|

Share buyback machine remains in overdrive and experts warn it will end

badly

Published: Feb 4, 2016

2:34 p.m. ET

Companies are draining funds with buybacks, instead of investing in growth

|

Getty Images

Is Corporate America

letting its cash drain away?.

|

In the midst of a gloomy earnings season, the share buyback

machine has remained in overdrive, and some experts are cautioning it will

all end badly.

Companies,

even those that are missing profit and sales estimates and cutting

outlooks, or restructuring and cutting jobs, are still announcing

buybacks. Coming after a long period of intensive spending on shareholder

returns, the news is bad for investors hoping to see a return to growth.

“We

continue to be skeptical about how companies are deploying capital,

especially when it’s tied to stock-based compensation,” said Ben

Silverman, vice president of research at InsiderScore, a research firm

that tracks buybacks and legal insider trading for institutional clients.

“We believe buybacks can be used to mask management’s inability to grow

the business and be innovative thinkers.”

William

Lazonick, professor of economics at University of Massachusetts Lowell and

director of the Center for Industrial Competitiveness., went a step

further, suggesting that buybacks have the potential to push the U.S. into

recession. He argues that companies are using them to prop up share prices

at the expense of reinvesting in the business and supporting job stability

and long-term growth.

“It has

the potential to really drive the economy into the ground,” he said.

“Companies have given away so much money, it’s been a long-run secular

problem that has contributed to why income is so concentrated at the top.”

Data shows

that 78% of the total compensation paid to executives at the top 500 U.S.

companies in 2014 went on stock options and stock awards, he said.

“Executives are basically incentivized and rewarded for getting the stock

up, and buybacks are a prime way of doing that,” he said.

The

emergence of aggressive activist hedge funds has exacerbated the problem,

as they deliberately target companies with strong cash flow that can be

strong-armed into distributing those funds.

‘It

behooves people not to look at buybacks as some kind of magic bullet to

put a floor under the stock.’

Ben Silverman, VP at InsiderScore

Many

activist shareholders, including billionaire investor Carl Icahn, have

pushed companies to return more of the cash they hold to shareholders

through share buybacks. The idea is that buybacks boost earnings per share

by reducing the number of outstanding shares, and the additional buying

can raise the share price. However, It doesn’t always work out that way.

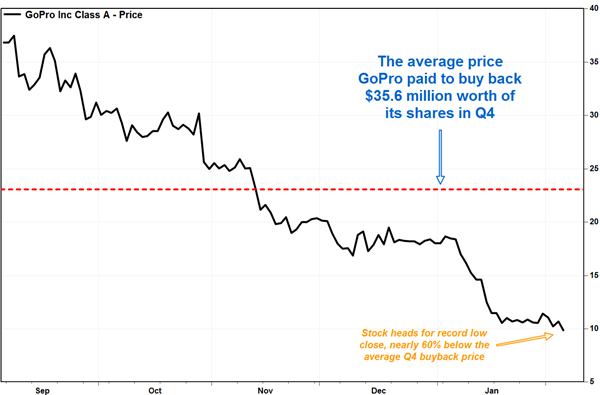

For

example, GoPro Inc.

GPRO said late Wednesday that it

spent $35.6 million to buy back stock during the fourth quarter, at an

average price of $23.05, but to little avail.

The

company still reported

a surprise fourth-quarter loss,

and provided a dismal first-quarter sales outlook. And the stock ended the

fourth-quarter $18.01, which was 22% below the average price the company

paid to buy them back.

FactSet

|

On

Thursday, it tumbled 8.5%, toward a record closing low, that was nearly

60% below what the company paid just a few months ago.

“I always

caution retail investors to not get too excited about buybacks, because

what are they doing?” Silverman said. “If the stock price is not

increasing, they’re just repatriating capital without getting additional

value from it.”

Shareholder returns in the form of dividends and buybacks hit a record

$245.7 billion in the third quarter, according to a report Thursday from

Arance (Investment Research), up 4.9% from the year earlier period. On a

trailing 12-month basis, returns to shareholders stood at a record $934.8

billion in the quarter, beating the previous record of $923.3 billion set

in the second quarter of 2015.

“The trend

is expected to continue to reach another record figure of $950 billion for

2015 and may likely touch the trillion-dollar mark,” said Aranca.

Companies

that spent large sums on buybacks in the December quarter may be wishing

they had waited, given the massive across-the-board selloff in January.

“It does

appear to be ill-timed,” said Silverman. “Companies as a group bought into

strength, rather than weakness.”

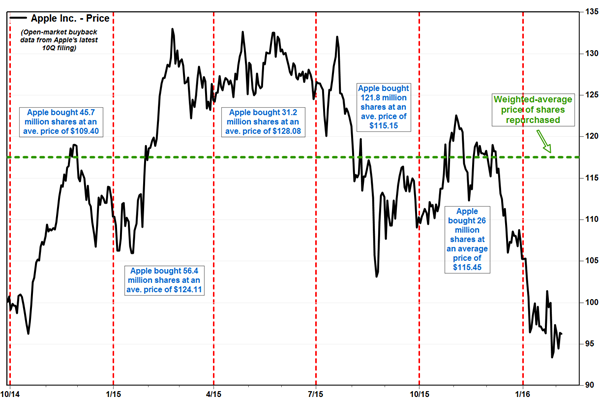

A good

example of this has been Apple Inc.

AAPL The technology giant

repurchased 281.12 million shares in open-market transactions over the

past five quarters, at a weighted average price of $117.48, according to

an analysis of data provided in the company’s latest quarterly filing.

FactSet

|

The stock

was trading at $96.60 in afternoon trade Thursday, or 18% below the

average price the company paid.

“It

behooves people not to look at buybacks as some kind of magic bullet to

put a floor under the stock,” Silverman said. “At the end of the day, the

market will typically reward companies that run their businesses well.”

|

Copyright

©2016 MarketWatch, Inc. |

|