|

Shareholder activism

US companies embrace virtual annual

meetings

Moving from a conference centre

to the internet allows you to boast about improving shareholder access

“On

Wall Street

|

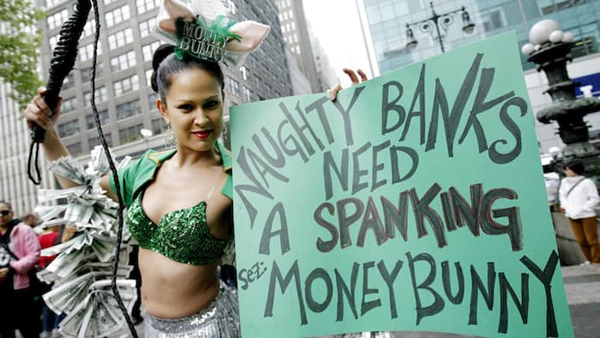

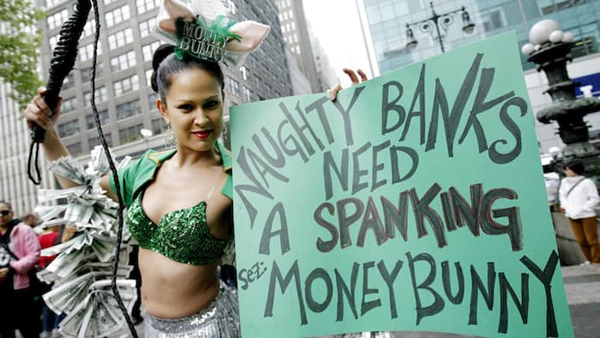

Marni Halasa of New York, a

veteran of protests at Citigroup's AGM, dresses as the © Getty

|

[march

11, 2016]

by:

Tom Braithwaite

Dressed in spandex, brandishing a whip and holding a sign that said,

“Bankers need a spanking.”,

Marni Halasa protested outside

Citigroup’s annual meeting in New York in 2013. A year earlier Wells

Fargo’s annual meeting in San Francisco attracted hundreds of

activists in the streets outside and a smaller number, who bought

shares, disrupted the meeting from within.

Suddenly, the attractions of

hitting the road grew.

JPMorgan Chase graciously laid on water and portable toilets for any

protesters who wanted to sit in a pen outside its annual meeting in

the outskirts of Tampa. Few did. Wells Fargo decided it would visit

Texas; Citi has ventured to St Louis; Goldman to Salt Lake City. No

major US company is believed to have selected Antarctica.

But now they don’t have to. In those San Francisco protests,

Mother Jones magazine

interviewed one protester who explained her presence: “It’s about

doing things in real life, like, physically.” Which suggests a

workaround. An increasing number of states — including, notably,

Delaware, where many companies are registered — now allow “virtual”

meetings. Here is the best part — moving from a conference centre to

the internet allows you to boast about improving shareholder access.

Now investors can submit questions online from anywhere in the world!

They can vote at the push of a button!

One recent convert, HB Fuller, a California-based adhesives company,

was “pleased to inform” its shareholders in the proxy filing that

announces annual meetings that it was not stuck in the past — it would

hold its first “completely virtual” meeting. Hewlett-Packard and its

spin-off HP Enterprise have gone virtual. GoPro’s shareholders, who

might well like to meet the well-paid management of their

poorly-performing company, cannot. SeaWorld Entertainment, which would

probably receive animal rights protests, is virtual only. Yelp, the

struggling reviews business, and El Pollo Loco, a chain of chicken

restaurants, have also gone virtual.

The disinterested observer can sympathise, in part. An annual meeting

can be tiresome, dominated by gadflies, priests and union officials

whose pet issues often have little to do with the core business. It is

rare for a heavyweight institutional investor, or even sellside

analyst, to cross-examine management. Activist battles are largely

waged in the run-up and most voting occurs in advance. Only Warren

Buffett can be counted on to throw a good party.

It is no surprise, then, that there appears to be rapid growth in a

virtual solution. Broadridge Financial Solutions, the leading virtual

meeting service, hosted only one virtual-only meeting and three hybrid

meetings in 2009. In 2015 it did 90 virtual only meetings and 44

hybrids. Cathy Conlon, vice-president of strategic development at

Broadridge, says the increase in 2016 is likely to surpass the 44 per

cent year-on-year increase in 2015. “The numbers are looking pretty

strong for proxy season,” she says, and points to “the ability to have

more transparency and the ability to have more shareholders

participate”.

This is only really true for the companies who use video or audio (the

vast majority select only audio) as a supplement rather than a

substitute to a physical meeting. Calpers, the large California public

pension fund, is one of many to argue against virtual only meetings

but more apolitical funds are not too bothered.

Mike Mayo, a banks analyst at CLSA, sees the rise of virtual meetings

as “a further marginalisation of the shareholder-company bond”. And

indeed one of the first virtual meetings, from software company

Symantec, drew complaints from shareholders that their online

questions had been ignored. Harder for that to happen face to face.

Institutional investors may prefer private meetings with management,

but as Mr Mayo notes, any concerns raised there may never reach the

independent board of directors. He adds: “Just because the

institutional investor community has fallen short in holding boards

accountable shouldn’t mean that boards provide even lower service to

shareholders.”

Ms Halasa, who now protests as part of a group called Revolution is

Sexy, says: “To keep this sanitised environment that effectively

quashes dissent is not in a company’s long-term interest.”

They are both right. The fact that few bother to use them effectively

does not mean that an annual meeting is useless. Companies should

think hard about joining the motley crew who have gone virtual only.

Using technology to broaden access is well and good; using it to shut

out shareholders is another.

tom.braithwaite@ft.com

Copyright The Financial Times Limited 2016. |