Loeb Attacks Dow

Chemical After Talks Over Board Seats Break Down

By

Michael J. de la Merced

November

13, 2014 3:27 pm

|

Daniel S. Loeb is the chief

executive of Third Point.

Credit Michael Nagle for The New York Times. |

Updated, 4:54 p.m. |

Daniel S.

Loeb is finally taking off the gloves in his fight with

Dow Chemical.

Mr.

Loeb, the activist hedge fund manager, unveiled on Thursday

a new

website that takes aim at Dow after months of trying to

persuade it to take further steps to increase shareholder value,

including a breakup.

Dow has

already promised to sell several divisions and announced that it would

increase its stock dividend and a share

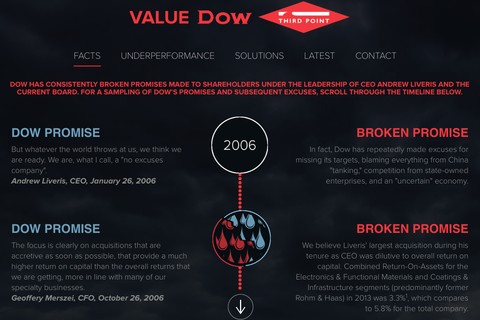

buyback program. Yet Mr. Loeb’s firm, Third Point, lists on the website

several instances of what it called “broken promises” by Dow and its chief

executive, Andrew N. Liveris.

Among them

are several missed earnings targets. Of a claim by Mr. Liveris that Dow is

no longer in the petrochemical manufacturing business, Third Point wrote

that the contention was “nonsensical” because the company draws a majority

of its profits from ethylene cracking, a process used in the petrochemical

industry.

|

The activist investor Daniel S.

Loeb is pushing to break up Dow Chemical.

value-dow.com. |

The site

also discloses that Mr. Loeb has retained two longtime executives as

advisers: Robert. S. Miller, the chairman of the

American International Group, and

Raymond J. Milchovich, the former chief executive of the airplane maker

Hawker Beechcraft.

Though both

men are described on the site as being an “advisory board” to Third Point,

they were also two of Mr. Loeb’s suggested candidates for Dow’s board during

about a month of discussions between the two sides, people briefed on the

matter said. Mr. Loeb gave the company until last Thursday, but held off

from taking further action after Dow promised constructive cooperation with

the activist investor.

However, Dow

on Thursday countered with two other director candidates, whom Mr. Loeb

rejected.

Though Mr.

Loeb has stepped up his attack on Dow, he has not yet decided whether to

move forward with a public proxy fight, these people said.

A spokesman

for Dow said in a statement that the company “fundamentally disagrees” with

Mr. Loeb and that its board and management are running the company with an

eye on both the short- and long-term interests of shareholders.

Of the

website, the company said, “The statements contained therein display a

fundamental lack of understanding of our company and an approach by an

activist investor that has little interest in anything that benefits the

many long-term shareholders in Dow.”

Copyright 2014

The New York Times Company |