|

THE

WALL STREET JOURNAL.

Business

How Some Investors Get Special Access to Companies

In meetings with top executives, facts and body language flow from

public companies to handpicked recipients

|

A.G. Lafley, Procter & Gamble Co.'s chairman and chief

executive, speaks on just one of the company's earnings calls a

year but meets regularly with investors in private. PHOTO:

TIMMY HUYNH/THE WALL STREET JOURNAL |

By

Serena Ng and

Anton Troianovski

Sept. 27, 2015 10:24 p.m. ET

Procter & Gamble

Co. Executive A.G. Lafley speaks on just one earnings conference call

a year, down from his previous practice of every quarter. The company

says that helps him stay focused on pulling P&G out of a growth slump.

But Mr. Lafley still meets

regularly with investors in private. In March, Mr. Lafley’s comments

during a string of conversations with investors in New York gave a

Wall Street analyst who was present the strong impression that he

would step aside as CEO sooner than expected. That hunch was confirmed

in July.

P&G says it is careful not

to reveal market-sensitive information to investors and analysts who

get special access to the company.

For the past 15 years, selective

disclosure by companies has been illegal under U.S. securities rules.

Yet the same rules explicitly allow private meetings like those by

P&G.

The result is a booming

back channel through which facts and body language flow from public

companies to handpicked recipients. Participants say they’ve detected

hints about sales results and takeover leanings. More common are

subtle shifts in emphasis or tone by a company.

“You can pick up clues if

you are looking people in the eye,” says Jeff Matthews, who runs Ram

Partners LP, a hedge fund in Naples, Fla. He says he never invests in

a company without meeting its management.

|

A Bebe Stores window in New York City. In April, the retailer

said it had made an ‘inadvertent disclosure’ while meeting with

a ‘select group of investors.’

Photo: Craig Warga/Bloomberg News

|

|

Access usually is

controlled by brokers and analysts at Wall Street securities firms,

who lean on their relationships with companies to secure meetings with

top executives. Invitations are doled out to money managers, hedge

funds and other investors who steer trading business to the securities

firms, which in turn provide the investors with a service called

“corporate access.”

Investors pay $1.4 billion

a year for face time with executives, consulting firm Greenwich

Associates estimates based on its surveys of money managers. The

figure represents commissions allocated by investors for corporate

access when they steer trades to securities firms.

Publicly traded U.S.

companies held an average of 99 one-on-one meetings with investors

apiece last year, according to a survey by market-information company

Ipreo.

General Electric

Co. said in its annual report that it “ensured strong disclosure by

holding

approximately 70 analyst and investor

meetings with GE leadership present” in 2014. The total was

roughly 400 when including meetings with other executives, such as

those in GE’s investor-relations department, a spokesman says.

Companies that use closed-door dialogues

say they help executives persuade current and potential investors that

the company’s stock is a worthwhile investment. But some companies

avoid the practice.

Morningstar Inc.,

a financial-research firm based in

Chicago, says it holds no private meetings because all investors

should have equal access to the same information.

Easy to

trip

And it is easy for companies to trip over

the legal line. In April,

Bebe Stores Inc.

told what it called a “select group of

investors” that the retailer was “meeting our expectations.”

The next day, Bebe, based

in Brisbane, Calif., disclosed the same comment in a securities

filing, saying it had

made an “inadvertent disclosure.”

The company didn’t respond to requests for comment.

Communication by publicly

traded companies is closely regulated and usually scripted carefully.

Companies report financial results every three months in news

releases, typically following up with open conference calls to discuss

the results in more detail.

Between quarterly results,

company executives often make presentations to investors at

conferences sponsored by securities firms and have one-on-one meetings

with large investors on the side. Some companies host investor

meetings at their headquarters, or their executives may go on

“roadshows” to meet with shareholders and potential investors.

During the stock-market

boom of the 1990s, some companies leaked earnings forecasts to certain

securities analysts, who then passed the information along to their

clients. The details sometimes differed widely from the opinions

published by the same analysts in official research notes.

After the technology

bubble burst, the Securities and Exchange Commission cracked down with

a rule called Regulation Fair Disclosure. Since 2000, Reg FD has

penalized selective disclosure of

information that might be reasonably expected to affect the price of a

stock or bond.

Companies and securities

firms lobbied successfully to preserve the right to hold private

meetings with investors. During the rulewriting process, Lou Thompson,

president of the National Investor Relations Institute at the time,

says two of the trade group’s board members role-played to SEC

officials a hypothetical conversation between a company executive and

securities analyst to help convince regulators that executives could

speak privately “without giving away the store.”

But some academic

researchers have concluded that investors often can turn special

access into a trading advantage and profits.

A recently published paper

in the Journal of Law and Economics analyzed the trading behavior of

dozens of investors who met during a 5½-year period with senior

management of a company listed on the New York Stock Exchange.

|

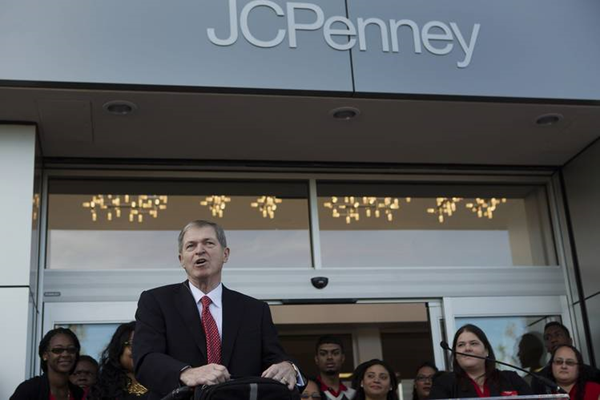

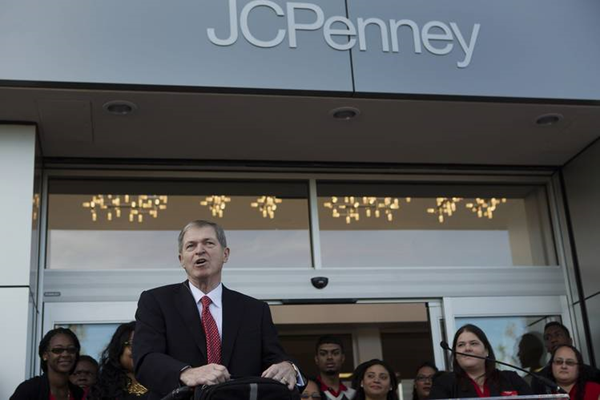

J.C. Penney CEO Myron ‘Mike’ Ullman speaks at an event in

Brooklyn in 2014. The company’s shares sank 15% after some

investors didn't like Mr. Ullman's body language at a breakfast

meeting in September 2013.

Photo: Victor J. Blue/Bloomberg News |

While the paper doesn’t

identify the company or investors, researchers concluded that the

investors who got face time with management made better trading

decisions. Several large hedge funds met the company as frequently as

once a quarter.

“I think firms are

following the law, but clearly some investors are gaining access to

preferential information,” says Eugene Soltes, a Harvard Business

School professor and one of the paper’s authors.

A separate study that

hasn’t been published in an academic journal examined trading data

right before and after 7,668 company conference presentations. More

than half of the presentations were accompanied by private meetings

between investors and executives.

Brian Bushee of the

University of Pennsylvania’s Wharton School and two other academic

researchers concluded that

trading volume picked up around

the time of the private meetings. Trades made then were more likely to

be profitable than trades made at other times.

Securities analysts also

can get an edge from special access to company executives. Analysts

who hosted executives at an investor conference made more accurate

earnings forecasts and changes to their ratings during the next three

months than other analysts,

according to a paper by Stanimir

Markov, an associate professor of accounting at Southern Methodist

University, and three co-authors.

Sidoti & Co., a New

York brokerage firm that earlier this year filed documents to go

public, has said in securities filings that its analysts generally

don’t cover companies that limit access

to their senior executives.

Sidoti also offers clients

access to senior management, “which our clients can use to improve

their trading decisions and ultimately their investment returns,”

according to the brokerage firm. Sidoti declines to comment further.

At P&G,

Mr. Lafley’s approach has changed

since he returned as chief executive in 2013. As CEO from 2000 to

2009, he more than doubled the company’s revenue and market value. He

came back after his successor left amid shareholder discontent over a

downturn in the company’s performance.

Mr. Lafley turned down

requests for media interviews and kept a low public profile. He cut

back his appearances on earnings calls, while continuing to make

occasional presentations at investor conferences and meeting

one-on-one with large P&G shareholders and potential investors.

In February 2014, a group

of analysts and investors flew to Cincinnati to hear presentations by

Mr. Lafley and other top P&G executives, including two who were

candidates to become the company’s next CEO.

The executives explained

how they were making productivity gains and cost cuts a priority, and

they discussed P&G products ranging from household cleaners to

shampoos.

At one point during the

half-day meeting, a P&G executive in charge of investor relations

mentioned that foreign-currency exchange rates had shifted in recent

weeks, according to two people who were present. The company had

issued a financial forecast two weeks earlier with its quarterly

results.

A few days after the

meeting, the three analysts who attended published reports summarizing

their visits to P&G. Each said P&G might reduce its earnings forecast

because of bigger-than-expected foreign-exchange headwinds.

P&G soon announced that it

was revising its sales and earnings estimates to account for the

foreign-exchange moves. Its shares fell 1.7% the next day.

Company spokesman Paul Fox

says executives didn’t disclose any new information during the

meeting. He says the company had said before that its financial

forecast was based on prevailing currency exchange rates.

Since then, Venezuela, a

major market for P&G, had undergone a widely known devaluation of its

bolivar, as the company noted in a securities filing before the

meeting.

Ever since Mr. Lafley

returned to P&G, analysts and investors have wanted to know how long

he might stay as CEO. Mr. Lafley and other executives said publicly

that he would stick around for as long as the board of directors

wanted him.

In early 2015, several

analysts who hosted meetings with top P&G executives reported that the

executives discussed how the company could benefit from having Mr.

Lafley remain chairman for a year or two after a successor was chosen.

Wendy Nicholson of

Citigroup Inc.’s Citigroup

Research,

concluded from Mr. Lafley’s comments

in meetings her firm arranged that Mr. Lafley would likely relinquish

the CEO job later this year, or earlier than expected.

In July, P&G’s board

announced that company veteran David Taylor will

take over as CEO on Nov. 1, with

Mr. Lafley shifting to executive chairman.

Mr. Fox, the P&G

spokesman, says the company didn’t actively discuss succession plans

at any investor meeting. Our response [was] always the same” when

asked about the eventual CEO shift, he says.

P&G shares didn’t move

much around the time of the meetings but are down 9.4% since the CEO

change was announced and P&G reported weaker-than-expected results.

Watching

for clues

Investors who attend

private meetings with company executives say they watch carefully for

clues in much the same way as good poker players do.

In 2013, representatives

from 10 investment firms sat down for dinner in Boston with

Regions Financial Corp.’s finance

chief and other executives of the Birmingham, Ala., bank holding

company.

The invitation-only event

happened a few days before the Federal Reserve was due to release

results of its annual “stress tests” for large banks, which would

determine if Regions could return more capital to shareholders.

At the dinner, Regions

executives appeared “very confident” that the company would be able to

boost dividends or stock buybacks, according to a note from Kevin

Fitzsimmons, a banking analyst who organized the event for clients

while working at Sandler O’Neill + Partners LP.

Mr. Fitzsimmons upgraded

his rating on Regions shares to a “buy,” citing the company’s “upbeat

tone.” The shares edged higher, and Regions won approval from the Fed

a few days later to raise its dividend.

A Regions spokeswoman says

management had no insight into the Fed’s decision ahead of time. She

says the analyst’s conclusions were consistent with broad public

statements that the bank had made for some time.

Mr. Fitzsimmons, who now

does banking research at Hovde Group LLC, says meetings with companies

“can have value even if management isn’t saying anything new, because

investors can gauge their tone and confidence level.”

Securities regulators have

little or no way to monitor what goes in the thousands of private

meetings with analysts and investors that take place each year at

publicly held companies.

A few years ago, the SEC

sought information from multiple securities firms about meetings they

set up between companies and investors, according to people familiar

with the matter.

Regulators wanted to know

how the meetings were conducted and what was being done to ensure

compliance with Reg FD, these people said. No action was taken after

the inquiry, the people added.

An SEC spokesman wouldn’t

say if the agency has sought similar information more recently or is

considering doing so now.

Arthur Levitt, who led the

SEC when Reg FD was passed, says the agency “should conduct

examinations of meetings and come down hard on people who are

violating FD either accidentally or intentionally.”

In the past 15 years, the

SEC has brought 14 enforcement actions under Reg FD, according to

Joseph Grundfest, a former SEC commissioner who now is a professor at

Stanford University.

Most of the cases related

to selective disclosure of earnings guidance, financial performance or

business activity levels, he says. Regulators also found examples of

private statements by executives that differed from public comments.

Most of the firms consented to cease-and-desist orders, and some paid

small civil penalties to settle the allegations.

Regulators usually look

for telltale signs, such as a large stock-price move, that

market-moving information might have been leaked. Even then, though,

it can be hard for the SEC to make a case.

In September 2013,

J.C. Penney Co. Chief Executive

Myron “Mike” Ullman sat down for breakfast with about 30 investors in

New York to add context to the retailer’s financial results released

the previous month.

The Plano, Texas, company

was trying to reverse a deep sales slump, and speculation was rife

that its finances were rapidly weakening.

At the meeting, one person

pressed Mr. Ullman for an update on Penney’s cash position and asked

if the company needed to raise capital, according to people who were

there. Mr. Ullman referred to numbers Penney had disclosed earlier and

said he couldn’t share more information.

Some investors didn’t like

Mr. Ullman’s body language, and Penney shares sank 15% after the

meeting. The stock sank again after Penney

announced a large share sale the

next day. The SEC launched an inquiry into the stock offering but

shortly after closed the probe.

Write to

Serena Ng at

serena.ng@wsj.com and Anton

Troianovski at

anton.troianovski@wsj.com

|