|

THE WALL STREET

JOURNAL. |

MARKETS

|

Deals & Deal

Makers

Returns From Activist Hedge

Funds Are Causing a Stir

Hedge Funds That Clash With Companies Are Coming Up Winners

|

|

By

Rob Copeland

July 7, 2014 6:45 p.m. ET

Speaking

up is paying off.

Activists

are once again at the top of the hedge-fund heap, after a profitable

stretch of clashes with companies around the world.

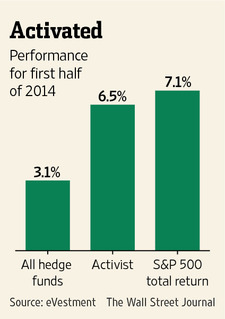

Activist

managers gained 6.5% in the first half of the year, almost double the

total for the average hedge fund, according to data to be released

this week by research firm eVestment. Activist investing, in which

managers buy stakes in companies and then agitate for changes in the

form of buybacks, divestitures or management shakeups, was also the

top-performing strategy among hedge funds in 2013.

The fund

managers could earn millions for themselves—and billions for their

investors—if the gains stick through the end of the year.

But with

deal making near its historical peak, some investors and analysts

wonder if the activist rally could start to sputter.

William Ackman,

founder of Pershing Square Capital Management LP, is likely the

biggest winner among the larger firms this year. His main fund posted

a 25% gain in the first half, investor documents show, likely earning

his firm fees estimated at nearly $1 billion so far in 2014.

Mr.

Ackman has profited from his unusual backing of

Valeant Pharmaceuticals International Inc.’s bid for Botox maker

Allergan Inc., as well as a recent decline in the price of

Herbalife Ltd., the nutritional-supplements maker he is betting

against. Allergan traded at $116 a share before Pershing Square began

rapidly building its stake in April. Shares closed Monday at $165.85,

or 51% higher. Herbalife, which closed Monday at $66.18, is down 16%

this year.

Mr.

Ackman has long been known for his large, concentrated public bets.

But this latest rise of shareholder activism, which was earlier known

by less-flattering terms like corporate raiding, is creating new

standouts.

Keith

Meister spent most of his career as a little-known deputy of

Carl Icahn before striking out on his own three years ago to start

Corvex Management LP in New York. Since the start of last year, Corvex

has more than tripled in size to manage more than $7 billion.

Its main

fund is up nearly 11% this year, a person familiar with it said,

helped by the resolution of Corvex's battle against

CommonWealth REIT and the purchase of jeweler Zale Corp. by

Signet Jewelers Ltd., a large Corvex holding.

Despite

the strong first half from activists, they still trailed the broader

stock market: The S&P 500 rose 7.1% in the first half, including

dividends.

Hedge

funds as a whole gained about 3.1% in the first half, though most

managers profess not to measure themselves against the broader stock

market, because they aspire to do well in both rising and falling

markets, and because they also invest in areas outside equities.

Bolstered

by wealthy investors eager to profit from corporate changes, activist

managers continue to engorge with cash—they attracted some $4 billion

of new allocations in May alone, eVestment said.

"It's not

just the money that's gone in, but the world is more supportive of

what they are doing," said Justin Sheperd, chief investment officer at

Chicago-based Aurora Investment Management LLC, which puts more than

$9 billion into hedge funds. "It's a different environment today."

Activists

also are increasingly busy. According to FactSet SharkWatch, there

were 148 activist campaigns launched in the first half of this year,

the most since the financial crisis.

The tide

could yet turn if stock markets stumble. Many activists, as well as

others who bet on company changes, lost money in the second half of

2011, when economic uncertainty put the brakes on mergers activity.

Mr.

Sheperd said he was optimistic for the back half of the year, as long

as interest rates remain low, encouraging mergers and acquisitions.

However, he said if markets go "haywire," then activists could do the

same.

There are

some indications that the great swelling of many activist firms, which

has given them broader heft to agitate for corporate changes, may be

on the ebb. Jana Partners LLC, a New York activist firm that rose past

$10 billion under management this year, closed its largest fund to new

investment in the spring so it could better manage the growing size,

according to investor communications.

Jana,

which gained 8% in that fund in the first half, also is weighing

shutting off fundraising at its other fund in the near future, a

person familiar with the firm said.

Several

investors cited Jana founder Barry Rosenstein's reported purchase this

spring of the most expensive home in the U.S., a $147 million

beachfront mansion in the Hamptons, as a reminder of past market

peaks.

Mr.

Ackman, whose Pershing Square manages more now than it ever has

before, has actually seen more money leave than come in this year,

documents show, as some investors take money off the table.

Investors

have pulled more than $400 million from Pershing Square over the past

six months, though that sum represents less than 3% of the firm's

capital.

Other

well-known activists also posted solid starts in 2014, as Daniel

Loeb's $15 billion Third Point LLC and Trian Partners LP, part of the

$9 billion firm co-founded by

Nelson Peltz, each returned about 6%.

It also

has been a long wait for one big-name hedge fund that has increasingly

dabbled in activism in recent years.

Paul Singer's

Elliott Management Corp. is sitting on defaulted Argentine bonds and

related claims valued at as much as $2.5 billion, or 10% of the firm's

total assets under management.

As Mr.

Singer and Argentine officials tussle publicly over the repayment of

the bonds, however, the New York-based firm's Elliott International

Ltd. fund is lagging behind its peers. It is up just 4.1% in the first

half of 2014, an investor update shows.

Write to

Rob Copeland at

rob.copeland@wsj.com

|