|

Business Day

Why Putting a Number to C.E.O. Pay Might Bring Change

AUG. 6,

2015

It is

a confounding truth about outsize

executive pay — all past attempts

to rein it in have failed.

So why

does anyone expect a different outcome from the

Securities and Exchange Commission’s

new

rule requiring disclosure of the

gap between what a company’s chief executive is paid and what its

rank-and-file workers earn?

I put

that question to some experts on executive pay; several of them gave

intriguing reasons to be optimistic that this rule may actually do

something to curb over-the-top pay.

Their

thinking goes like this: Because the rule will generate an easily

graspable and often decidedly shocking number, it may energize a cadre

of new combatants in the executive pay fight. And because these

newcomers — company employees, state governments and possibly even

consumers — will most likely be more vocal on the matter than

institutional investors have been, the executive pay bubble might

actually start to deflate.

“The

pay ratio was designed to inflame the employees,” said

Charles Elson, professor of

finance and director of the John L. Weinberg Center for Corporate

Governance at the University of Delaware. “When they read that number,

employees are going to say, ‘Why is this person getting paid so much

more than me?’ I think the serious discontent will force boards to

reconsider their organizations’ pay schemes.”

The

rule, which passed the commission on a 3-to-2, party-line vote, has

been five years coming. Under the Dodd-Frank law, the S.E.C. had to

come up with a regulation requiring large public companies to

calculate the difference between what their top executives receive in

compensation and the median pay level for their other employees.

The

new rule goes into effect Jan. 1, 2017, over strenuous opposition from

the

U.S. Chamber of Commerce and other

corporate lobbying groups. But there was also support for the rule

from investors, individuals, academics and advocacy groups. More than

287,000 letters poured into the S.E.C. after it

proposed the rule in September

2013.

The companies’ pay ratios haven’t been calculated yet, but everyone

acknowledges that many will be astronomical. A

2014 study by Alyssa Davis and

Lawrence Mishel at the Economic Policy Institute, a left-leaning

advocacy group in Washington, showed that chief executive pay as a

multiple of the typical worker’s earnings zoomed from an average of 20

times in 1965 to almost 300 in 2013.

Some

companies’ ratios will be far

higher than that.

And

yet, Brian Foley, an independent compensation consultant in White

Plains, said the way the S.E.C. was requiring companies to calculate

the rule would probably understate the true pay gap. That’s because

the calculation, which relies upon what is known as the summary

compensation tables in the annual proxy statement, does not include

the total amounts executives have built up in their pensions and

supplemental retirement plans.

“The

pension numbers baked into the summary compensation table are only

year-over-year improvements and don’t begin to capture how much the

C.E.O. has on the table in terms of retirement money compared to how

much the troops typically have on the table,” he said.

The

S.E.C. has always contended that the rule will help inform

shareholders, especially as they ponder how to vote on companies’ pay

practices.

But

Mr. Foley doesn’t think investors will pay much attention to the new

rule. Neither does James Reda, managing director of executive

compensation consulting at Arthur J. Gallagher & Company. “It is not

clear how institutional investors or their advisers will use the pay

ratio, if at all,” he said. “However, it is conceivable that labor

pension funds may use the number to consider an investment in a

company.”

| |

Fair Game

A

column from Gretchen Morgenson examining the world of finance

and its impact on investors, workers and families

See More »

|

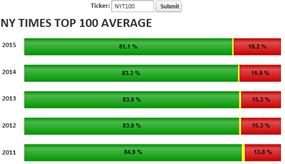

The

fact is, few institutional shareholders appear to be distressed by

excessive pay levels at companies whose shares they hold. A tally by

the Shareholder Forum of the most

recent votes on pay practices at companies in the Standard & Poor’s

500-stock index shows a median support level from shareholders of 94.9

percent this year.

This

complacency could have a lot to do with the rising stock market. But

it almost certainly does not reflect the views of 95 percent of

investors. What it does reflect is the practice of large

mutual fund companies like

Vanguard and Fidelity to vote their clients’ shares routinely in

support of lush pay practices whether they like it or not. These

voting policies help keep corporate boards clubby and executive pay

aloft.

Although institutional investors will probably continue to look the

other way on executive compensation, the disclosure of a pay gap may

encourage other stakeholders to act differently. That’s the view of

Sarah Anderson, global economy project director at

the Institute for Policy Studies,

a left-leaning organization in Washington.

“It

makes a lot of sense to bring the C.E.O. pay ratio out of the

shareholder realm and into the consumer’s,” Ms. Anderson said.

“There’s also interest at the state level to take this indicator of

C.E.O.-to-worker pay and incorporate it into tax policy and

procurement policy.”

She

cited a

2014 bill proposed in the

California Senate that would have raised the state’s corporate income

tax to 13 percent from 8.84 percent for companies that pay their top

executives over 400 times the median pay of their workers. That bill

also would have lowered the tax rate to 7 percent on companies with a

top-executive-to-worker pay divide of less than 25 to one.

The

bill did not pass with the two-thirds majority it needed, but one of

its co-sponsors is working to move it forward, Ms. Anderson said.

In

January, five Rhode Island senators introduced

a bill setting preferences for how

state contracts are awarded, giving a leg up to businesses that have

relatively low pay ratios of 25 to one.

A

companion bill may be introduced in the Rhode Island House of

Representatives in the next session.

It’s

possible, too, that some consumers, disturbed by the disparity between

a corporate chief’s pay and that of lower-level workers, will change

their shopping habits to favor companies whose pay is fairer. If

institutional investors won’t vote with their feet on this matter,

perhaps consumers will.

“Everybody is outraged about C.E.O. pay, but people feel they can’t do

anything about it,” Ms. Anderson said. “What I’m hoping is that this

will give people something to do about it that’s concrete.”

[The Fair Game column appears in print on page

BU1 of the Sunday New York Times.]

© 2015 The

New York Times Company |