|

This Chart Shows How CEOs

Get Rich by Dumping Cash on You

by

Alex Barinka

July

7, 2015 — 5:00 AM EDT

Updated on July 7, 2015 —

5:00 PM EDT

n

Buybacks Mean

Paychecks for CEOs

Buybacks and dividends are rising to

records

in the U.S., and for many chief executives, that means a fatter pay

check -- even if sales aren’t growing.

Eleven of the 15 non-financial U.S.

companies that spent the most on buybacks last year base part of CEO

pay on earnings per share or total shareholder return, or both,

according to data compiled by Bloomberg. These metrics get a boost

when businesses return cash to investors, giving companies like

International Business Machines Corp. and Cisco Systems Inc. added

incentive to dole out cash to stockholders.

Linking compensation to buybacks and

dividends can encourage managers to sacrifice funds that could be used

for long-term investments, economist William Lazonick said. It also

raises the prospect that executives are being paid for short-term

returns rather than running a business well.

“A lot of people are making money without actually creating value,”

said Lazonick, an economist who focuses on innovation and economic

development and has

written

about the economic effect of buybacks for the Harvard Business Review.

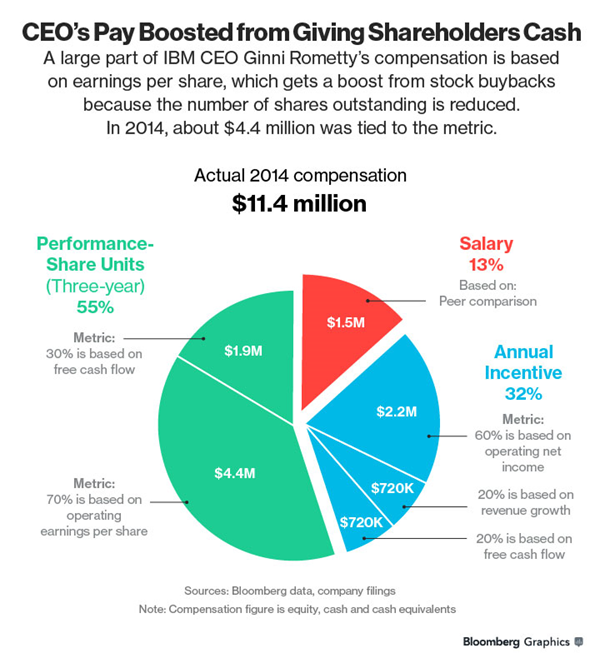

At IBM, almost 40 percent of CEO Ginni

Rometty’s $11.4 million compensation package last year was based on

operating earnings per share, according to the company’s

proxy statement.

By contrast, Intel Corp., Hewlett-Packard Co. and Oracle Corp. don’t

use earnings per share to remunerate leaders.

IBM drew

criticism

from analysts and investors last year for what they considered

excessive share repurchases. The company returned more than $13

billion, the fourth-largest amount in the U.S., while it was

struggling to reinvent itself to a provider of cloud services. In 12

straight quarters of year-over-year declines in sales, IBM boosted

operating EPS in nine quarters -- with the help of buybacks.

The company has this year reduced

planned

buybacks

to about $6.3 billion in 2015, the lowest level in 11 years.

“There might be some distraction on the

incentive side,” said Todd Lowenstein, who helps manage $16 billion at

HighMark Capital Management Inc., which holds shares of IBM. “It’s

lopsided and skewed toward short-term EPS.”

Ian Colley, a spokesman for Armonk, New

York-based IBM, declined to comment beyond the company’s proxy

statement.

Shareholder Friendly

Tying pay to performance has long been

considered a shareholder-friendly move that gives executives an

incentive to ensure that the company is on solid footing. Investors

such as Warren Buffett have applauded payouts when they consider

shares to be undervalued. Large pension funds have welcomed pay

incentives, like when Walt Disney Co. in 2013 changed the way it

calculates CEO Bob Iger’s stock awards.

Yet dividends and buybacks can prop up

per-share earnings and total shareholder return -- lifting CEO pay as

a result -- even in cases where sales are falling.

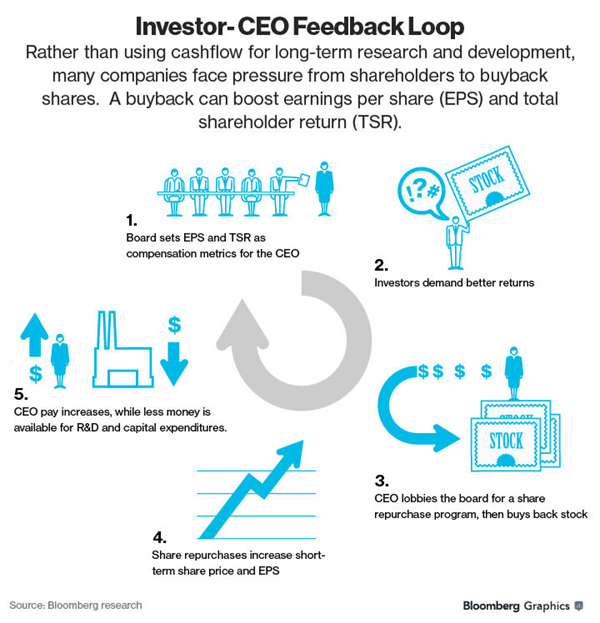

The focus on shareholder value has “led

to this really corrosive feedback loop between executive compensation

and corporate behavior,” said Nick Hanauer, co-founder of venture

capital firm Second Avenue Partners LLC. “When everyone around a board

room can justify essentially any behavior to generate a higher stock

price, no stone shall go unturned.”

Johnson & Johnson shows that it’s

possible to use earnings per share as a metric, while capping the

impact of buybacks on the CEO’s paycheck. The drugmaker

excludes

share repurchases, as well as other one-time occurrences, from pay

calculations if they increase earnings per share by more than 1

percent.

Besides IBM, other technology companies

that use EPS to calculate executive pay include San Jose,

California-based Cisco and Xerox Corp. Like IBM, both posted sales

declines in their last fiscal years.

Outgoing Cisco CEO John Chambers, who

was paid $16.5 million in the

year

ended July 2014, also got rewarded for boosting total shareholder

return, which was added to his pay calculation since 2012.

Last fiscal year, Chambers doled out

$9.5 billion on stock repurchases, the eighth most of non-financial

American companies. Sales fell 3 percent in the period, the first drop

since the financial crisis, amid stiffening competition. Chambers will

step down

this month, handing the reins to Chuck Robbins.

“Our compensation program is strongly

aligned with the long-term interests of our shareholders,” said Andrea

Duffy, a Cisco spokeswoman. The executive compensation philosophy and

practice is based on pay for performance, she said.

Sean Collins, a spokesman for Xerox,

said EPS is a major component used to calculate the price-to-earnings

ratio, which is widely used to value stocks by investors.

“Growth in EPS is an important measure

of management’s performance because it shows the bottom-line

profitability we are generating for each of our shareholders,” Collins

said.

Apple Buybacks

Topping last year’s list of share

repurchases, Apple Inc. spent $45 billion as Carl Icahn agitated for

the iPhone maker to return more cash to shareholders. The billionaire

investor has

re-upped

his call for more buybacks this year, even as a debate has mounted

about whether the company has enough new, innovative products to drive

sales growth. Apple paid about $11.1 billion in dividends last year,

while spending $16 billion on

research and

development and capital expenditures.

While Apple doesn’t use earnings per

share to calculate CEO Tim Cook’s pay, the company changed the

requirement for an equity award Cook received when he took over in

2011. After the change, a portion of the shares would only vest if

certain total shareholder return goals were met. Cook’s reported pay

was

$9.2 million

in fiscal 2014, according to Apple’s

proxy filing,

a year when he increased both sales and net income by 7 percent.

Josh Rosenstock, a spokesman for Apple,

declined to comment beyond the proxy statement.

Disney CEO Pay

After Disney shareholders including

California State Teachers’ Retirement System opposed CEO Iger’s 2012

compensation, the world’s largest entertainment company modified his

performance-based stock awards to ensure that earnings per share would

be part of the calculation.

As a result, half of Iger’s

performance-based stock award is based on meeting total shareholder

return goals relative to the Standard & Poor’s 500 Index, with the

rest contingent on earnings per share growth compared with the index.

The aim was “to ensure that the program meets the objective of

providing clear incentives tied to the creation of long-term

shareholder value,” Disney said in a 2013

proxy statement.

Earnings per share now factor into both

short- and long-term incentives for Iger, whose reported pay was

$46.5 million

last year. (Reported pay is disclosed in the U.S. Securities and

Exchange Commission-mandated summary compensation table, which may

include some awards in the year they’re granted rather than for the

year they’re earned.)

Disney spent $6.5 billion repurchasing

its own stock last year and more than $1.5 billion on its annual

dividend. Meanwhile sales grew 8 percent and net income surged 22

percent.

“The company’s capital allocation

strategy is designed to create growth opportunities through investment

in existing businesses or through acquisition, and to return excess

capital to shareholders via share repurchases and dividends,” David

Jefferson, a spokesman at Disney, said in an e-mail. “This balanced

approach has resulted in stellar financial results and created

significant value for our shareholders.”

Ninety-two percent of Iger’s

compensation is performance-based, Jefferson said.

Record Payouts

Average CEO

compensation

for the top 350 U.S. firms by revenue has climbed to $16.3 million

last year, according to data from the Economic Policy Institute.

That’s up from $15.7 million in 2013.

Overall in 2014, non-financial companies

returned almost $1 trillion in share repurchases and dividends. As a

percentage of gross domestic product, that’s among the largest payouts

on record.

Not all investors are applauding the

bonanza.

BlackRock Inc.’s Laurence D. Fink, whose

firm is the largest shareholder in many large companies, recently

penned a

letter

to S&P 500 CEOs, urging them to resist payouts to shareholders if it

compromises long-term opportunities.

“Corporate leaders’ duty of care and

loyalty is not to every investor or trader who owns their companies’

shares at any moment in time, but to the company and its long-term

owners,” Fink wrote in the April letter.

The inclusion of earnings per share or

total shareholder return in CEO pay is above average for the 15

companies that spent the most on buybacks last year. According to a

Towers Watson survey of 2012 proxy statements, one of the metrics, or

both, were included in less than half of short-term compensation plans

at Fortune 500 companies.

Amid a bull market, shareholders may not

be as concerned as they should about the potential boost that buybacks

and dividends can give to CEO pay, said Robert Barbetti, head of

compensation advisory for J.P. Morgan Private Bank in New York.

“Boards and compensation committees

should be thinking very carefully about the incentive plans and

objectives that work long term,” said Carol Bowie, head of Americas

research at proxy advisory firm Institutional Shareholder Services

Inc. “The real question for investors is: Is that use of EPS -- and

potential misuse of EPS -- driving pay packages and payouts that are

not really delivering solid long-term value?”

©

Bloomberg L.P. |