Divided Nation

Rise of activist investing is felt at

century-old firm

Investors saw

opportunity; paper firm CEO, a threat

|

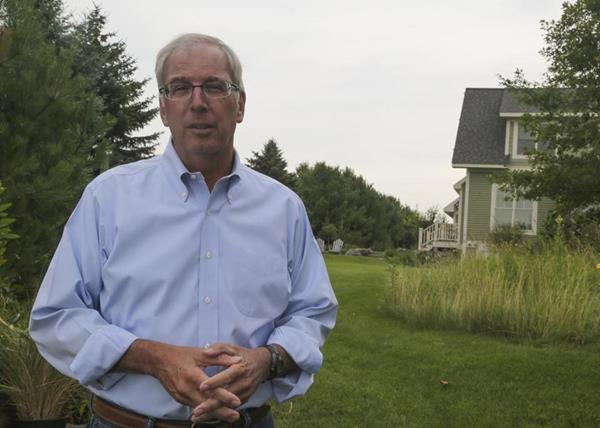

Nathan Wallin for

The Boston Globe

Hank Newell, former

head of Wausau Paper, blamed activist investor Jeffrey Smith for

undermining a deal that could have saved the mill. |

By

Michael Kranish

| Globe

Staff August 15, 2015

BROKAW, Wis. — For more than a century, this village on the banks of

the Wisconsin River stood as a symbol of one way the American economy

was built, a compact between a company and a community.

Wausau

Paper built the houses, stores, and even the Methodist church.

Hundreds of workers streamed down Everest Avenue to work at the mill,

which hummed day and night, its signature smokestack looming over the

landscape.

But as

a former Army artillery officer named Hank Newell prepared a few years

ago to take over as Wausau Paper’s chief executive officer, he knew he

faced a dilemma. The mill seemed prosperous, as workers produced a

rainbow of colorful paper products at one of the largest such plants

in the world. Yet the company needed to sell the mill as it reshuffled

its priorities in a fast-digitizing world, and Newell wanted a buyer

who would keep the place going.

Otherwise, 450 people could lose their jobs and the village itself

might go bankrupt.

The

negotiation to sell the plant was at a delicate stage, Newell said in

an interview, when he received a letter that alarmed him from a New

York City hedge fund called Starboard Value. Newell soon learned that

the fund’s chief executive officer, Jeffrey Smith, was part of a new

breed known as “activist” investors, who scoop up a sizable portion of

company shares and fight to boost the price. And Smith, even as he

snapped up Wausau shares, was calling for big changes at the

struggling firm.

What

followed was a clash of corporate cultures that is being played out

across America, a Main Street versus Wall Street story with a powerful

new twist provided by the growing clout of activists. It is a trend

that could eventually affect the majority of publicly traded companies

and tens of millions of workers.

Activist investors scour reams of data about the nation’s publicly

traded companies in search of targets. They look for firms that may

have piles of extra cash, or that can be reshaped quickly. They often

cast themselves as outsiders who can take a cold-blooded look at a

firm’s finances, and push for steps that can boost a company’s stock

price.

Activists say they provide a valuable service by turning around poorly

run companies, pressing for change, and forcing out ineffective

executives. Critics of the practice, however, said that companies can

be blindsided by high-flying investors whose main goal is to quickly

profit from their stock position, regardless of the long-term impact

on companies and communities.

Popular

strategy

|

|

Nathan Wallin for The Boston Globe

The Wausau Paper mill in the village of Brokaw, Wis., the

world’s biggest producer of colored specialty paper, employed

450 people before it closed in 2012.

|

The

strategy has become one of Wall Street’s hottest trends. The number of

major activist investors has tripled to 203 in the last four years,

while the number of companies subjected to pressure from activists has

jumped from 136 to 344 worldwide during that time,

according to the publication Activist

Insight.

Such

investors are having more success than ever, not just by pressuring

companies to change, but also by winning in nearly three-quarters of

proxy fights, which typically involve battles over board seats and

thus sway over corporate strategy, according to Factset.

All of

this is starting to resonate in the presidential campaign. Democrat

Hillary Rodham Clinton on July 24 blasted what she called “hit-and-run

activists” during

a New York City speech in which

she proposed a series of restrictions on the practice.

Republican Donald Trump said in June that, if elected president, he

would like to nominate one of the nation’s leading activist investors,

Carl Icahn, to be secretary of the Treasury. (The 79-year-old Icahn

responded on his blog that he does “not get up early enough

in the morning to accept this opportunity.”)

Newell, suddenly swept up into this new world of activism, hoped that

he could persuade Smith to be patient.

Lightning struck near Newell’s home on the Wisconsin River in March

2011 — a moment of peril that proved a personal turning point as well.

Newell

was hours away at the time. He was visiting a company plant in

Kentucky that was central to his plan to remake Wausau Paper. He

wanted to pour company resources into the plant to focus on products

such as tissues and toilet paper, business lines holding up better in

the digital age. His goal was to produce such products in an

environmentally friendly way. As prosaic as the products seemed, they

were the company’s future.

In

short order, Newell would receive a series of rude awakenings, first

on the homefront, and then in his business world.

The

lightning strike near his house set off a chain reaction. Indirect

lightning can travel through a nearby house’s wiring, knock out smoke

detectors, and cause gas appliances to torch. Newell’s wife, Becky,

was asleep as flames spread toward the bedroom.

The

Newell’s dog, Dolly, pawed Becky’s shoulder and awakened her. Feeling

the heat from the other side of the bedroom door, she left it closed,

scrambled to the first floor window and leapt out, her life saved by

her dog and her quick wits.

As

Becky, who had been home alone, gathered herself, hearing the distant

sirens gradually come closer, she soon saw volunteer firefighters leap

from the trucks.

She

realized that a number of them were Wausau Paper mill workers who had

left their own homes, risking their lives to save hers. Hearing of the

dog’s heroics, a number of mill workers decided to donate to the local

Humane Society in honor of Dolly, who survived the fire.

As

Becky later related her survival story to her husband, the couple saw

it as confirmation of what they believed about how a community and its

major employer should interact; it became for them a defining moment.

Newell

had long worked in the paper industry and knew that change, sometimes

disruptive change, was a constant. But he also saw more clearly now

that they were all part of a community, not just a company, and were

in it together. That was the way Newell wanted to run the company, he

said.

Some

of the mill workers had questioned whether Newell was just another

drive-by executive, whether he really was committed to the small-town

mills.

He

was. He would rebuild his house and stay at Wausau Paper for the long

term – or so he thought — and try to preserve as many of the company’s

jobs as possible.

Wall Street

steps in

Two

months later, another thunderbolt arrived, this time from Wall Street.

Newell

in June 2011 had had a cordial get-acquainted meeting with Smith but a

month later the tone had changed.

Smith,

in a public letter, criticized what he called the “dismal performance”

of the company’s paper business, the focus of the Brokaw mill, urging

that Wausau get out of that product line. He also criticized Newell’s

plan to invest $220 million to modernize a Kentucky plant that

produced tissues, toilet paper, and towels.

Smith’s criticism drew headlines across Wisconsin. “Wausau Paper

shareholder concerned over lagging paper business,” said the headline

in The Wausau Daily Herald on Sept. 11, 2011.

No one

disputes that there were concerns about the future of the Brokaw mill,

given the shift in market trends. But Newell said the mill had years

of useful life.

He

said that after Starboard’s criticism, the would-be buyer lowered its

offer to an unacceptable price, and then a major customer of the mill

went elsewhere. Smith, however, would later blame the problems on

management failures by Newell and others.

Either

way, the mill was no longer sustainable. Word began to leak that the

Brokaw mill would close.

Jeffrey Weisenberger, like his father before him, had long worked at

the sprawling paper mill here on the banks of the Wisconsin River,

earning a good living. Growing up in Brokaw, Weisenberger said, was

like being in “a touch of heaven,” with the company providing nearly

all that was needed. Wausau Paper was founded here in 1899 by Norman

H. Brokaw, for whom the village is named.

Weisenberger figured the work would be there for generations to come.

By 2011, Weisenberger had put in 35 years, enough to assemble the

trappings of a good life in the Wisconsin, a place in the north woods,

boat, truck, motorcycle. He had time to fish and hunt and devote time

to the place he loved most, becoming Brokaw’s village president.

Weisenberger had heard that a New York City-based hedge fund had

started buying shares of Wausau Paper. He knew from his work as a

union shop steward that the Brokaw mill was the world’s biggest

producer of colored specialty paper, such as the brightly colored

index cards for sale at Staples. He didn’t believe the mill was at

risk.

Then

one day in 2011 he received a call on his cellphone, while he was at a

funeral, that the mill would close.

| |

Nathan Wallin for The Boston Globe

“I’ll never forget it,” Weisenberger said. “It was Dec. 7, ‘day

of infamy.’ It was the day I buried my father and the day I lost

my job.”

|

It

fell to Newell, who was promoted from chief operating officer to chief

executive in January 2012, to complete the closure of the Brokaw mill.

It was in the end Wausau Paper’s decision — affirmed by Newell and the

board of directors — not that of Smith or Starboard Value, which did

not operate or control the firm or have insider access to corporate

financials or strategic plans.

But to

this day, Newell believes the Brokaw mill could have remained open if

it had not been for Starboard’s public criticism that he believes

undermined his effort to sell the plant.

“No

reason why that mill would have had to shut,” Newell said. As for

Starboard’s role, he said: “Starboard has no responsibility. That’s

part of the issue. An activist has no responsibility for the things

they say in the public domain.”

Smith

and his Starboard partner, Gavin Molinelli, who now sits on Wausau’s

board, declined to speak on the record about Newell’s version of

events.

An

activist investor allied with Smith said Starboard should be praised

for trying to rescue the company and blamed Newell for the problems,

but this investor also declined to speak on the record. Wausau Paper

officials similarly declined to speak on the record and provided only

a press release that confirmed the company had tried and failed to

sell the Brokaw mill.

The

plant closed for good in early 2012. Then a Minnesota mill was closed,

costing 134 jobs, which Newell said was a ripple effect of the failed

Brokaw sale, but which Smith charged in another letter was another

sign of bad management.

The

clash between Newell and Smith escalated in their public letters;

Smith wrote that the company had a history of “failed commitments,”

while Newell cosigned a letter that said Smith’s charges were “without

any basis in fact.” Smith, meanwhile, used his leverage to get four

Starboard-backed candidates on the nine-member board of directors.

Newell’s control was becoming tenuous.

Stock

buyback twist

Jeffrey Smith strode to a stage at New York City’s Time Warner Center

on Sept. 17, 2013, and waxed rhapsodically to hedge fund managers and

reporters about why investing in Wausau Paper would be so lucrative.

Toilet

paper,

he said, “is a beautiful,

beautiful business.”

Smith

thought things were going so well that he dropped a bombshell. He

wanted Wausau Paper to make what is known as a “stock buyback.”

| |

HEIDI GUTMAN/CNBC/NBCU PHOTO BANK VIA GETTY IMAGES

Activist investor Jeffrey Smith publicly criticized the way

Wausau Paper was being managed.

|

Smith

believed that the company, then worth about $650 million, could afford

to allocate $100 million to buy back stock. In some cases, stock

buybacks jack up the price because fewer shares are available. As the

company’s single largest shareholder, holding about 15 percent of the

stock, Smith’s hedge fund stood to benefit if the share price went up.

Such

buybacks are now common but controversial. Typically, they are done by

companies flush with extra cash, which was not the case with Wausau.

But the Wall Street audience was cheered by Smith’s buyback plan, as

well as his call for the company to increase its dividend. As he

spoke, the stock of Wausau Paper climbed upward.

Smith

followed up with

a letter to Newell on Oct. 22,

2013, in which he said he found it “particularly troubling” that

Newell “would like to prioritize growth,” at Wausau, charging that

Newell had made “value destructive capital investments.” He urged

Newell to commit “to returning a large portion of cash” to

shareholders.

He

began one section of the letter with the headline, “Wausau Should

Initiate a Buyback Now, then Increase its Dividend Substantially.” He

tied the call for a buyback and dividend hike to the company meeting

its own rosy financial projections — projections that did not pan out.

Newell

says he was stunned by the buyback proposal. He said that far from

having extra cash with which to buy back stock, the company would have

had to try to borrow money to pay for it. He said he needed the

company’s cash to pay off the debt on the $220 million tissue-making

machine in Kentucky, on which he had bet the firm’s future.

The

clash highlighted one of the biggest debates on Wall Street: While

some activists argue that a company’s main obligation is to its

shareholders, others say that many factors such as the impact on jobs

and communities must be top priorities.

“The

reality is I have 25 to 30 percent of my stock controlled by hedge

funds, all articulating ‘share repurchase and dividends,’ ’’ Newell

said, noting that other activists had piggybacked on Starboard’s

investment. “And so it presents a dilemma for the company.”

For a

while, Wausau stood by Newell,

issuing a January 2014 press release

that attacked Starboard’s plan to try to control the board. “We

believe that it is disproportionate and inappropriate that Starboard —

which holds only 15 percent our shares — should be able to designate

the majority of the board,” Wausau wrote. But the activist investors

won the day, and Newell resigned in April 2014. Shortly thereafter,

Starboard successfully nominated Smith’s partner, Molinelli, to sit on

the board and gained majority control.

The

circle was complete: In less than three years, Starboard had gone from

being an obscure investor to controlling the board. During this

tumultuous transition, mills were shut or sold. A chief executive was

replaced.

Starboard has high hopes that profits will grow and gives itself

credit for righting the company. Those who lost jobs can only wonder

whether it was due to structural change in the paper business, poor

management, activist demands, or a combination. What is clear is that

what happened to Wausau Paper is being echoed at many other companies

as activism grows, for better or worse.

Preston Athey, who managed the T. Rowe Price Small Cap Value Fund, one

of Wausau’s largest shareholders at the time, saw the fight unfold.

His fund was a longtime “passive” investor, making suggestions and

anxious for better returns, but willing to be more patient to see if

Newell could succeed.

“Part

of this issue from Mr. Newell’s standpoint was he was not given the

time to see if the changes that he had put in place would work,” said

Athey, a T. Rowe Price vice president who no longer manages the fund.

“In a sense, it is not his fault it hasn’t been turned around, but it

is fair to say that changes had been a long time coming.”

Wausau

Paper, having sold its other two Wisconsin mills, no longer has any

presence in the state aside from its headquarters.

Smith

has gone on to much glory on Wall Street.

Forbes magazine calculated that

his firm made a profit in 84 percent of its activist campaigns since

2002. One of Smith’s big successes came when his hedge fund purchased

5 percent of AOL’s stock and, after applying pressure on management to

sell patents and other assets in 2012, the value of his shares soared

250 percent, according to a report by Fortune, which

last year called him “the investor

CEOs fear most.” Starboard was named the

No. 1 activist of 2014 by the

trade publication Activist Insight.

Smith’s investment in Wausau Paper has not gone as well. He began

accumulating significant amounts of Wausau stock around June 2011,

when it was in the $6 range. It closed on Friday at $8.65.

More

than a year after Starboard won control of the board, the company has

not done a stock buyback or raised its dividend. Smith has held on to

the stock for four years, much longer than the short-term reputation

of activists might suggest, and has continued to express confidence

that the share price will go up.

Newell, sitting at his home down-river from the Brokaw plant, said he

is speaking out because the public should understand the impact that

some activist investors can have on companies and communities.

“Shareholders have responsibility as well as rights,” Newell said.

“When employees in small towns work their whole lives for companies at

the same place, there’s a broader social responsibility of companies

to do their darnedest so those operations survive. . . . Employees are

more than a cost. They are the biggest asset that a company has.”

Restrictions

sought

The

case has prompted US Senator Tammy Baldwin, a Wisconsin Democrat, to

call for restrictions on activist investors, which she said she will

outline soon in legislation. She said she was “shocked” by Starboard’s

criticism of Wausau for preferring growth over a $100 million stock

buyback.

“Part

of what we should be looking at is the impact of decisions of the

workforce, the impact on communities, and there’s no better example of

that than the impact on Brokaw,” she said.

Back

in

Brokaw, the village’s 248 residents struggle with the

aftermath of the mill closure. The village’s sale of water to Wausau

Paper had accounted for 95 percent of its revenues, which it relied on

to pay for the water system. The village tried to make up some of the

loss by raising taxes to three times the rate of neighboring

municipalities, and the water rate to five times the nearby level.

That hasn’t been nearly enough.

Weisenberger, in his role as village president, tried to declare the

village bankrupt, but Wisconsin officials told him that wasn’t allowed

under state law. Governor Scott Walker, a Republican seeking the

presidential nomination, did not respond to a request for comment. An

aide said a provision was included in the state budget that would

allow Brokaw to be subsumed by two neighboring municipalities that

would have to pay off its debts.

In

other words, Brokaw would no longer exist.

Some

longtime residents can’t accept the idea that their village might

disappear. Across the street from the mill, the Frank family is

working on a plan. For three generations, the family has sent its

members to the mill, and they have been a fixture in Brokaw since the

1920s. Ruthelle Frank, now the 87-year-old family matriarch and a

former mill employee, feels betrayed.

“I

don’t think anybody could appreciate what this little town was and

what was destroyed,” she said.

She

recently heard of the website GoFundMe, which enables anyone to

finance a cause. She talked it over with her husband, Henry, who

worked at the mill for 38 years, and her children, Rochelle and

Randall.

“It’ll

take YOU to save a VILLAGE,” the Franks

wrote on the website. They set a goal they believe would

enable Brokaw to avoid dissolving: $2.5 million. The response got

local news coverage but, as of Friday, had raised only $756, much of

it from the family.

Ruthelle is trying to remain optimistic. Maybe, she said, there’s an

investor out there willing to bet on Brokaw.

Michael Kranish can be reached at

kranish@globe-.com.

© 2015

Boston Globe Media Partners, LLC |