February 9, 2014 6:59 pm

Activist investors force higher price

takeovers

By Ed Hammond in New York

Corporate America’s battle with activist investors is increasingly being

fought across the deal table rather than the boardroom, according to new

research.

There has been a surge in the number of campaigns to force companies to pay

higher prices when taking over a competitor.

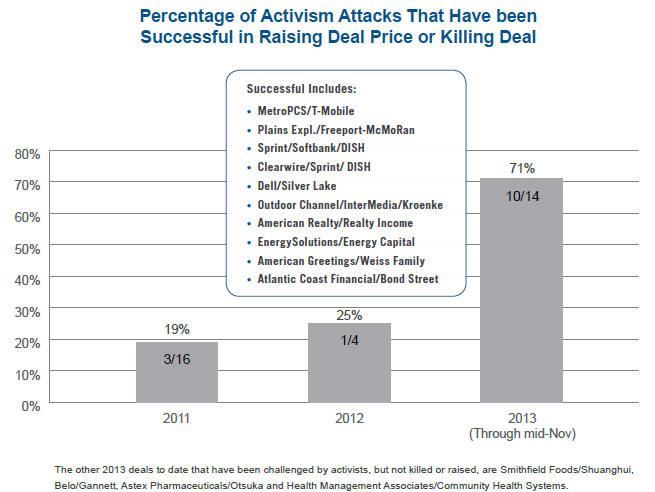

In the first 10 months of 2013, hedge funds pushed for higher prices in 14

takeover attempts, achieving success in 10, according to a study from Wall

Street law firm Simpson, Thacher & Bartlett.

The increase in the number of campaigns – and their success rate – is

pronounced: in 2012, only one of the four campaigns to lift the price of a

target company was successful.

Agitating for higher deal prices, or so-called “bumpitrage”, combines the

activist predilection for audacity with the traditional practice of

arbitrage by investors, who buy into a target company in the hope of the

shares being acquired at a premium.

Recent successful campaigns include those against the

merger of MetroPCS and T-Mobile US last year

and

McKesson’s $8.6bn takeover of

rival drugs distributor Celesio.

Activist investor

Carl Icahn mounted a successful

campaign during Michael Dell’s $24.9bn buyout of the computer maker that

bears his name.

After months of public fighting over the future of the business with Mr

Icahn, Mr Dell and his private equity backers bumped the price to $13.88 a

share from $13.65 a share. Both sides claimed a victory.

“Someone like me is not going to show up in a deal unless it’s obvious that

a company is being sold too cheap,” said Mr Icahn.

“Dell was different from a classic move just to raise the price of the bid;

I was prepared to invest $4bn of our own capital to make a counter-offer

because we thought Michael Dell was buying it too cheaply”.

The growing success that activists enjoy in forcing higher takeout prices

also reflects the rise of the industry. At the end of 2013, US activist

funds had more than $90bn of assets under management, up from $39bn at the

end of 2009.

“Every deal that I am working on now, the issue of whether an activist turns

up in the stock and starts pushing for a higher price is one concerning

boards and management,” said Mario Ponce, a partner at Simpson Thacher.

“The six million dollar question is whether this will have a chilling effect

on M&A,” said Mr Ponce. “It hasn’t yet, but the spectre of it is hanging

over certain types of transactions and that could spread doubt.”

|