|

THE WALL STREET

JOURNAL. |

MARKETS

|

Markets

BlackRock's

Fink Sounds the Alert

|

|

By

David Benoit and

Liz Hoffman

Updated March 25,

2014 6:45 p.m. ET

In a shot across the bow of activist investors,

BlackRock Inc. Chief Executive

Laurence Fink has privately

warned big companies that dividends and buybacks that activists favor

may create quick returns at the expense of long-term investment.

In so doing, the head of the world's largest money manager by assets

lent his voice to a popular criticism of activist investors, even as

his firm sometimes aligns with and may benefit from their efforts.

"Many commentators lament the short-term demands of the capital

markets," Mr. Fink wrote in the letter reviewed by The Wall Street

Journal, sent to the CEO of every S&P 500 company in recent days,

according to BlackRock. "We share those concerns, and believe it is

part of our collective role as actors in the global capital markets to

challenge that trend."

Mr. Fink doesn't specifically mention in his letter activist hedge

funds, which typically take stakes and push for corporate or financial

changes, from management ousters to buybacks, dividends and spinoffs.

Instead, he addresses a broader concern that markets and companies

generally have become too vulnerable to short-term thinking.

But the increasing clout of activists contributed to Mr. Fink's

decision to write the letter, people familiar with the matter said.

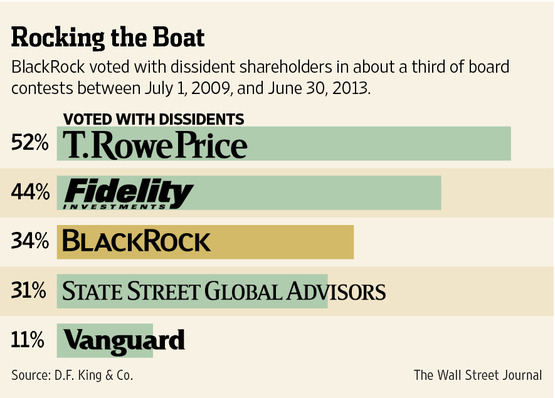

New York-based BlackRock itself votes about a third of the time with

dissident shareholders seeking corporate board representation,

according to data from D.F. King & Co., a proxy-solicitation firm.

Activists are attracting more assets and enjoying greater acceptance,

even as the debate continues over whether they are good for all

shareholders and, more broadly, economic growth.

Critics of activists contend that when companies use cash or new debt

to buy back shares or pay cash dividends to shareholders they are

forgoing the opportunities to invest in labor, production or other

potential avenues of future growth.

This month, Leo E. Strine Jr., chief justice of the Delaware Supreme

Court, argued that constant pressure from shareholders may distract

company executives and hurt returns. "Giving managers some breathing

space to do their primary job of developing and implementing

profitable business plans would seem to be of great value to most

ordinary investors," he wrote in the Columbia Law Review.

Activists, who move in and out of stocks more quickly than long-term

managers like BlackRock, have said their actions do more than cause

short-term pops.

By better focusing management, shedding low-performing businesses and

returning unused cash to investors, companies are on stronger footing

for the future, they said.

"The critique that activists are short-termed focus is a red herring

that typically comes from underperforming companies that have no

choice but to promise bluer skies in days to come," Jared L. Landaw,

chief operating officer of Barington Capital Group LP, said in an

email. His activist investing firm holds stakes three years, on

average, he said.

Unlike activists, BlackRock can't just sell out of most stocks, as

about 85% of its $2.3 trillion in equity assets are held in index

funds, which mirror collections of stocks. That long-term view drives

the firm's thinking, even when it supports activists, said Michelle

Edkins, BlackRock's head of corporate governance.

Activists themselves say a big driver of their success in recent years

has been the willingness of institutional investors to side with them.

Management has to pay more attention when its biggest shareholders

echo complaints that others raise.

Dissident shareholders who challenge management scored outright or

partial victories in about 60% of board fights in 2013, the highest on

record, according to FactSet, whose data go back to 2001.

Of the 30 fights that went all the way to a vote last year, activists

won 17.

"Institutional investors are looking at these situations much more on

a case-by-case basis" than in the past, said Richard Grossman, a

Skadden, Arps, Slate, Meagher & Flom LLP lawyer who represents

companies in activist fights. "That pendulum has swung, but it's swung

more to the middle."

In 50 board fights from July 2009 through June 2013 that

activist-nominated directors were up for election, BlackRock voted for

dissident nominees 34% of the time, according to D.F. King.

That compares with 11% for Vanguard Group, one of its largest peers.

But it is less than some other big investors, including

T. Rowe Price Group Inc. and

Fidelity Investments, which backed activists 52% and 44% of the time,

respectively.

These types of situations can arise over different views on a number

of issues, from buybacks to dividends to corporate breakups.

BlackRock voted for some dissident nominees of Jana Partners LLC in

that hedge-fund firm's fight to replace the board of

Agrium Inc. last year,

according to regulatory filings, a fight that Jana lost. It also

supported some of TPG-Axon Capital Management LP's nominees against

SandRidge Energy Inc., in

which TPG-Axon gained board seats.

BlackRock voted against

Carl Icahn in campaigns

against Forest Laboratories Inc. in 2011 and Oshkosh Corp. in 2012,

filings show. Mr. Icahn lost both those votes, though in later years

he gained board seats at Forest.

Ms. Edkins, BlackRock's head of corporate governance, said votes are

based on the quality of the nominees proposed by activists, which she

said have generally improved. She said activist campaigns still

represent a small minority of all situations in which BlackRock votes.

Write to

David Benoit at

david.benoit@wsj.com and Liz Hoffman at

liz.hoffman@wsj.com

|