the debt, but

instead was used to buy back shares. Corporate investment has picked

up recently, but overall buybacks are being funded from borrowing, as

Andrew Lapthorne, a strategist at Société Générale, points out.

This creates three risks.

First, rising interest rates for corporate debt would have a much

bigger impact on profits and shareholders than usual, and could lead

to a wave of defaults, as the energy sector showed.

Second, more caution in

the bond market, perhaps caused by recession, could make it hard for

companies to roll over debt; again, the energy sector has been a

painful demonstration of what happens to highly indebted companies

when they lose access to credit.

Third, if companies

themselves become more cautious, it could remove the biggest buyer of

stocks from the market. Share buybacks have helped support prices and

earnings per share even as profits have fallen back to mid-2012

levels.

If companies stop

borrowing to finance buybacks, another generation of shareholders will

discover the downside of financial engineering.

Write to

James Mackintosh at

James.Mackintosh@wsj.com

|