|

April 14, 2015 9:58 am

US companies unleash share buyback binge

Eric Platt in London

An ageing US equity bull run retains one major source of buyers these days —

the large companies that dominate the share market including

Apple,

Intel,

IBM and now

General Electric.

No matter the muted interest on the part of US investors, companies are

increasingly upping their purchasing power, helping maintain a bull market

run that over the past six years has left equities looking richly priced.

Buybacks have been a popular way to boost shareholder value for several

decades and help companies offset equity options granted to employees. But

in the current environment of sluggish economic growth, the rising tide of

buybacks and dividends being paid out worries some observers, as it suggests

corporations are less optimistic about future prospects and see a paucity of

long-term investment opportunities.

Strategists have debated the degree to which buybacks have accelerated the

current bull run, with several noting the downturn in Europe would have

probably pushed sovereign wealth funds, pension funds and other

institutional investors into US stocks.

“It’s not a zero sum game and it doesn’t have to be,” says David Lefkowitz,

an equity strategist with UBS Wealth Management. “The flows are not

necessarily indicative of how much support corporate buybacks are lending to

the bull market. If that goes away, I wouldn’t necessarily be concerned

about a downside in equities.”

With investors expecting a big reduction in quarterly earnings growth

compared with a year ago, the return of cash shows no sign of abating, with

GE announcing last week it would

return a massive $90bn over the next three years.

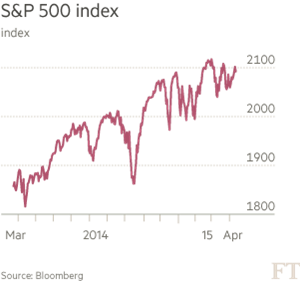

Now the market stands on the cusp of seeing a record of more than

$1tn returned to shareholders in the

form of dividends and stock repurchases this year — with this activity

supporting equity prices and valuations as the benchmark index hovers less

than 1 per cent from a record high.

Qualcomm,

Lowes,

General Motors and

Simon Property have initiated or

authorised multibillion-dollar increases to share buyback programmes in the

past two months, while the financial sector cleared a key hurdle in early

March when the Federal Reserve

gave a green light to dividend

increases and repurchase plans from the country’s largest banks.

Citigroup,

American Express and

JPMorgan led a group of nearly two

dozen financials that committed as much as $50bn to buybacks over the next

five quarters. Attention has now shifted to Apple, the exemplar of share

repurchases, which is expected to announce changes to its multiyear $130bn

programme in late April. Those repurchases are “crucial” to valuations and

earnings growth, Orrin Sharp-Pierson of BNP Paribas says, a point echoed by

Goldman Sachs.

“There is still a very clear preference to receive buybacks as an investor.

You get this sense of perpetual synthetic growth, which investors appreciate

in the presence of little underlying growth,” he says. “And you get a boost

to secondary demand — the stock effect creating the additional bid for

equities has been really quite important.”

Retail investors have been absent from buying US equities, joining

institutions looking to Europe and Asia for growth opportunities. Investors

have pulled $18bn from exchange traded funds invested in US stocks since the

year began, compared with $11bn that has flowed to ETFs investing in

European and Asian equities,

according to data provider Markit.

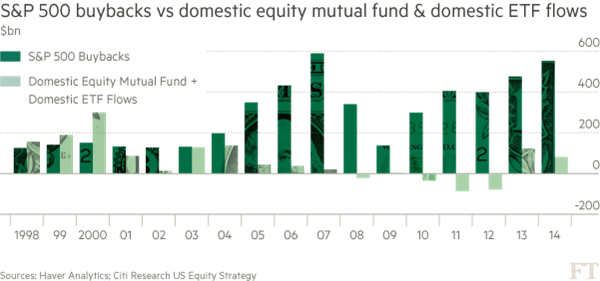

Tobias Levkovich, a strategist with Citi, notes that over the past decade,

S&P 500 companies have repurchased $4tn worth of shares — in part to offset

stock options offered to employees — while domestic investors have added

less than $100bn to the mix.

“The lack of US retail investor interest in stocks has been stunning and

equity market tops usually consist of overly aggressive individual investor

interest in the asset class,” says Mr Levkovich.

The pace of companies buying back their own shares now accounts for more

than 2 per cent of overall equity volumes in the US and contributed 2.3 per

cent to earnings growth for the S&P 500 last year, according to strategists

with JPMorgan. That figure, the brokerage says, will probably accelerate

this year as a slide in the dollar and oil cut into earnings gains from

underlying operations.

The returns have made valuations more palatable for the S&P 500 — the index

trades at 17.8 times 2015 expected earnings, above its 10-year average — as

analysts ready for two quarters of

earnings declines. Companies on the

US blue-chip index offer a dividend yield of 2 per cent, just above the

yield on the benchmark 10-year Treasury.

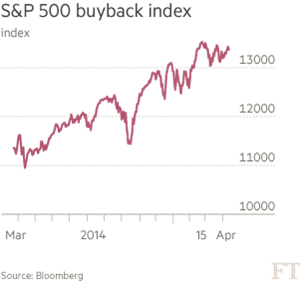

US multinationals steadily increasing returns to shareholders have in turn

found stronger buyer interest. Both the S&P 500 buyback and S&P 500 dividend

aristocrats indices have outperformed their namesake over the past 12

months, with the former outpacing the broader blue-chip index by nearly 650

basis points.

“With rates expected to remain low, search for yield to continue, and a

cautious investor base, shareholder-friendly companies with attractive total

yields and strong cash flow generation should benefit from the current

market environment,” says Dubravko Lakos-Bujas, a strategist with JPMorgan.

eric.platt@ft.com

|

© The Financial Times Ltd 2015 |

|