|

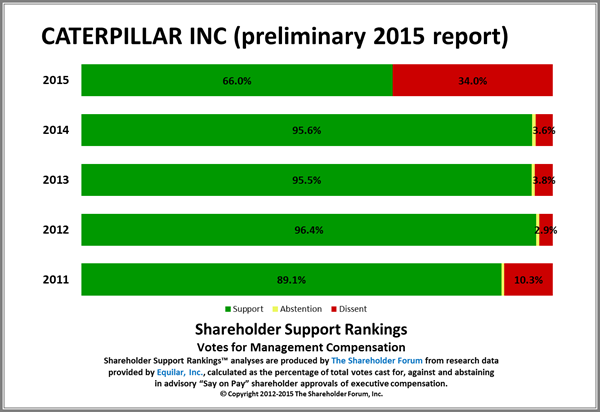

A Third of Caterpillar

Investors Reject Executive Pay Plan

by

Shruti Singh

June 10, 2015 — 11:15 AM EDT

Updated

on

June 10, 2015

— 4:27 PM EDT

Caterpillar Inc. shareholders approved

an advisory vote on executive compensation, with a third voting

against the plan signaling some dissatisfaction with management’s

performance.

Preliminary voting results indicate 66

percent of stockholders of the world’s largest maker of mining and

construction equipment approved the proposal, Rachel Potts, a

spokeswoman for the Peoria, Illinois-based company, said in an e-mail

Wednesday. Last year, Caterpillar’s executive compensation proposal

received 96 percent approval, Potts said.

“We will continue to maintain a dialogue

with our stockholders with regard to issues that are of interest

and/or concern to them,” Edward Rust, presiding director of the

Caterpillar board, said in an e-mailed statement.

Caterpillar’s sales have dropped about

$10 billion in the last two years as demand for its signature yellow

equipment declined after mining activity slowed and oil prices

tumbled. Sales are expected to fall again this year and profit per

share will drop 22 percent, according to the average of 13 analysts’

estimates surveyed by Bloomberg.

Meanwhile, Caterpillar Chairman and

Chief Executive Officer Doug Oberhelman’s reported pay has climbed 14

percent to $17.1 million in 2014, according to data compiled by

Bloomberg. Over the past 12 months, the stock has tumbled 19 percent.

Shares rose 2 percent to $88.48 at the close in New York.

‘Shareholder

Discontent’

The company is facing “shareholder

discontent” over a widening gap between its waning stock price and

Oberhelman’s compensation, according to CtW Investment Group, which

was pushing for investors to reject the pay proposal. The group had

criticized the company’s shift to connecting compensation to earnings

per share, which it argues can be affected by share buybacks.

In January 2014, Caterpillar’s board

approved a share repurchase plan for as much as $10 billion. Through

the end of the first quarter of this year, $2.9 billion has been

spent, according to a securities

filing.

“Caterpillar has a rebuilding project of

its own: executive pay needs overhauling and its credibility with

long-term investors re-constructed,” Dieter Waizenegger, executive

director of CtW Investment Group, said in an e-mailed statement

Wednesday.

The board today also approved increasing

the quarterly cash dividend 10 percent to 77 cents a share.

©

Bloomberg L.P. |