|

How to protect your deal from

an activist

Deals, deals, deals… and activism. Why

companies shouldn’t be overly concerned about shareholders trying to

wreck their big moment.

Deal-making isn’t what it used to be. Increasingly, the advisers

corporate management teams and boards turn to when they announce a

transaction are advising on how to deal with an activist showing up,

and there is little chance of that threat receding. “In today’s environment every transaction comes under increased scrutiny, not

just from activists but also from other shareholders,” says David

Hunker, Executive Director at JP Morgan and head of the firm’s

activism defense practice. “The days when deals were decided on a

handshake are gone.”

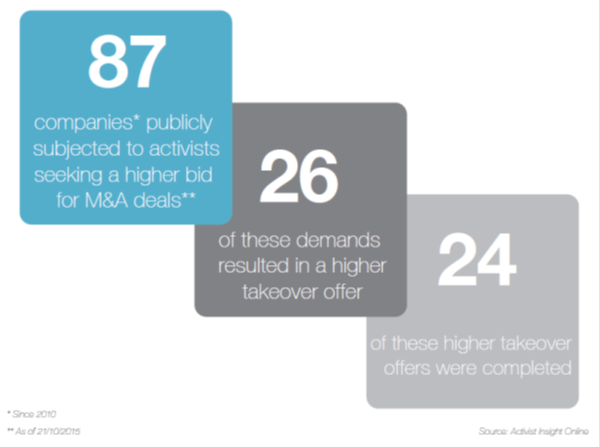

If

activists are often seen as mostly pro-deal, there are a significant

number of campaigns each year when the investors seek to hijack

previously announced situations. Activist Insight has tracked

“reactive” campaigns opposing either the rationale or the terms of

mergers or takeovers at 112 companies since the beginning of 2010,

with the overwhelming majority (97) facing criticism on the terms of

the deal, rather than the strategic basis.

|

“IF YOU ANNOUNCE A DEAL IN TODAY’S

ENVIRONMENT, YOU SHOULD HAVE A PLAN

READY IN CASE AN ACTIVIST EMERGES” |

This

year alone, Elliott Management has waged high profile campaigns at

Samsung C&T—where it said fellow Samsung- group company Cheil

Industries was underpaying—and Family Dollar Stores—where a rival

bidder had been frozen out of the auction process. Two years ago, Carl

Icahn was railing against the leveraged buyout of Dell and Starboard

Value publicly criticized Smithfield Foods over its planned

acquisition by Shangui. All four examples highlight another key

feature of so-called “deal activism”— they each completed, with only

Dell adjusting its price to see off Icahn’s rival bid. As Sabastian

Niles, of Wachtell, Lipton, Rosen & Katz, the New York law-firm known

for its corporate defense and M& A practice, says, “Value-creating

deals continue to get identified, signed and done, regardless of

activist intervention.”

How to prepare

“If

you announce a deal in today’s environment, you should have a plan

ready in case an activist emerges,” says Steve Balet, of the

communications firm FTI Consulting. “You should also understand your

shareholder base will change.” The acquirer will usually see its stock

sink, while a target’s rises as arbitrageurs pile in. The first few

days after a deal goes public are a treadmill of activity. During the

“rollout,” a company and its advisers publish press releases, host

conference calls, brief analysts, shareholders and reporters on the

merits of the deal, and try to get the “story” widely heard before

alternative viewpoints creep in. Gary Lutin, a former investment

banker and now Chair of the Shareholder’s Forum, an advisory group,

says economics should be foremost. “Focus on the real benefits of what

you propose, and provide decision-makers with information they can

trust,” he advises. “For example, an independent, peer-reviewed

valuation is more likely to compel support from shareholders

than a proponent-commissioned fairness opinion.”

“Issuers need to articulate the basis for value and deal rationale

clearly, forcefully and consistently,” says Niles. “That also means

focusing on the economic and, where relevant, governance aspects of

the deal to win the support of the proxy voting advisers.”

Highlighting a robust process at board level—most comprehensively in

the proxy statement if the deal requires shareholder approval—is

critical, he suggests. And prudently structuring and protecting

the deal, including by accelerating deal approval, regulatory

and closing timelines, is also advisable.

When activists attack

“M&A

activism requires a similar response to other forms of activism,” says

Hunker. “It’s the same combination of theatre and politics on the

activist side, and companies have to be able to sell the benefits of

the deal.”

Broadly speaking, shareholders can raise three main issues with a

deal. First, a class action lawsuit, which inevitably follows the

announcement of any transaction. Second, an activist investor could

run a hostile process—a withhold campaign or even a proxy contest— to

force management to reconsider. Finally, appraisal funds pursuing a

re- evaluation of the deal price through the courts, which has

the potential to be an ongoing distraction. Icahn threatened to

use this latter option at Dell, but the standard was instead taken up

by a small number of funds patient enough to tie up their capital for

long periods (two years later, valuation arguments have just been

heard).

|

“ACTIVISTS

LIKE

TO

RATTLE

THE

CAGE.

ANYONE

WHO

CAN’T

DEAL

WITH

THAT

SHOULDN’T

BE DOING

DEALS IN

THE

FIRST

PLACE” |

While

a robust process can mitigate all three risks, the prospect of facing

down an activist requires a more vigorous response from both the

board and management team of the companies involved—especially

since both the buyer and the acquirer may be targeted (as Virginia-based

Media General recently found). Some companies have dealt

with activists by bringing them inside the tent; OM Group offered FrontFour Capital Management board seats shortly before selling

itself, while TICC Capital appears to have bought the support

of Raging Capital Management with a board seat and a couple of other

concessions.

Game-theory

Activists are mostly looking for a bump in the price, some corporate

advisers argue. Although target companies must be careful not to

breach their fiduciary duties by leaving value on the table, acquirers

can adopt precisely the opposite approach. “Leaving a few dimes in

reserve to placate the inevitable activist agitator has become just as

much a part of the standard playbook as reserving a few disclosure

statements to buy off the inevitable class action lawyers,” says

Lutin.

Both

he and Niles argue that activists have plenty to lose from a deal

falling through, since the target’s stock will typically sink. To

Balet, however, yesterday’s dumped M&A targets may be tomorrow’s

activist fodder, if one isn’t already present on the share register.

“Activists get a free look at value when a deal is fended off,” he

says. “If the company’s stock price sinks after the deal collapses,

the activist knows what the upside is.”

Not

all boards should be worried, however. Most advisers see deal-activism as a game of brinkmanship, in which the activist has as much

to lose as the company. “Activists like to rattle the cage,” Lutin

muses. “Anyone who can’t deal with that shouldn’t be doing deals in

the first place.”■

|

All rights reserved.

The entire contents of Activism Monthly are the Copyright of

Activist Insight Limited. No part of this publication may be

reproduced without the express prior written approval of an

authorized member of the staff of Activist Insight Limited, and,

where permission for online publication is granted, contain a

hyperlink to the publication. |

PUBLISHED BY:

Activist Insight Limited

26 York Street, London, W1U 6PZ

+44 (0) 207 129 1314

www.activistinsight.com

info@activistinsight.com

Twitter: @ActivistInsight |

|

|