|

Business

| Mon May 2, 2016 12:21am EDT

Capital Group leaders look to rein in inflated CEO pay

BOSTON

|

By

Ross Kerber

|

Alan

Berro, Capital Group portfolio manager, is seen in an undated

picture courtesy of Capital Group. Capital Group/Handout via

Reuters

|

The usually close-mouthed Capital Group is speaking up on executive

pay - throwing more brickbats than bouquets.

In a

recent interview, leaders of the $1.4 trillion Los Angeles-based

investment manager said they worry about the magnitude of pay for chief

executives and question whether corporate boards are using the right

benchmarks to determine compensation.

"There

has been this continued escalation where everybody wants to be in the

upper quartile," Alan Berro, senior portfolio manager at Capital Group,

told Reuters.

"Once

one guy raises it, they all want those raises, and we are willing to say

no," he said.

Berro's comments are important because Capital Group, which oversees the

big American Funds mutual fund family, is one of the largest holders of

U.S. stocks and is emerging as one of the toughest critics of corporate

compensation.

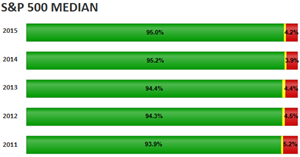

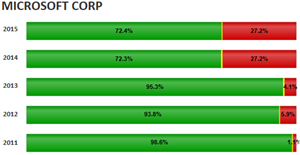

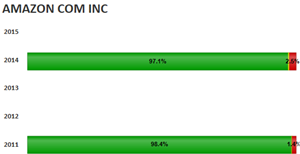

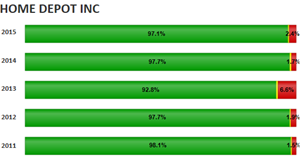

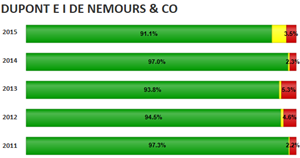

A

measure is its voting record on what are known as "say-on-pay" resolutions

- non-binding measures which let shareholders vote on whether to approve

compensation for top executives.

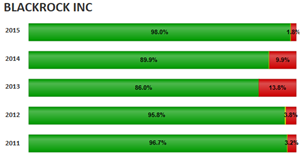

Last

year, big mutual fund providers including BlackRock Inc (BLK.N)

and Vanguard Group voted in support of say-on-pay resolutions of S&P 500

companies at least 96 percent of the time, according to research firm

Proxy Insight. Capital Group, however, was less generous in its support,

with its funds supporting the pay 86 percent of the time, one of the

lowest rates among big U.S. fund managers.

Executive pay, which has been a source of controversy for some time, has

drawn more scrutiny amid stagnant U.S. wages for the typical worker.

Median pay among S&P 500 CEOs rose to $11.3 million in 2014 from $9.4

million in 2010, according to pay consultant Farient Advisors.

Capital Group has rarely spoken about its proxy voting before, but decided

to offer more explanation because of growing interest in the area,

including from financial advisers and institutional investors, executives

said.

Like

other asset managers, Capital Group says executive pay should be linked to

performance. But proxy voting principles Capital recently posted online

also have an unusual caveat about "preventing excess" pay.

In

making pay judgments, Berro said, "We always come back to fairness, and

what makes sense in the given circumstances."

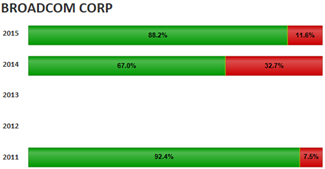

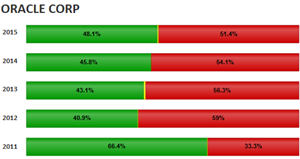

Berro

and others at Capital declined to single out individual companies whose

pay packages they view as problematic. A securities filing shows the $140

billion Growth Fund of America mutual fund (RGAGX.O)

voted "against" pay at two of the fund's 10 largest holdings last year:

Broadcom Corp and

Oracle Corp, (ORCL.N)

historically among the higher-paying technology firms. (Broadcom is now

part of Broadcom Ltd (AVGO.O).)

Top

holdings of its Capital World Investors unit include

Microsoft Corp (MSFT.O),

Amazon Inc (AMZN.O)

and Home Depot Inc (HD.N),

according to securities filings tracked by edgar-online.com. Capital World

has a stake of at least 4.5 percent in each of those companies, and other

Capital Group units hold additional shares.

Lately, the firm has been building up a database to track topics like how

companies' executive pay compares to peers, and to what extent stock

grants to executives have diluted outside shareholders, Berro said.

Berro

helps oversee investment selection among a wide range of blue-chip

companies that are now entering the season for annual meetings.

Not

all of Capital Groups' votes will please corporate critics. Its funds

opposed nearly all proposals calling for companies to report on climate

change, for instance. Berro said regulators are better-positioned than

shareholders to oversee such matters.

Capital Group has also gained a reputation in some quarters as being

activist-friendly - for instance, backing some dissident nominees to

Dupont's (DD.N)

board last spring.

But

Capital Group senior counsel Walt Burkley said his firm does not recruit

activists to target companies for changes. "There is no call to activism

from us," he said.

(Reporting by Ross Kerber; Editing by Lauren Tara LaCapra and Leslie

Adler)

|

News

and Media Division of

Thomson Reuters

© 2016

Reuters All Rights Reserved |

|