|

THE

WALL STREET JOURNAL.

Markets |

Stocks

|

Ahead of the

Tape

Buybacks Arenít What They Used to Be

Investors arenít rewarding companies that deploy the biggest

buybacks as much as they once did

|

Cisco Systems remains committed to stock buybacks. PHOTO:

MIKE BLAKE/REUTERS |

The corporate buyback

binge continues at full tilt. But, perhaps with good reason, investors

may be losing faith in its ability to propel share prices.

U.S. companies

authorized $158 billion of new stock buyback programs in January and

February, according to Birinyi Associates Inc. While there is no

guarantee the rest of 2016 will maintain such a pace, it marked the

best start to a year since the research firm started tracking this

data in 1984.

February, in particular,

stood out, as cash-rich companies said they would continue rewarding

shareholders rather than investing. It was the fourth strongest month

on record.

Cisco Systems Inc. and

Gilead Sciences Inc.

led the pack with the heftiest announcements.

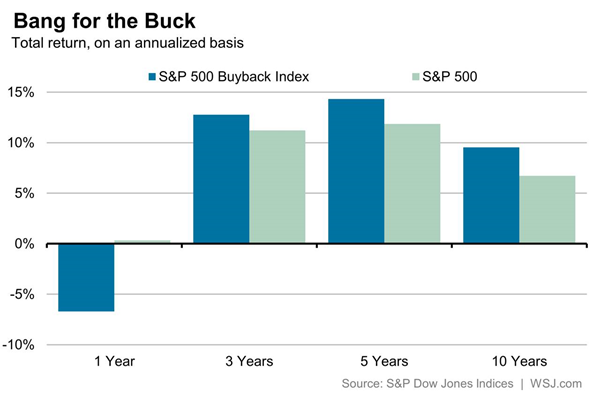

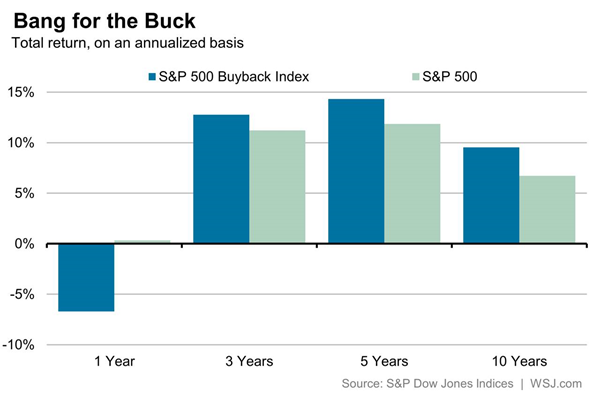

Even so,

the S&P 500 Buyback Index, which

contains stocks with the highest ratio of buybacks to market value,

has fallen by 7% over the past year. That compares with a slight gain

for the S&P 500 on a total-return basis.

The explanation may be

that investors

know how buyback booms end: When

the market loses momentum, companies tend to get skittish about

spending money on their own shares, even though they are on sale.

|

The Wall Street Journal |

For example, in booming

2007 when the last bull market peaked, buybacks totaled $761 billion.

That plunged to $387 billion in 2008 and just $149 billion in 2009,

according to Birinyi.

Based on what companies

have announced, and also some evidence of what they have spent, such a

pullback hasnít happened this time. But the fact that a company says

it will repurchase stock doesnít mean it will. In 2015, companies

bought back about four-fifths of the authorized amount.

So, one explanation for

the sputtering Buyback Index is that investors smell trouble. Another

explanation is more benign: That investors are optimistic about the

economy and are rewarding companies that plow money into productive

assets.

After all, if a company

can get a higher return on a dollar than one returned to investors, it

should retain and spend it.

Capital expenditures, research

and development and even wage increases have largely taken a back seat

in this bull market.

The buyback express

isnít slowing. But more investors want to switch trains.

ó

tape@wsj.com

|