Activist Investors, Cash, and Capital Allocation

Posted by Paula Loop,

PricewaterhouseCoopers LLP, on Thursday, March 24, 2016

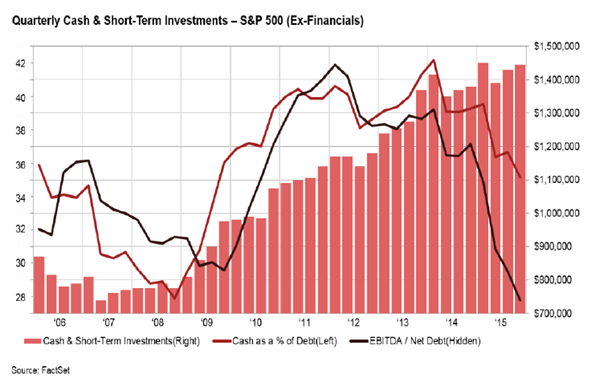

US companies are holding record sums of

cash on their balance sheets. In fact, the total cash balance of S&P

500 companies was $1.45 trillion at the end of the third quarter of

2015, representing a 5.8% increase year-over-year. While this

phenomenon indicates robust balance sheet health, it also raises

questions about the best way to use this liquidity. And these

challenges stimulate provocative questions and discussions about the

most prudent use of company resources—taking into account different

stakeholders’ expectations, the company’s individual circumstances,

and the overall economic environment. Ultimately, companies need an

effective capital allocation strategy that is well thought-out, linked

to their overall strategy, and clearly communicated. And a key element

of this capital allocation strategy is whether, and/or how, cash is

returned to shareholders.

At the same

time, shareholder activism has shifted into high gear. With about $173

billion currently under activist management, proxy contests are more

frequent—as are settlements. Activists’ strategies often involve

pressuring companies to take one or more of several actions: increase

share repurchases, increase dividends, restructure, spin-off a

division, or even sell the company. In many of these areas, including

increasing share repurchases and dividends, activists have been

effective in achieving their goals.

Between 2003

and 2013, S&P 500 companies doubled their spending on share

repurchases and dividends while cutting their spending on investments

in new plants and equipment.

[1]

Companies targeted by activists increased spending on share

repurchases and dividends to an average of 37% of operating cash flow

in the first year after being approached—from 22% the year prior. This

trend has been partly fueled by the low-interest-rate

environment—enabling companies to borrow money cheaply to finance

their share repurchase and dividend programs. So in the face of

pressure to boost short-term performance, how should directors and

shareholders be thinking about the impact share repurchases and

dividends may have on the company’s ability to create long-term value?

A

complicating factor for executives and boards is that shareholders are

not monolithic. While both activist hedge funds and state pension

funds seek a return on investment, they likely employ very different

investing time horizons to achieve those returns. They may also have

vastly different views about the viability of a particular company’s

strategy. Directors need to be prepared to pose tough questions to

executives about the virtues of long- and short-term capital

allocation strategies. Similarly, investors need to make informed

investment and proxy voting decisions based on the interests of their

specific constituencies—resisting any urge to follow the lead of those

with a different focus.

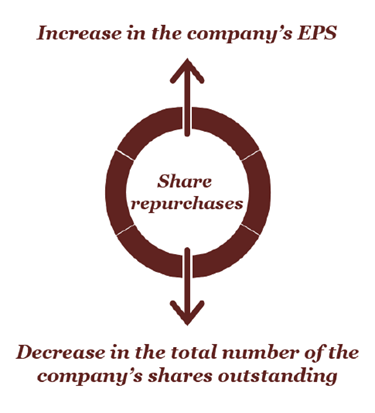

Share repurchases

One reason

companies adopt board-authorized share repurchase plans is that they

perceive their shares to be undervalued by the market and want to

signal management’s confidence in the company’s future prospects. By

repurchasing shares, the company buys its own stock and reduces the

total number of its shares outstanding. Because the denominator is

lower, the same earnings will increase the company’s earnings per

share (EPS). Share repurchases are also a way to offset the dilutive

impact of shares issued in acquisitions. Or those treasury shares can

be issued to satisfy the equity component of acquisitions or mergers.

Repurchased shares can also be used to satisfy the shares needed upon

exercise of employee stock options. The effect of these actions can

allow a company to remunerate employees at a higher level by issuing

more stock options without increasing the number of outstanding

shares.

Executives

sometimes prefer share repurchases to dividends because they generally

require less of a long-term commitment and provide more flexibility.

For example, a company may delay or defer an announced plan to

repurchase its shares due to unexpected capital needs or changes in

stock price. While not ideal, there is generally less negative market

reaction to this outcome than there would be to cutting a regular

dividend.

There are

several different approaches to share repurchases:

-

Open market repurchases. The vast majority of share

repurchases are on the open market. The manner, timing, volume, and

price of these repurchases are governed by detailed rules set forth

in the Securities and Exchange Act. In these transactions, companies

usually enter into an agreement with a broker or dealer that

executes the repurchases according to the companies’ instructions.

-

Tender offers. A tender offer is a public offer to

shareholders to tender their shares for sale at a specified price

during a specified time, subject to the tendering of a minimum and

maximum number of shares. This can be done at a fixed price or at a

range of prices for a set amount of shares. A company may be more

inclined to initiate a tender offer in order to repurchase a large

number of its shares at one time.

-

Privately-negotiated repurchases. A company can also decide

to enter into share repurchase agreements with individual

shareholders. This approach is often used when companies want to

repurchase a significant number of their shares from a small number

of individual investors.

-

Accelerated share repurchase programs. These are types of

economic hedges that allow, for a fee, a company to purchase a

specific number of shares immediately with the final purchase price

determined by an average market price over a specified future

period. If the average price is higher at the end of the program,

the company returns the necessary number of net shares to cover the

shortfall. If the share price is lower, the bank delivers more

shares. This approach combines the immediate share retirement

benefits of a tender offer with the market impact and pricing

benefits of an open market repurchase program. However, these

transactions are sometimes off-balance-sheet and while they can have

a large upside if the shares appreciate, there are also potential

risks. Fluctuations in the company’s stock price during the

specified period can have a significant economic benefit, or cost,

to the company. Companies can find themselves underwater on these

contracts if the share price declines. And some critics question

whether these practices amount to a company ‘betting’ on its own

stock.

Share

repurchases can also provide investors with tax advantages when

compared to other forms of cash distributions, such as dividends.

Dividend distributions are subject to capital gains taxes. By

contrast, share repurchases don’t result in a direct distribution, and

taxes are generally deferred until shareholders choose to sell their

shares.

It’s

particularly important for directors and shareholders to understand

the effect of share repurchases on some of the company’s key

performance metrics—as improved ratios can impact executive

compensation tied to such metrics. For example, many executive

compensation plans are linked to EPS—which increases by repurchasing

shares. This can potentially give executives a better chance of

reaching bonus targets tied to that measure. Executives also stand to

gain if the company’s share repurchases drive the stock price to a

level that makes the exercise of their stock options economically

beneficial. As a result, some critics of share repurchasing argue that

executives’ self-interest is in conflict with their authority to make

decisions on making repurchases.

It is also

important to assess the appropriateness of the company’s equity and

debt structure. Using cash to repurchase shares can put pressure on

debt-to-equity ratios and adversely impact a company’s credit rating.

Another

consideration for using cash to repurchase shares is that much of that

cash may be held in foreign jurisdictions and subject to US taxes upon

return of the money to the US (repatriation). The optics of the

balance sheet indicate the cash is liquid and available, but a

reduction for potential repatriation taxes may not be reflected other

than in the footnotes if the foreign cash is considered “permanently

reinvested” in the particular jurisdiction. A decision to bring cash

home may trigger additional tax expense, thereby reducing what would

otherwise appear as cash available for repurchases.

Dividends

Issuing a

dividend is another way for companies to return cash to shareholders.

A dividend is a cash distribution of the company’s assets, paid on a

periodic basis (generally quarterly, annually, or in special

circumstances). As of the end of the third quarter of 2015, 85% of S&P

500 companies paid a regular quarterly dividend, and 63% had raised

their dividend from the previous quarter. Aggregate S&P 500 dividend

payments amounted to $103.3 billion during the third quarter of 2015,

and $410.8 billion over the trailing twelve months.

[2] Both

numbers represented ten-year highs.

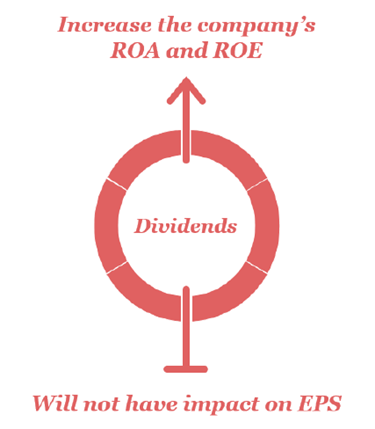

Similar to

share repurchases, dividends are viewed by the markets as a signal of

management’s confidence in the company’s future prospects and

financial liquidity. The payment of a dividend will reduce the amount

of cash and thus, total assets, on the balance sheet. Because of this,

a company’s return on assets ratio (ROA) is enhanced over what it

would be absent the payment of the dividend. It will similarly

increase the return on equity ratio (ROE), but earnings per share is

unchanged. As with share repurchases, it is important for directors to

understand how improved ratios might impact triggers for the payment

of executive compensation. The achievement of performance targets

related to these two enhanced metrics may make bonuses more attainable

if dividends are initiated or increased. The reverse may be true if

dividends are stopped or reduced. Revisions to the dividend policy

that were not anticipated in defining the original compensation

program should be carefully considered.

A company’s

decision to pay a dividend should be supported by many of the same

considerations as a stock repurchase. Specifically, directors and

shareholders should understand whether this use of cash is consistent

with a reasoned cash allocation strategy. A decision to issue or

modify a dividend payment speaks to whether the company believes it

can maintain that dividend in the future. Decisions around paying

regular dividends are particularly important because the market

expectation is usually that the company will continue to pay out the

existing dividend. In fact, there is frequently an expectation that

the company will raise its dividend periodically. Such dividend

increases are viewed by many investors as even stronger forms of

assurance that management believes the company has the ability to

generate adequate cash to service the enhanced dividend commitments.

Conversely, markets generally have a negative reaction to stagnant or

reduced dividends.

While the

majority of S&P 500 companies issue regular quarterly dividends, some

companies may choose to utilize a “special dividend”—a one-time cash

distribution, separate from the regular dividend cycle. One of the

benefits of special dividends is that companies can choose to pay them

at their discretion without incurring the perceived longer-term

commitment that accompanies a regular dividend.

The debt

leverage and earnings repatriation considerations relevant to

repurchasing shares are also relevant to other uses of cash, including

paying dividends.

There are a

number of factors that may motivate a company to initiate share

repurchases, change dividend policy, and issue or increase dividends

to return cash to shareholders. While different investors have

different time horizons and views about how companies should best

use their cash, directors must carefully consider what course of

action is in the best interest of the company and its

stakeholders—while balancing short- and long-term concerns.

The complete

publication, including Appendix, is available

here.

|

Harvard Law School Forum

on Corporate Governance and Financial Regulation

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2016 The President and

Fellows of Harvard College. |

|