|

THE WALL STREET

JOURNAL.

Business

Activist Pushes

for Split of Darden Restaurants

Barington Capital Wants

to Separate Red Lobster, Olive Garden From Rest of Company

By Dana Mattioli

Updated

Oct. 9, 2013 4:59 p.m. ET

An activist investor is

hungry for change at

Darden Restaurants Inc.

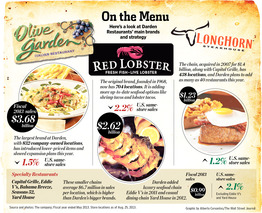

Hedge fund Barington Capital Group LP, along with other investors, has

taken a 2.8% stake in Darden, the owner of Olive Garden, Red Lobster

and six other restaurant chains. The fund is pushing for Darden to

form two separate companies, among other changes, according to people

familiar with the matter.

New York-based Barington has held talks with the restaurant operator's

management. The investor group argues that Darden should create one

company with its Olive Garden and Red Lobster restaurants, and another

with its higher-growth chains, which include Capital Grille, the

people said.

It isn't clear what other

investors are in the group, which also has urged the company to reduce

costs faster than it already is and to try to cash in on its real

estate. Based on Darden's current market value of about $6.47 billion,

the group's stake is worth roughly $181 million.

"We believe that Darden has the potential to deliver significantly

higher returns to shareholders," said a Barington spokesman.

A spokesman for Darden said the company "welcomes input on enhancing

shareholder value," adding that its board "will take the time

necessary to thoroughly evaluate Barington's suggestions, just as the

company does for any of its shareholders."

Based in Orlando, Fla., Darden has more than 2,100 restaurants in

North America, which, in addition to the other chains include the

LongHorn Steakhouse, Yard House, Eddie V's Prime Seafood, Seasons 52

and Bahama Breeze brands. The company owns the land at more than 1,000

of its restaurants, according to financial filings. Other companies

have extracted value from their real estate by creating real-estate

investment trusts or using sale-leaseback transactions.

Darden has been hurt by economic weakness as some consumers shift to

lower-priced fast-food restaurants, while others gravitate toward

competing chains like

Chipotle Mexican

Grill and

Potbelly

that don't have table service and therefore offer the prospect of

quicker meals—and no tips.

At Olive Garden—Darden's biggest chain by revenue—same-restaurant

sales dropped 4% in the first fiscal quarter, while they fell 5.2% at

Red Lobster.

The company also has been hit with higher food and labor costs. During

its most recent earnings call, Darden said that it would aim to save

about $50 million annually.

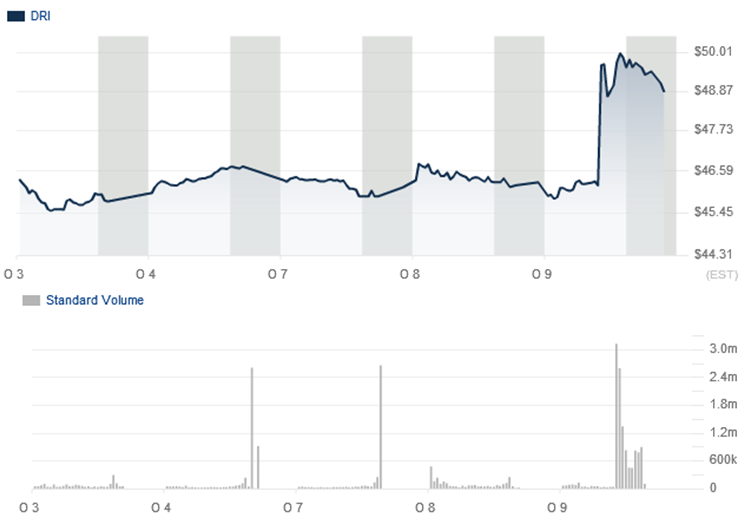

Reflecting the challenges the company faces, its stock price had

fallen about 15% over the past 12 months. It was little changed at

$46.35 around midday Wednesday before surging more than 6% on The Wall

Street Journal's report of the Barington group's stake.

In its most recent quarter, Darden's overall sales grew 6.1% to $2.16

billion, and the company posted a $70.2 million profit. Sales at its

higher-end chains have been more robust as well-off consumers continue

dining at upscale restaurants. Same-store sales at Darden's higher-end

chains rose 0.5% in the quarter.

Barington was co-founded in 1992 by James Mitarotonda , and was named

for Bari, Italy, near where he was born. Mr. Mitarotonda, now the

fund's chairman, president and chief executive, had previously worked

in the retail and financial-services industries, and participated in

the retail-management executive training program at Bloomingdale's,

according to Barington's website.

Barington's portfolio has around a dozen companies at any given time.

Earlier this year the hedge fund built up a stake in Jones Group Inc.,

pushing for the retailer to reduce costs, add directors and sell parts

of its portfolio. Jones is now in the late stages of an auction of the

entire company, according to people familiar with the matter.

In 2006, the fund contacted apparel maker Warnaco Group Inc.'s

management and suggested that the company sell non-core brands and

reduce expenses. Warnaco later sold its Anne Cole, Ocean Pacific and

other brands.

—Julie Jargon contributed to this article.

Write to Dana Mattioli at

dana.mattioli@wsj.com

|

Copyright ©2013 Dow Jones & Company, Inc. All Rights Reserved |

|